Capri Global's Rajesh Sharma wants to tap into India's fintech revolution. Here's how

How Rajesh Sharma rebuilt his empire and found his way to the Billionaires list

Rajesh Sharma, MD, Capri Global

Image: Neha Mithbawkar for Forbes India

Rajesh Sharma, MD, Capri Global

Image: Neha Mithbawkar for Forbes India

Rajesh Sharma has much to thank the city of Mumbai for. Especially, when it comes to making him a billionaire.

After all, it’s the country’s financial capital that sheltered him as a 20-something graduate, when he left his nondescript hometown of Mukundgarh in Rajasthan to pursue a career in chartered accountancy. It was also the city that showed him that pedigree was inconsequential, and what mattered was fortitude and perseverance.

“When you are in a city like Bombay (Mumbai) you can aspire for anything,” Sharma says. “People look at what you can do, not what background you come from or who you are. That is the beauty of this city.” Sharma moved to the city in 1989 and has since made it his home. In the process, he built a financial services firm, was arrested for an alleged bribes-for-loans scam, rebuilt his business into a notable Non-Banking Finance Company (NBFC), mopped up sporting franchises from kho kho to cricket, and this year, joined the coveted Forbes billionaires’ club.

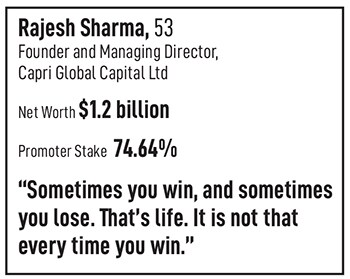

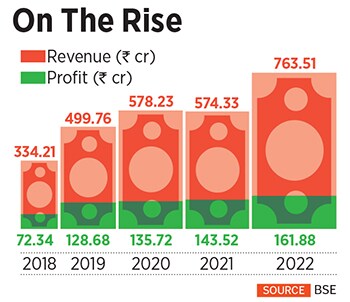

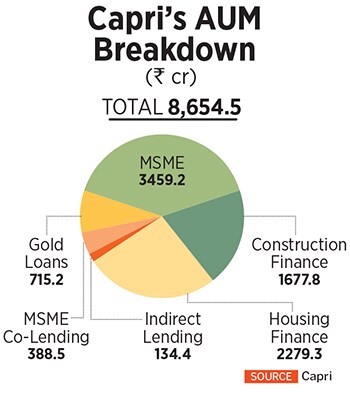

With a net worth of $1.1 billion, Sharma is the 2405th richest man in the world, according to the Forbes World’s Billionaires List 2023, the bulk of which he gets from a majority stake in the non-banking finance company, Capri Global Capital. Capri Global has a market capitalisation of ₹12,268 crore and offers home loans, construction loans as well as customised business loans for medium and small-scale enterprises.

“It doesn’t matter whether you have a wealth of ₹50 crore or ₹3,000 crore or ₹10,000 crore,” Sharma tells Forbes India in a video interview. “I don’t think that changes anything. Irrespective of how much money you have, if you can get to a stage where you are free to decide what you want to do and especially those things that satisfy you, that is what matters.”

Sharma’s Capri Global is a dominant financial services player in the western regions of the country, especially Gujarat, Maharashtra, Rajasthan, Madhya Pradesh and Delhi NCR, where it has tapped heavily into the MSME lending space, in addition to home loans, over the past few years. The company claims to have over 600 branches across the country, and last year also forayed into the lucrative gold loan business.

Sharma’s Capri Global is a dominant financial services player in the western regions of the country, especially Gujarat, Maharashtra, Rajasthan, Madhya Pradesh and Delhi NCR, where it has tapped heavily into the MSME lending space, in addition to home loans, over the past few years. The company claims to have over 600 branches across the country, and last year also forayed into the lucrative gold loan business.  In 1996, after working for a few years, Sharma set up his own professional services firm in Mumbai. “I started my own practice in financial services, where we used to help companies raise short-term capital,” Sharma says. “Then we started investment banking practices and, till 2010, we were doing that.”

In 1996, after working for a few years, Sharma set up his own professional services firm in Mumbai. “I started my own practice in financial services, where we used to help companies raise short-term capital,” Sharma says. “Then we started investment banking practices and, till 2010, we were doing that.” “We stuck to our core competencies,” Sharma says. “Which was debt funding. And we started building retail lending. That was followed by recruiting people and opening branches.” By 2013, the company expanded its business into MSME lending. “We identified the opportunity that banks do not lend in the informal self-employed, non-professional segment,” Sharma says. “So there was an opportunity to start lending, and since we had an NBFC licence and capital, we ventured out.”

“We stuck to our core competencies,” Sharma says. “Which was debt funding. And we started building retail lending. That was followed by recruiting people and opening branches.” By 2013, the company expanded its business into MSME lending. “We identified the opportunity that banks do not lend in the informal self-employed, non-professional segment,” Sharma says. “So there was an opportunity to start lending, and since we had an NBFC licence and capital, we ventured out.”