Being an old-school fundamentals guy in the era of Amazon, Tesla, GameStop and Bitcoin

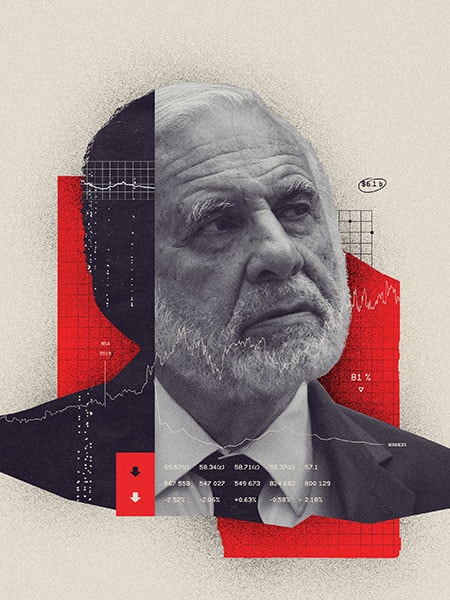

Growth, momentum and investor psychology are the most important drivers of success on Wall Street today. But at 85, street legend Carl Icahn is one of the last remaining OG corporate raiders who still like asset- and cash-rich companies in need of a shake-up

Carl Icahn’s fund has lost money in five of the last seven years. He hopes to turn things around with big bets on Occidental, Bausch Health, Cheniere Energy, Newell Brands and Xerox

In October 2013, when Carl Icahn started selling his large position in Netflix, many believed the vaunted billionaire investor had done it again. The company had successfully transitioned from a DVD-by-mail rental service to video streaming, and Icahn had made a 457 percent return in just 14 months.

“As a hardened veteran of seven bear markets,” Icahn announced, it was time for him “to take some of the chips off the table”. Icahn’s son, Brett, begged his father not to sell. By 2015 Icahn was out, making a tidy $2 billion profit on Netflix. But since his departure, the stock has appreciated another tenfold. Had Icahn held onto it, his profit would have been $19 billion.

Icahn’s Netflix miss isn’t just a fluke. Last year, while the US stock market returned 18 percent during a volatile pandemic bull market, Icahn’s hedge fund plunged by 14 percent. In 2019, it tumbled by 15 percent. In fact, the great trader has lost more than $5 billion trading over the last seven calendar years. His hedge fund has suffered so much that its average annual return since its inception in 2004 has fallen to 3 percent, versus 10 percent for the S&P 500.

Icahn’s struggles illustrate a major shift occurring on Wall Street. In the era of Amazon, Tesla, GameStop and Bitcoin, growth, momentum and investor psychology are the most important drivers of success. But at 85, Icahn is sticking to fundamentals. He is one of the last remaining OG corporate raiders on Wall Street, and he still likes asset- and cash-rich companies in need of a shake-up. “I am a value guy, and the activism model is still the best model if you can find a company with hidden value and the board is not taking advantage of it,” Icahn insists from his new office digs in Florida. “It is still the best on a risk-reward basis, but you need a lot of patience.”