Torrent Group: From pharma to power and gas, diagnostics, and more—of acquisitions and diversifications

Through diversification and acquisitions, Sudhir and Samir Mehta have put the Torrent Group on a path of steady growth in pharma, power and gas sectors. Now, they are embarking upon newer horizons

(Clockwise from front) Sudhir Mehta (seated), chairman emeritus, Torrent Group (pharmaceuticals & power), Aman Mehta, director, Torrent Pharmaceuticals, Varun Mehta, director, Torrent Power, and Samir Mehta, chairman, Torrent Power & Torrent Pharmaceuticals

Image: Mexy Xavier

(Clockwise from front) Sudhir Mehta (seated), chairman emeritus, Torrent Group (pharmaceuticals & power), Aman Mehta, director, Torrent Pharmaceuticals, Varun Mehta, director, Torrent Power, and Samir Mehta, chairman, Torrent Power & Torrent Pharmaceuticals

Image: Mexy Xavier

Off Billionaires’ Street in Ahmedabad a large but unassuming home stands surrounded by trees and connected to a plantation beyond. Inside, there are antique collections and paintings by artists like Manjit Bawa, Desmond Lazaro and Harry Bertoia that line the walls. As do several family portraits including one of late Uttambhai Nathalal Mehta, the man who laid the foundation of the 63-year-old Gujarat-based Torrent Group.

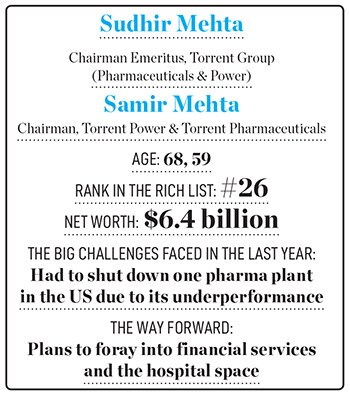

Second generation brothers Sudhir and Samir Mehta generously welcome us into their personal space. Ranked 26 on the Forbes India Rich List 2022 with a net worth of $6.4 billion (₹51,821 crore), the brothers have built on the pharma business, Torrent Pharma, started by their father in 1959 as well as diversified into the power and gas sector in 1990 and 2018, respectively.

This February, the group also diversified into the diagnostics sector by forming Torrent Diagnostics Private Limited. According to the company, this market is under-penetrated and with changing demographics, increasing urbanisation, and evolving regulations, there is an opportunity to provide incremental value and create a quality brand at the national level.

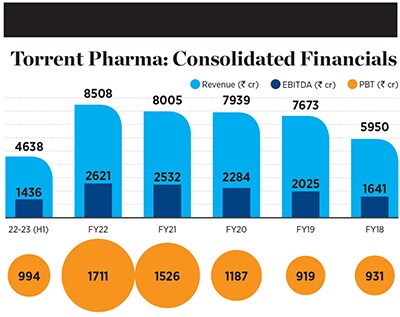

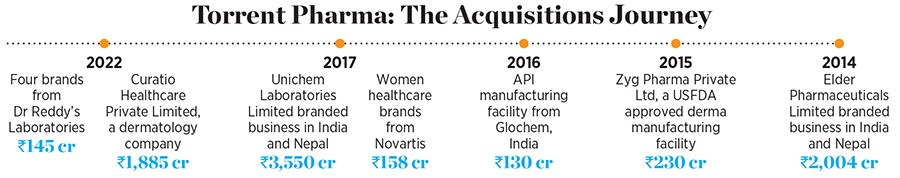

Acquisitions, too, have been part of the business strategy at the group. In a market that is not consolidated enough, organic growth is important, points out Samir, chairman of the group. “But to accelerate that growth, acquisitions play an important role,” he says. Recently, Torrent Pharmaceuticals entered into a definitive agreement to acquire 100 percent of skincare manufacturer Curatio Healthcare for ₹2,000 crore. With this acquisition, Torrent Pharma, which has an annual revenue of over ₹8,500 crore, will enter the league of top 10 players in the dermatology segment and will be the leader in the cosmetic dermatology space.

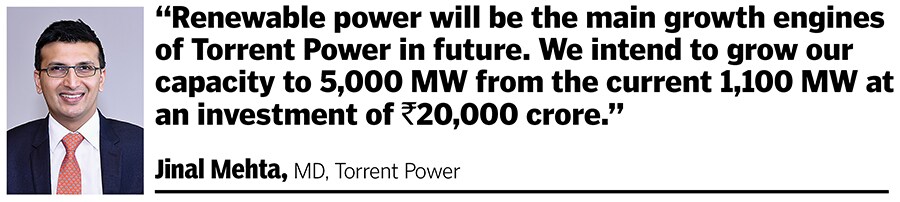

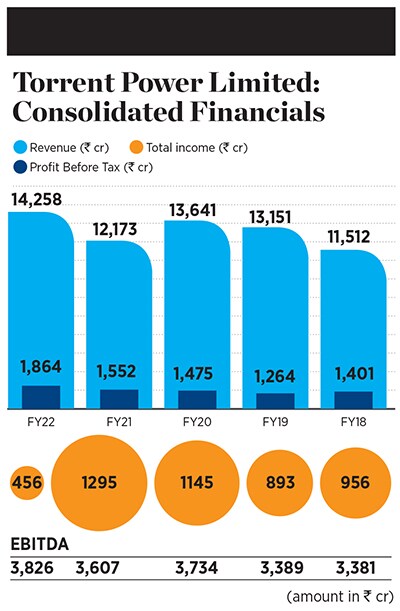

Acquisitions are also part of the strategy in the power business with the company expanding and increasing their footprint in the renewable energy space. Torrent Power formally entered the space a decade ago with the commissioning of a 50MW wind power project near Jamnagar in Gujarat. Today, the group has more than 1,100 megawatt (MW) of both wind and solar operating assets, and 715 MW under development. This is about 37 percent of their total power generation capacity. The aim is to reach 5 gigawatt over the next five years. Even as the company plans to keep participating in state, central and discom RE tenders, last year it completed four acquisitions totaling 281 MW and is also looking at acquiring more operating assets.

The next gen takes charge

The next gen takes charge

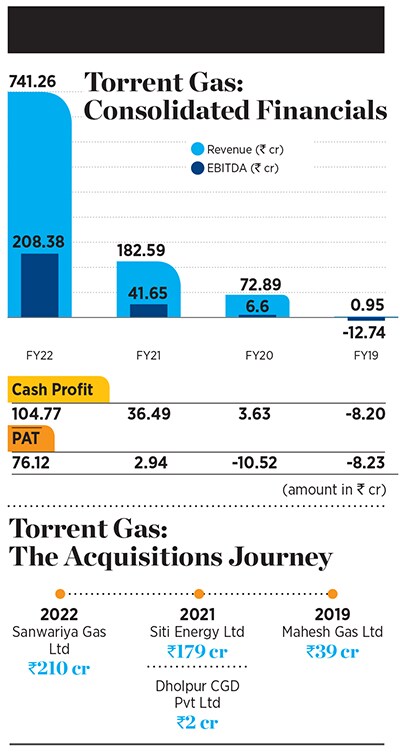

Jinal led the formation of Torrent Gas, which has emerged as one of India’s largest City Gas Distribution (CGD) companies within four years of inception. The group entered the CGD sector in 2018 after being awarded an exclusive city gas distribution license. The company is now present in 17 geographic areas in seven states and one Union Territory and includes cities such as Chennai and Jaipur. Torrent is among the top private CGD entities covering over nine crore people, which is around 7.4 percent of the total country’s population. The company is also planning to invest more than ₹10,000 crore in the business in the next five years. The plan is to cater to domestic PNG, CNG for transport and PNG for industrial and commercial segments.

Jinal led the formation of Torrent Gas, which has emerged as one of India’s largest City Gas Distribution (CGD) companies within four years of inception. The group entered the CGD sector in 2018 after being awarded an exclusive city gas distribution license. The company is now present in 17 geographic areas in seven states and one Union Territory and includes cities such as Chennai and Jaipur. Torrent is among the top private CGD entities covering over nine crore people, which is around 7.4 percent of the total country’s population. The company is also planning to invest more than ₹10,000 crore in the business in the next five years. The plan is to cater to domestic PNG, CNG for transport and PNG for industrial and commercial segments.

Thirty-one-year-old Aman joined the family business in 2013, starting by working in Torrent Power where one of the first projects he undertook was improving customer service delivery. “Along with the team, I established many new digital touch points, we revamped physical experience centres and catalysed customer orientation transformation within the distribution business,” he says. He then went for an MBA to Columbia University.

Thirty-one-year-old Aman joined the family business in 2013, starting by working in Torrent Power where one of the first projects he undertook was improving customer service delivery. “Along with the team, I established many new digital touch points, we revamped physical experience centres and catalysed customer orientation transformation within the distribution business,” he says. He then went for an MBA to Columbia University.

Given that the business was going through a rough patch and was creating significant financial pressures on the cash flow, the brothers sold one of their power plants in 1999. The sale of equity stake in Gujarat Torrent Energy Corporation (GTEC) to Powergen India Pvt. Ltd, was India’s largest M&A transaction of the 20th century. “The 90s was when we expanded at a fast pace. It was such a pace that we didn’t realise that maybe we had spread ourselves too thin. But when that recognition came in, we did course correct, rather than letting it drag on and creating more damage in the process,” says Samir, chairman of Torrent Power and Torrent Pharmaceuticals.

Given that the business was going through a rough patch and was creating significant financial pressures on the cash flow, the brothers sold one of their power plants in 1999. The sale of equity stake in Gujarat Torrent Energy Corporation (GTEC) to Powergen India Pvt. Ltd, was India’s largest M&A transaction of the 20th century. “The 90s was when we expanded at a fast pace. It was such a pace that we didn’t realise that maybe we had spread ourselves too thin. But when that recognition came in, we did course correct, rather than letting it drag on and creating more damage in the process,” says Samir, chairman of Torrent Power and Torrent Pharmaceuticals.

Param Desai, research analyst at Prabhudas Lilladher Pvt Ltd, who has been tracking Torrent Pharma, says it has been a been a very stable company. “If you see the growth profile of the company in the last 8-10 years, they have been consistently growing at steady intervals because the inherent business model is that they are focused on the branded generics market, which continues to do very well,” he says.

Param Desai, research analyst at Prabhudas Lilladher Pvt Ltd, who has been tracking Torrent Pharma, says it has been a been a very stable company. “If you see the growth profile of the company in the last 8-10 years, they have been consistently growing at steady intervals because the inherent business model is that they are focused on the branded generics market, which continues to do very well,” he says.