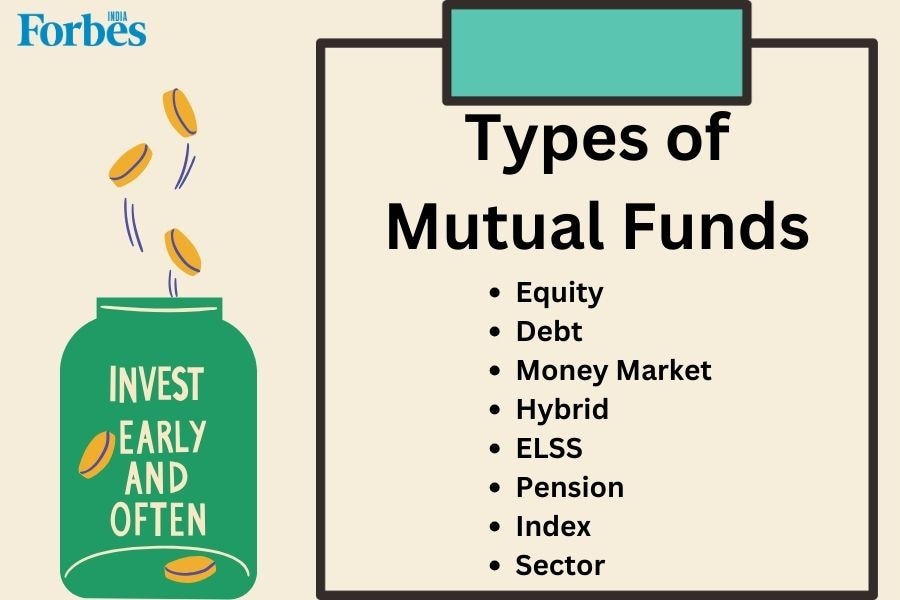

Types of Mutual funds in India based on investment goals, asset class, risk and more

By Forbes India| Sep 27, 2023

Wondering about the different types of mutual funds? Here, we categorise them based on asset class, investment goal, structure, and more

A mutual fund is an investment vehicle that pools money from multiple investors to put into a diversified portfolio of stocks, bonds, and other securities. Mutual funds offer individuals a convenient way to invest in various assets, providing diversification and professional management. In this blog, we'll navigate the many types of mutual funds. Whether you're an experienced investor or only starting, our guide should help you make informed decisions when deciding the best mutual fund for investment.

Also Read: Long term capital gains (LTCG) tax: Rates, calculation, and more

Types of Mutual Funds Based on Asset Class

There can be various differentiating factors when naming the types of mutual funds. Going by asset class, here they are:

| Fund Name | Description | Allocation |

|---|---|---|

| Equity | Invests in stocks | Variable in large-cap, mid-cap, small-cap |

| Debt | Invests in bonds and debt securities | 80-100 percent |

| Money market | Focuses on short-term, low-risk securities | Variable |

| Hybrid | Mix of stocks and bonds | Variable |

Equity Funds

Equity funds invest in stocks or equities of different companies. These mutual funds suit those seeking long-term growth and are ready to accept the accompanying market risk.

Also Read: Top 10 equity mutual funds in India to invest in 2024

Debt Funds

These types of mutual funds pool money in fixed-income securities like bonds and serve as an ideal mutual fund for investment for conservative investors.

Money Market Funds

These mutual funds invest in short-term, low-risk instruments like treasury bills. They are a safe place to park surplus cash, offering stability and liquidity.

Hybrid Funds

These types of mutual funds blend equity and debt in a single portfolio. They are an ideal mutual fund for investment for those looking for diversification and moderate risk.

Also Read: Stock market timings in India: Opening and closing time of BSE and NSE share markets

Types of Mutual Funds Based on Investment Goals

The types of mutual funds judging by one’s investment goals would be:

| Fund Name | Description | Allocation |

|---|---|---|

| Growth | Aims for long-term capital appreciation | Mostly in stocks |

| Income | Seeks regular income through interest | Primarily in bonds |

| Liquid | Focuses on high liquidity and safety | Predominantly in liquid assets |

| Tax-Saving | Offers tax benefits under Section 80C | Mix of stocks and bonds |

| Aggressive Growth | Seeks high returns with higher risk | Predominantly in high-growth assets |

| Capital Protection | Aims to protect the capital invested | Mix of low-risk and capital protection assets |

| Fixed Maturity | Has a fixed maturity date | Predominantly in fixed-income securities with the same maturity date |

| Pension | Designed for retirement planning | Mix of growth and income assets tailored for retirement |

Growth Funds

They focus on long-term capital appreciation, investing in companies with high growth potential. While they offer substantial returns, they come with higher volatility.

Also Read: Mutual fund stress test: Methodology and test results for small and mid cap funds

Income Funds

These mutual fund types prioritise providing a steady income stream through dividend-paying stocks, interest-bearing securities and so on.

Liquid Funds

These mutual funds offer safety, liquidity, and a slightly higher return than traditional savings accounts. They are an ideal mutual fund for investment for short-term cash management needs.

Also Read: What is the price-to earnings (P/E) ratio

Tax-Saving Funds (ELSS)

ELSS means to combine the potential for equity market growth with tax benefits under Section 80C of the Income Tax Act in India.

Aggressive Growth Funds

This mutual fund type invests in high-growth stocks. These are tailored for investors willing to endure market fluctuations in pursuit of potential high returns.

Capital Protection Funds

These mutual funds primarily invest in fixed-income instruments to protect investors' initial capital, serving as an ideal mutual fund for investment for conservative investors.

Fixed Maturity Funds

These types of mutual funds come with predefined maturity dates and provide predictability in returns.

Pension Funds

These types of mutual funds are designed for long-term retirement planning and balance growth and stability.

Also Read: Cost inflation index (CII) for FY 2023-24 to calculate capital gains

Types of Mutual Funds Based on Investment Structure

The mutual fund types based on investment structure would be:

| Fund Name | Description | Allocation |

|---|---|---|

| Open-ended | Offers unlimited shares at Net Asset Value | Varies, based on investor demand |

| Closed-ended | Has a fixed number of shares traded on exchanges | Varies, may trade at a premium or discount |

| Interval | Combines open-end and closed-end funds | Varies, typically allows limited redemptions at specified intervals |

Open-Ended Funds

This mutual fund type allows investors to buy or sell shares anytime. They are an ideal mutual fund for investment for those who want to adjust their investments in response to market conditions or personal financial goals.

Closed-Ended Funds

These have a fixed number of shares and trade on secondary markets. They often come with a specified maturity date.

Also Read: Section 80C: Income tax deduction and limits under section 80C, 80CCD in 2023

Interval Funds

Interval funds blend features of open-ended and closed-ended funds, allowing investors to enjoy periodic liquidity while maintaining structure in their investments.

Types of Mutual Funds Based on Risk

Going by risk, here are the mutual fund types:

| Fund | Description | Allocation Percentage |

|---|---|---|

| Very-Low Risk | Focuses on capital preservation with minimal risk | Predominantly in low-risk assets |

| Low-Risk | Aims for steady returns with relatively low risk | Mix of low to medium-risk assets |

| Medium-Risk | Balances risk and return with moderate risk | Mix of low to high-risk assets |

| High-Risk | Seeks potentially high returns with higher risk | Predominantly in high-risk assets |

Very-Low-Risk Funds

These funds primarily invest in safe assets like government bonds and money market instruments.

Low-Risk Funds

These generate modest returns through a mix of fixed-income securities while preserving capital.

Medium-Risk Funds

This mutual fund type balances safety and growth by diversifying across asset classes.

Also Read: Cost inflation index (CII) for FY 2023-24 to calculate capital gains

High-Risk Funds

High-risk funds focus on assets with higher volatility, such as growth stocks, emerging markets, and so on.

Specialised Mutual Funds

Aside from the many types of mutual funds mentioned above, some special mutual funds do not fit under any of the aforementioned categories.

| Fund Name | 1-Liner Description |

|---|---|

| Concentrates on a specific industry or sector | Sector |

| Passively tracks a market index | Index |

| Invests in other mutual funds | Fund of Funds |

| Focuses on developing economies | Emerging Market |

| Invests in foreign markets | International |

| Invests in both domestic and foreign markets | Global |

| Invests in real estate properties or securities | Real Estate |

| Focuses on commodity-related stocks | Commodity-Focused Stock |

| Aims to generate returns regardless of market direction | Market neutral |

| Profits from declining markets | Inverse |

| Allocates across various asset classes | Asset Allocation |

| Facilitates charitable giving | Gift |

| Trades on stock exchanges like individual stocks | Exchange-Traded |

Sector Funds

These mutual fund types are favoured by those who have strong convictions about specific industries or wish to diversify beyond broad market exposure.

Index Funds

Index funds aim to replicate the performance of a specific market index, such as the S&P 500. Those seeking a cost-effective way to gain exposure to the overall market prefer these mutual fund types.

Fund of Funds

This mutual fund type is an efficient way for investors to access multiple investment strategies and asset classes within a single fund.

Emerging Market Funds

This mutual fund type offers growth potential but can experience higher volatility due to economic and political factors in emerging markets.

International Funds

This mutual fund type appeals to investors who want to capitalise on international growth.

Global Funds

These can be the ideal mutual funds for those seeking a comprehensive solution to access diverse markets.

Real Estate Funds

This mutual fund type is attractive to those interested in real estate but want to avoid engaging in direct property ownership.

Commodity-Focused Funds

This mutual fund type provides exposure to commodities like precious metals, oil, or agricultural products, offering a hedge against inflation.

Market-Neutral Funds

This mutual fund minimises market risk and appeals to those interested in alternative investment strategies.

Inverse Funds

This mutual fund type is ideal for those who seek to profit from bearish market conditions.

Asset Allocation Funds

These mutual funds dynamically adjust their portfolio mix based on market conditions and the fund manager's strategy. They are appealing to investors who want an actively managed, diversified portfolio.

Also Read: What is equity? What are its types? How does equity investment work? Formula to calculate and more

Gift Funds

This mutual fund type allows individuals to make contributions to charities.

Exchange-Traded Funds

ETFs offer exposure to various asset classes, sectors, and strategies.