How Sleepy Owl switched from cold to hot to survive the pandemic

How hot brew helped Sleepy Owl shed its cold brew tag and survive the pandemic chill

Image: Amit Verma

Image: Amit Verma

For close to four years, Ajai Thandi, Ashwajeet Singh and Arman Sood were addicted to a caffeinated life. The three friends started ready-to-brew coffee brand Sleepy Owl in June 2016, and had scaled it up handsomely till March 2020. From a revenue of Rs1.8 crore in FY19, sales jumped by almost 300 percent to Rs5.2 crore in March 2020; the cold brew brand expanded its reach to over 1,000 general and modern retail outlets across Delhi-NCR, and Mumbai; and B2B business made up close to one-third of sales for Sleepy Owl. Another high for the venture was $1.5 million round of funding in September 2019 from a clutch of investors such as Rukam Capital, AngelList India and DSG Consumer Partners. Clearly, a lot was happening over coffee for the fledgling brand, which was all set for a hooting summer of 2021.

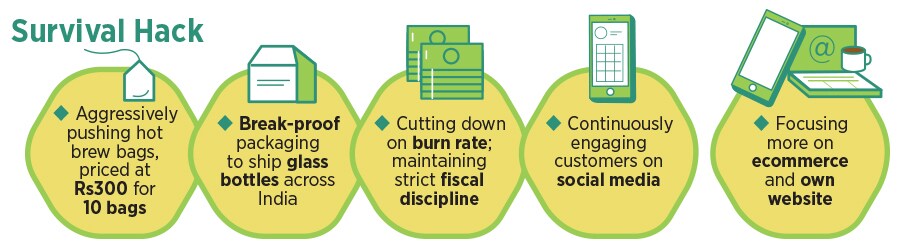

Then came the pandemic. What followed next was a wake-up call for Sleepy Owl, and sleepless nights for the co-founders. Institutional sales slumped to nought; airlines business got grounded; and retail sales evaporated. The co-founders developed cold feet. Reason: Rs15 lakh-inventory of cold brew bottles largely for institutional sales in Delhi-NCR and Mumbai was stranded. With a product shelf life of a few months and no clarity on the lockdown blues, Sleepy Owl was staring at an eventuality of discarding all the bottles. The startup quickly came up with a break-proof packaging to ship bottles across India; the co-founders loaded their cars with cold brew and went direct to consumers in terms of delivering; and Sleepy Owl managed to exhaust the inventory over the next few months.

A sip, though, does not make a summer. A prolonged lockdown, and a subsequent staggered unlockdown, brought in their wake another set of serious problems. As the business gathered steam, Sleepy Owl ran out of coffee. Sourced directly from the farms of Chikmagalur in Karnataka, consignments of Arabica coffee beans got stuck in the highways for over 45 days. There was another irritating glitch. Sleepy Owl ran out of packaging as well. The survival hack, though, was a smart quick fix: Using the packs of ‘dark roast’ variant to sell ‘original cold brew’. The brand apologised for the switch. ‘We are sorry for the switch’, it underlined in a sorry note attached with every such pack. The packaging of original cold brew, it stressed, has been slightly delayed due to the pandemic. “We didn’t want to keep you waiting for your brew. So this is a quick-fix,” the note read.

Quick fix, though, didn’t result in quick sales. With ready-to-drink bottles and cold brew losing steam, Sleepy Owl needed a booster caffeine dose. And it did come in the form of hot brew bags—coffee in a tea bag—which the startup rolled out during the winter of 2019. Priced at Rs300 for a box of 10 pouches, Brew Bags—which made up around 29 percent of sales clocked by Sleepy Owl before Covid—gained heady traction. Look at the numbers. Post-Covid, Brew Bags made up for 45 percent of sales; 36 percent was contributed by cold brew blend; and ready-to-drink chipped in with 19 percent, a fall from 35 percent before Covid.

The co-founders of Sleepy Owl loaded their cars with cold brew and went direct to consumers in terms of delivering; and the team managed to exhaust the inventory over the next few months

The co-founders of Sleepy Owl loaded their cars with cold brew and went direct to consumers in terms of delivering; and the team managed to exhaust the inventory over the next few months