Art Market Is Back

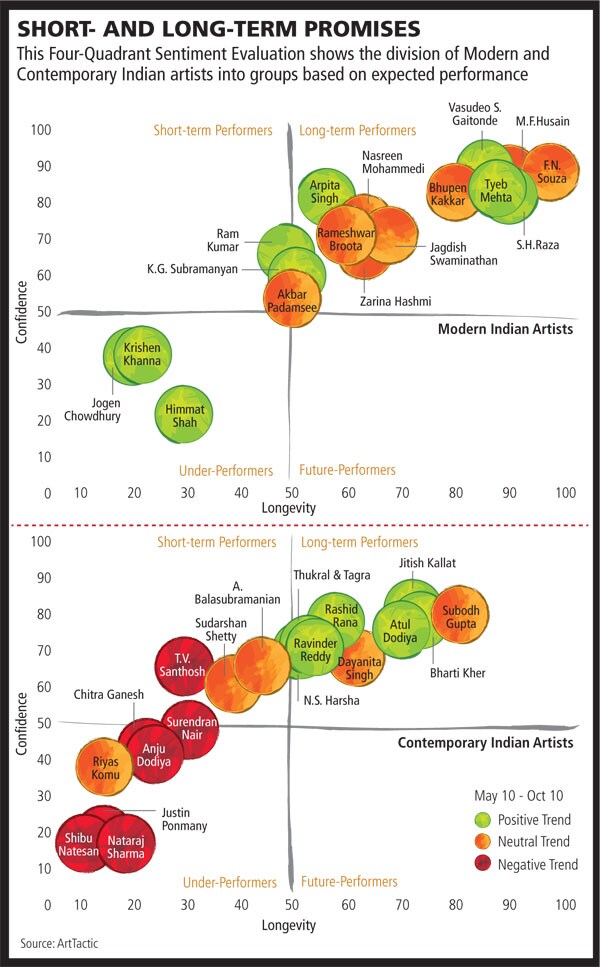

After a gut-wrenching correction that has largely eliminated the wannabe money throwers, the art market is back on a surer footing

In 2002, Bhupen Khakhar’s Buddha in Thailand sold for $8,963 at Christie’s. The same painting was bought in 2010 for $52,500, having appreciated 486 percent in less than eight years. Never mind that the world went through a recession that saw the art market virtually collapse.

Yes, the good news is that art investment is back in business. The past year has seen a smart recovery in values and the top artists are quoting at the pre-crisis prices again. If you missed the action in 2010, don’t fret. There is a lot of room left for making money in art if you choose well; or listen to us.

“If you buy something you love, chances are that down the road if you want to sell it, there will be others who will also like it and want to buy it,” says Menaka Kumari-Shah, Christie’s Mumbai. Mind you, art doesn’t come with P/E multiples or other measurements of value. It is all about the personal connection which cannot be put in a spreadsheet.

During the art market boom, people looked at art as a commodity and put their money in without assessing quality or price points. Flush with profits from stock markets or real estate, they put money in art purely for a signature and set themselves up for failure.

Then the international markets tanked, and those who partook in such deals panicked, tried to sell the works and realised their loss. From September 2008 (when Lehman Brothers collapsed) to March 2009, the total auction value in the modern and contemporary sectors dropped by 63 percent and 93 percent respectively, according to research firm ArtTactic.

Contours of the Recovery

Modern art has recovered faster due to it irrefutable historical value and decreasing quantity. The modern art market, which includes artists born before 1947, is almost back on track.

Data from ArtTactic shows that the average auction prices that halved between June 2008 ($112,000) and March 2009 ($54,000), bounced back by September 2010 ($92,000). This still lags the 2008 peak and that’s where the opportunity lies. “Works by the Progressives and the Modern masters which are considered blue chip, are commanding very high prices and significant works are selling for world record prices at almost every auction,” says Anuradha Ghosh Mazumdar, specialist in Indian art at Sotheby’s.

The contemporary sector which includes artists born post-independence suffered much more and will take longer to recover. Think of them as mid-cap or small-cap stocks. Before the crisis, they had seen a boom that was cut short, says Anders Petterson, founder and managing director, ArtTactic. In June 2008, the average auction price was $89,000. These prices were unsustainable and the false notions “needed to be brought down to earth,” says Sanjay Kumar, director, Sakshi Art Gallery. Small wonder that they crashed by 84 percent to $14,000 in March 2009. Buyers have now become more selective about the works they buy. The average auction price moved up to $63,000 in September 2010, but many contemporary artists are still languishing at the bottom. This slow revival has made lots of valuable works available at relatively affordable prices.

It is now the best time to buy any art, especially works by the moderns as the supply of good works is not going to remain forever, especially with so many museums coming up. If you buy now, you could reap the benefits in a year or two when the market peaks.

The Sound Portfolio

It is advisable to have a portfolio with both modern and contemporary works as each has its strength and potential. The former illustrates our nation’s history and will continue to appreciate due to this significance, while the latter represents the culture of our times.

However, “an art portfolio should consist mostly of moderns. Their works have surpassed the market movements and sustained. Invest a smaller percentage on contemporaries because a lot of them have shown erratic movements in terms of pricing and many have not been able to sustain their quality. Focus on those whose prices have not been unnaturally volatile,” says Sunaina Anand, director, Art Alive Gallery.

For the sake of understanding and reducing the risks, we can break the broad categories of modern and contemporary into smaller components: Top-tier moderns, second generation moderns, established contemporaries, and the young contemporaries.

Top-Tier Moderns

This is the least risky segment of the market, though you may need bigger outlays to afford the works. About 40 percent of your portfolio should include works from this category. “The prices you pay for them now are going to appear cheap in the long term,” says art collector Abhishek Poddar.

Infographic: Hemal Sheth

This group consists of first generation moderns such as F.N. Souza, Ramkumar, Jagdish Swaminathan, K.G. Subramanyam and Chittaprosad. “There is only a finite group of masterpieces by these artists and the value of these works will continue to grow over time,” explains Deepanjana Klein, specialist in Indian Modern and Contemporary art, Christie’s.

Artists of the 19th and early 20th Centuries, such as Sailoz Mookherjea, A.R. Chughtai, Kshitindranath Mazumdar, Raja Ravi Varma, Jamini Roy, Gaganendranath and Tagore among others, also belong in this category. Each of them played a major role in the progress of Indian art. Their history goes back further than the moderns, but the prices are surprisingly lower. There is such a miniscule number of these available, that an investment in a well-maintained work with impeccable provenance could be your very own pot of gold.

Second-Tier Moderns

The second generation moderns like Manjit Bawa, Laxma Goud, Ganesh Pyne, Prabhakar Barwe, Avinash Chandra, Gulamohammad Sheikh and Nalini Malani fall in this group. These are great to invest in because even though they are well established, their prices have not climbed high as yet. Due to the limited supply of modern art, this will happen soon enough. “These artists hold a lot of value and importance, historically and in terms of the market,” says Roshini Vadehra, director, Vadehra Art Gallery. For this reason, the risks here are less.

The investment is lower than with the top-tier, but the long-term appreciation will be high provided you invest in quality. Of your portfolio, 35 percent should be invested in this group. This way you have 75 percent in the moderns, sharply reducing your risks.

Established Contemporaries

Now we are getting bolder. Rashid Rana, Jayashree Chakravarthy, Paresh Maity, Arpana Caur, Jayashree Burman and Jagannath Panda are some who fall in this category.

These artists have built their reputations and are supported by renowned local and international galleries. The contemporary sector will go back to its peak soon and could even surpass it.

If they continue to turn out good works, they will appreciate well. But there is no saying how the career of a contemporary artist will shape up.

Invest only 10 percent here because in spite of the possibility of high returns, the risk is high. “In the contemporary arena, there are many artists who come up but do not sustain,” says Sanjay Kumar.

Young Contemporaries

Invest your remaining 15 percent in the young contemporaries. The risk is high in this category as artists could have a lapse in creativity at any point. But the investment is lower, so if you choose well, your returns could be quite high.

It is imperative to buy from reputed galleries as they promote and nurture an artist’s career. Explore the artist’s international presence because it represents the future promise.

Most importantly, if you invest in high quality art that you connect with, you are likely to spot the best works. “I have often picked up works from now-established artists’ first exhibitions when they were unknown and fresh,” says Poddar.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)