Torrent Group: From pharma to power and gas, diagnostics, and more—of acquisitions and diversifications

By Naandika Tripathi| Nov 30, 2022

Through diversification and acquisitions, Sudhir and Samir Mehta have put the Torrent Group on a path of steady growth in pharma, power and gas sectors. Now, they are embarking upon newer horizons

[CAPTION](Clockwise from front) Sudhir Mehta (seated), chairman emeritus, Torrent Group (pharmaceuticals & power), Aman Mehta, director, Torrent Pharmaceuticals, Varun Mehta, director, Torrent Power, and Samir Mehta, chairman, Torrent Power & Torrent Pharmaceuticals

Image: Mexy Xavier[/CAPTION]

[CAPTION](Clockwise from front) Sudhir Mehta (seated), chairman emeritus, Torrent Group (pharmaceuticals & power), Aman Mehta, director, Torrent Pharmaceuticals, Varun Mehta, director, Torrent Power, and Samir Mehta, chairman, Torrent Power & Torrent Pharmaceuticals

Image: Mexy Xavier[/CAPTION]

Off Billionaires’ Street in Ahmedabad a large but unassuming home stands surrounded by trees and connected to a plantation beyond. Inside, there are antique collections and paintings by artists like Manjit Bawa, Desmond Lazaro and Harry Bertoia that line the walls. As do several family portraits including one of late Uttambhai Nathalal Mehta, the man who laid the foundation of the 63-year-old Gujarat-based Torrent Group.

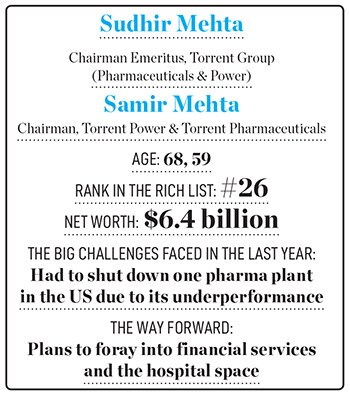

Second generation brothers Sudhir and Samir Mehta generously welcome us into their personal space. Ranked 26 on the Forbes India Rich List 2022 with a net worth of $6.4 billion (₹51,821 crore), the brothers have built on the pharma business, Torrent Pharma, started by their father in 1959 as well as diversified into the power and gas sector in 1990 and 2018, respectively.

_RSS_This February, the group also diversified into the diagnostics sector by forming Torrent Diagnostics Private Limited. According to the company, this market is under-penetrated and with changing demographics, increasing urbanisation, and evolving regulations, there is an opportunity to provide incremental value and create a quality brand at the national level.

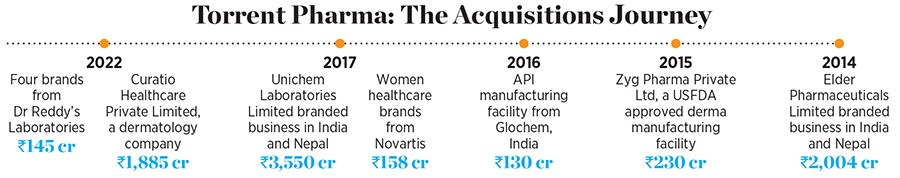

Acquisitions, too, have been part of the business strategy at the group. In a market that is not consolidated enough, organic growth is important, points out Samir, chairman of the group. “But to accelerate that growth, acquisitions play an important role,” he says. Recently, Torrent Pharmaceuticals entered into a definitive agreement to acquire 100 percent of skincare manufacturer Curatio Healthcare for ₹2,000 crore. With this acquisition, Torrent Pharma, which has an annual revenue of over ₹8,500 crore, will enter the league of top 10 players in the dermatology segment and will be the leader in the cosmetic dermatology space.

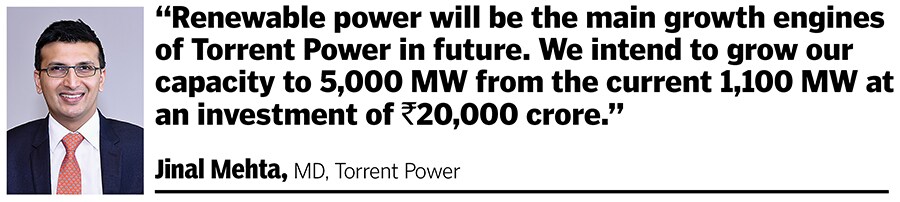

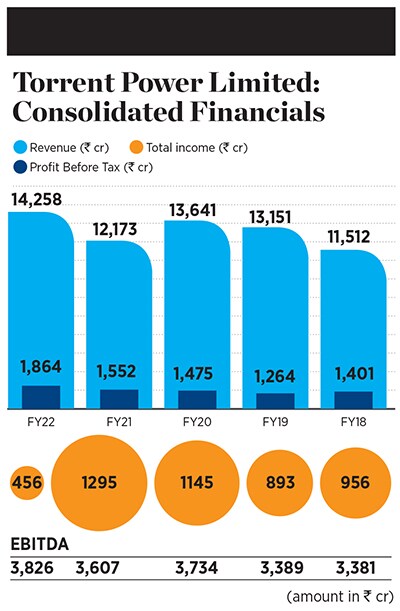

Acquisitions are also part of the strategy in the power business with the company expanding and increasing their footprint in the renewable energy space. Torrent Power formally entered the space a decade ago with the commissioning of a 50MW wind power project near Jamnagar in Gujarat. Today, the group has more than 1,100 megawatt (MW) of both wind and solar operating assets, and 715 MW under development. This is about 37 percent of their total power generation capacity. The aim is to reach 5 gigawatt over the next five years. Even as the company plans to keep participating in state, central and discom RE tenders, last year it completed four acquisitions totaling 281 MW and is also looking at acquiring more operating assets.

The next gen takes charge

The next gen takes charge

In 2014, when Sudhir stepped down as the chairman of Torrent Pharma, his brother Samir took over. Now, the next generation of the family is also gradually taking charge in various sectors. Succession planning too started a few years ago at the group.

While Sudhir’s sons Jinal and Varun have been associated with the group’s power business for years, four years after Sudhir’s retirement in 2014, Samir became Torrent Power chairman and Jinal was made the managing director of Torrent Power.

Samir’s son Aman has been inducted into the board of Torrent Pharma recently, while his second son Shaan is currently pursuing his Master’s at Columbia University and will be joining the business in the coming months.

It is mandatory for the next generation to join the company as a management trainee first, learn the ropes from the professionals who have been around for years, and also go on the field to get a better understanding of the business. For instance, when Jinal joined the family business 22 years ago, he started off as a trainee in the commercial department of Torrent Power’s generation business. After a year, he went to pursue his MBA at the University of Technology Sydney. He rejoined in 2008 and spent the next three years at Torrent Power’s 1530 MW SUGEN project in Surat, where he gained experience in project management followed by another three years at Torrent Power’s 1200 MW DGEN project in Dahej, where he was in charge of setting up the project worth ₹5,500 crore.

Also read: Satyanarayan Nuwal: From sleeping on railway platforms to building the Rs 35,800 crore Solar Industries

Currently the managing director of Torrent Power, Jinal, 39, says, “Renewable power generation and power distribution will be the main growth engines of Torrent Power in the future.” In the medium term, they intend to grow their renewable generation capacity to 5,000 MW from the current capacity of 1,100 MW at an investment of around ₹20,000 crore. “Beyond these areas, Torrent Power is actively pursuing new energy opportunities in hydrogen, pumped storage hydro and more,” says Jinal, also director of Torrent Gas.

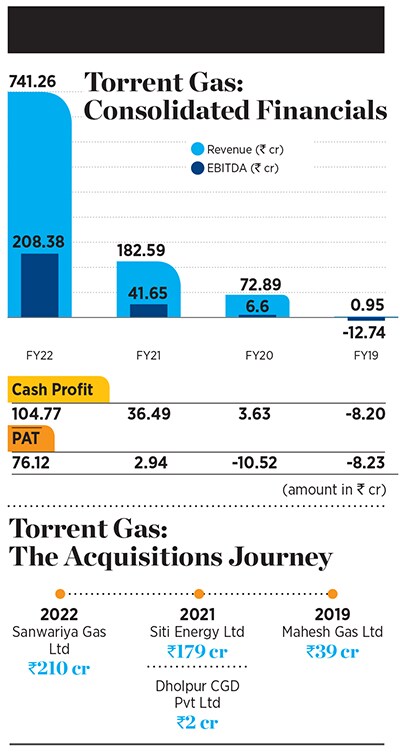

Jinal led the formation of Torrent Gas, which has emerged as one of India’s largest City Gas Distribution (CGD) companies within four years of inception. The group entered the CGD sector in 2018 after being awarded an exclusive city gas distribution license. The company is now present in 17 geographic areas in seven states and one Union Territory and includes cities such as Chennai and Jaipur. Torrent is among the top private CGD entities covering over nine crore people, which is around 7.4 percent of the total country’s population. The company is also planning to invest more than ₹10,000 crore in the business in the next five years. The plan is to cater to domestic PNG, CNG for transport and PNG for industrial and commercial segments.

Jinal led the formation of Torrent Gas, which has emerged as one of India’s largest City Gas Distribution (CGD) companies within four years of inception. The group entered the CGD sector in 2018 after being awarded an exclusive city gas distribution license. The company is now present in 17 geographic areas in seven states and one Union Territory and includes cities such as Chennai and Jaipur. Torrent is among the top private CGD entities covering over nine crore people, which is around 7.4 percent of the total country’s population. The company is also planning to invest more than ₹10,000 crore in the business in the next five years. The plan is to cater to domestic PNG, CNG for transport and PNG for industrial and commercial segments.

Jinal’s younger brother Varun joined the business in 2008. After gaining some experience, he went to do his MBA at INSEAD, France. He had started his career by formulating the entry strategy of the group in the area of renewable energy and setting up the initial set of renewable energy projects. The group today has a renewable portfolio of 1.6 gigawatts.  [CAPTION]Torrent Power’s Gensu solar power plant in Surat[/CAPTION]

[CAPTION]Torrent Power’s Gensu solar power plant in Surat[/CAPTION]

Varun also led a strategic initiative in thermal generation, importing LNG directly from international markets, making Torrent Power the first Indian player to successfully do so, thus significantly enhancing revenues and saving on costs. He has been responsible for the taking over of power distribution operations in Diu, Daman, Dadra & Nagar Haveli, Dholera and Mandal Bechraji, and improving AT&C (aggregate technical and commercial) losses.

The last year has been challenging for the energy sector with commodity prices shooting up after the Russia-Ukraine war. “This creates a big problem for us because most of our generation happens using fossil fuels,” says 35-year-old Varun. “It’s always a little challenging in a sensitive commodity like electricity to pass on all such big increases in one go. So we’ve been doing it gradually over a period of time, but that has, of course, led to some under-recoveries for us, which does create a little bit of operational challenge,” he adds. However, he is hopeful now that commodity prices have started cooling off again. “So over a period of time, we should be able to recover all the under recoveries of the past couple of months,” he says.  Thirty-one-year-old Aman joined the family business in 2013, starting by working in Torrent Power where one of the first projects he undertook was improving customer service delivery. “Along with the team, I established many new digital touch points, we revamped physical experience centres and catalysed customer orientation transformation within the distribution business,” he says. He then went for an MBA to Columbia University.

Thirty-one-year-old Aman joined the family business in 2013, starting by working in Torrent Power where one of the first projects he undertook was improving customer service delivery. “Along with the team, I established many new digital touch points, we revamped physical experience centres and catalysed customer orientation transformation within the distribution business,” he says. He then went for an MBA to Columbia University.

When he moved back to India post his MBA, he joined the pharma business and got the opportunity to do the integration of pharma firm Unichem, which the company acquired. “Those two years of deal integration were quite critical in helping me understand the business and improve my decision-making. I think it took at least seven to eight years for each one of us to get the whole idea of the business. Though it’s a family business, it still was a very professional setup that when we entered and that made a big difference,” recalls Aman, who is now director at Torrent Pharmaceuticals and heads the India business that contributes around 74 percent of its revenues. He is also a key contributor in evaluating acquisition opportunities and driving the strategic direction of the India business.

Also read: The rupee may be weaker, but the rich are richer

Torrent Pharma is ranked eighth in the Indian pharmaceutical market and is among the top five in the therapeutics segments of cardiovascular, gastro-intestinal, central nervous system, and vitamins minerals nutritionals. It has a presence in 40 countries and is ranked number one among the Indian pharma companies in Brazil, Germany and Philippines. Torrent has seven manufacturing facilities, of which four are USFDA approved. With R&D as its backbone for its growth in the domestic and overseas market, it has invested significantly in R&D capabilities with state-of-the-art R&D infrastructure and by employing more than 800 scientists.

In the past year, the business has faced challenges in the US market. Recently, it had to shut down one of its plants in Levittown, Pennsylvania, due to structural changes in the US market making it unviable. “The economics and structure of the business have changed completely from when this was acquired. It was a very tough call, but we made sure we did it in the best possible way. As a business, we still remain focussed on the US market. However, this decision helped us get some of our performance back in the US,” says Aman. [CAPTION]Torrent Pharma’s manufacturing facility at Indrad in Gujarat[/CAPTION]

[CAPTION]Torrent Pharma’s manufacturing facility at Indrad in Gujarat[/CAPTION]

Finding their feet

The founder of the group, late UN Mehta, was a sales and medical representative for Swiss pharma giant Sandoz. After working for seventeen years, he quit his job due to medical reasons, and established Trinity Laboratories (now Torrent Group) in 1959. The business did not really pick up because Mehta couldn’t completely focus on it due to his deteriorating health.In 1971, he relaunched the business as Torrent also roping in his elder son Sudhir who was then in his second year of graduation. “When I started initially, my father told me that you should have the experience of everything. From meeting the doctors to understanding their needs, marketing to going on the field, my father forced me to hit the ground running,” he says. Recalling his first field trip, he adds, “I had no knowledge about how to detail a doctor. My first visit was to NIMHANS in Bengaluru. The doctors used to ask tough questions and with time and more visits, I finally started learning,” he says. He then started visiting doctors across India. “Each region had its own specialty, different market, and I learnt a lot,” recalls Sudhir, adding that he did face rejections during the visits but converted them into opportunities.

Both Sudhir and Samir started working actively in their father’s pharmaceutical business in the early 1980s. “My father was not well and had not been active in the business for the last ten years of his life. He was, however, a guiding factor,” says Sudhir, now chairman emeritus of the Torrent Group, of his father who died in 1998.

In 1983, Torrent Pharma got its first export order to then Soviet Russia, a key milestone for the group. This led to the eventual diversification into the power sector in the 1990s. Torrent forayed into the power sector by taking over Mahendra Electricals, renaming it Torrent Cables Ltd (now merged with Torrent Power).

Check out the complete lndia's 100 Richest 2022 list

It was an eventful decade in other ways too. The early success in power gave the group the hope and confidence to look at businesses beyond power. They acquired what was then the third largest NBFC in the country, Gujarat Lease Financing. During the same period they also acquired management control of Surat and Ahmedabad Electricity Company as well as a large capital intensive project for penicillin. The Torrent Gujarat Biotech Limited plant was commissioned to produce penicillin-G. In the late 90s, however, the company took a hit like penicillin makers across the country due to the cheap dumping of the antibiotic by China.

Given that the business was going through a rough patch and was creating significant financial pressures on the cash flow, the brothers sold one of their power plants in 1999. The sale of equity stake in Gujarat Torrent Energy Corporation (GTEC) to Powergen India Pvt. Ltd, was India’s largest M&A transaction of the 20th century. “The 90s was when we expanded at a fast pace. It was such a pace that we didn’t realise that maybe we had spread ourselves too thin. But when that recognition came in, we did course correct, rather than letting it drag on and creating more damage in the process,” says Samir, chairman of Torrent Power and Torrent Pharmaceuticals.

Given that the business was going through a rough patch and was creating significant financial pressures on the cash flow, the brothers sold one of their power plants in 1999. The sale of equity stake in Gujarat Torrent Energy Corporation (GTEC) to Powergen India Pvt. Ltd, was India’s largest M&A transaction of the 20th century. “The 90s was when we expanded at a fast pace. It was such a pace that we didn’t realise that maybe we had spread ourselves too thin. But when that recognition came in, we did course correct, rather than letting it drag on and creating more damage in the process,” says Samir, chairman of Torrent Power and Torrent Pharmaceuticals.The cash generated through the selling of the power plant was used to pay off the creditors, lenders and everyone in the penicillin business. “Even the NBFC business had gone through a lot of stress. It was the first financial meltdown in the sector. But we managed to get through this difficult phase,” he adds.

Chaitanya Dutt is an ex-employee of Torrent Group who worked with the company for 33 years and retired two years ago as he turned 70. He is someone who has worked with all the three generations. From having the freedom to do whatever he wanted to sharing and executing his own ideas are some of the reasons he remained with the group for over three decades. “We were never put in a shell. There was liberty but with responsibility, of course. I got support in whatever I wanted to do. That was the best part of the whole journey,” says Dutt who was director on the board and whole-time director of research and development at Torrent Pharma.

Sharing his experience of working with three generations, Dutt says the management styles have been completely different. “Mr UN Mehta was more about building the company around people. Then that sort of transitioned into a more mature organisation,” he says. He recalls that organisational constraints were put in place. “We still have freedom but then it was more hierarchical, that was the second generation, after Samir came in. As the organisation grows, this has to come in, the risk-taking appetite tends to go down a bit,” he says adding that the third generation is still finding their feet. “That transition may take some time. These are people who have trained in B-schools so they would be less entrepreneurial and more management-oriented. Maybe the high-risk stuff is going to be a little less prominent now till they find their feet which may take a few years.”

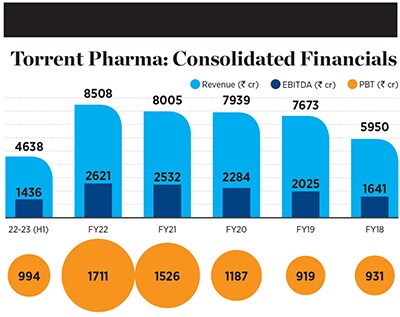

Steady Growth

Torrent Pharma, which was listed on the bourses in 1992, recently announced its second-quarter results. The pharma company reported a marginal decline in its consolidated net profit at ₹312 crore. The company had posted a consolidated net profit of ₹316 crore in the year-ago period. Revenue from operations rose to ₹2,291 crore in the July-September quarter as against ₹2,137 crore in the year-ago period. Meanwhile, the drug firm also reported robust sales across various international markets like the US, and Brazil. The company added that the growth was aided by the performance of new launches. Param Desai, research analyst at Prabhudas Lilladher Pvt Ltd, who has been tracking Torrent Pharma, says it has been a been a very stable company. “If you see the growth profile of the company in the last 8-10 years, they have been consistently growing at steady intervals because the inherent business model is that they are focused on the branded generics market, which continues to do very well,” he says.

Param Desai, research analyst at Prabhudas Lilladher Pvt Ltd, who has been tracking Torrent Pharma, says it has been a been a very stable company. “If you see the growth profile of the company in the last 8-10 years, they have been consistently growing at steady intervals because the inherent business model is that they are focused on the branded generics market, which continues to do very well,” he says. According to him, there is a strong pricing power in this market that has helped them and they have made some large acquisitions that have turned around the business really well and scaled up the business. “It has been generating good healthy return ratios. Currently, the US is 7-8 percent of their profile, recently they also had to shut down one of the plants because expenses were shooting up, it was not remunerative, and it was a good decision that helped them improve their margins as well.”

With the group revenue at over ₹22,500 crore, the company is also looking to enter new areas like hospitals and the financial services space which will range from being present in lending and insurance to asset reconstruction. Torrent Gas is likely to go public by 2025.

There have always been challenges in the business but the family has a clear philosophy and has always turned challenges into opportunity. “One good thing in the business was that it was always a challenging time,” recalls Sudhir. “I was never an expert at anything but I realised that there is no substitute for hard work. One needs to learn, and if you have made a mistake, you need to learn from your past mistakes and move on, that is the philosophy.”