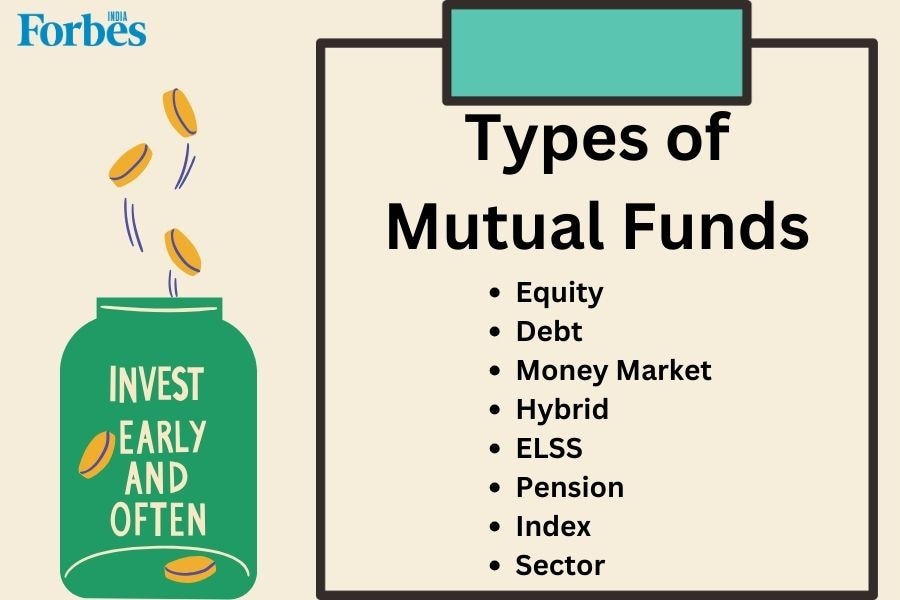

Types of Mutual funds in India based on investment goals, asset class, risk and more

Wondering about the different types of mutual funds? Here, we categorise them based on asset class, investment goal, structure, and more

A mutual fund is an investment vehicle that pools money from multiple investors to put into a diversified portfolio of stocks, bonds, and other securities. Mutual funds offer individuals a convenient way to invest in various assets, providing diversification and professional management. In this blog, we'll navigate the many types of mutual funds. Whether you're an experienced investor or only starting, our guide should help you make informed decisions when deciding the best mutual fund for investment.

Also Read: Long term capital gains (LTCG) tax: Rates, calculation, and more

Types of Mutual Funds Based on Asset Class

There can be various differentiating factors when naming the types of mutual funds. Going by asset class, here they are:

| Fund Name | Description | Allocation |

|---|---|---|

| Equity | Invests in stocks | Variable in large-cap, mid-cap, small-cap |

| Debt | Invests in bonds and debt securities | 80-100 percent |

| Money market | Focuses on short-term, low-risk securities | Variable |

| Hybrid | Mix of stocks and bonds | Variable |

Equity Funds

Equity funds invest in stocks or equities of different companies. These mutual funds suit those seeking long-term growth and are ready to accept the accompanying market risk.

Also Read: Top 10 equity mutual funds in India to invest in 2024