Anil Agarwal: Playing the big stakes game

Anil Agarwal has blueprinted a Rs 1.54 lakh crore game plan to become India's first chips and glass display maker. It may be unchartered waters, but Agarwal seems geared up and ready for the challenge

A recent report by Counterpoint Research and the India Electronics & Semiconductor Association says the Indian semiconductor market to be worth $64 billion by 2026; in 2019, that figure stood at $22.7 billion.

Another report by Deloitte is almost as bullish, and pegs the market at $55 billion in three years. Three industries are expected to account for more than 60 percent of that market: Smartphones and wearables, automotive components, and computing and data storage. What is more, semiconductor and chip technology will be in high demand between 2025 and 2028; that’s when private deployment 5G networks are expected to take off.

The government is enabling this push by pitching in with half of the new project costs via incentives; that’s excluding outlays for research and development, skill development and training. In end-December, it had earmarked $10 billion as an incentive to companies keen on the semiconductor sector. Five applications—three for chips and two for display—were received till February. Plus, the ongoing production-linked, and design-linked incentive schemes are expected to do their bit.

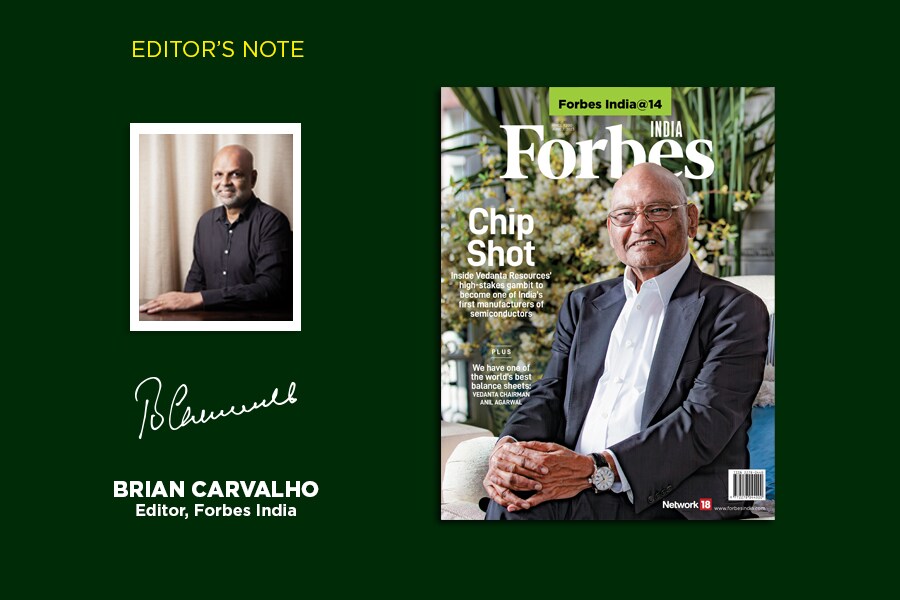

One industrialist keen to play for big stakes on this front is Anil Agarwal, the chairman of Vedanta Resources. “The future in India now is only for two or three things,” Agarwal tells Manu Balachandran, who has written the cover story on Agarwal’s gambit. “Seventy percent of our imports are between natural resources and electronics. For electronics, the basic raw materials are chips and glass.”

Agarwal has blueprinted a ₹1.54 lakh crore game plan to become India’s first chips and glass display maker. Half of that investment is expected from the central government’s subsidy (to both projects).