Bootstrapped Lotus Herbals is not afraid of MNC invasions. Here's why

In three decades, Lotus Herbals, the bootstrapped natural beauty care warrior has kept its turf safe from big MNC rivals

(Left)Nitin Passi, Chairman and MD, Lotus Herbal and Dipin Passi, Joint MD, Lotus Herbal

Image: Amit Verma

(Left)Nitin Passi, Chairman and MD, Lotus Herbal and Dipin Passi, Joint MD, Lotus Herbal

Image: Amit Verma

The young grad was about to learn two priceless lessons from his mentor. “Don’t let them get under your skin,” Kamal Passi counselled his son, Nitin, who was getting bogged down by his wily opponents. Nitin completed his MBA in corporate strategy and finance from Katz Graduate School of Business, University of Pittsburgh, in 2000. After a two-year stint with Deloitte, the third-generation entrepreneur returned to India and joined the family business of natural skincare and beauty care products in December 2003. His father, an electrical engineer, was set to impart practical knowledge, which are either missed in B-schools’ curriculum or don’t find a mention in management books.

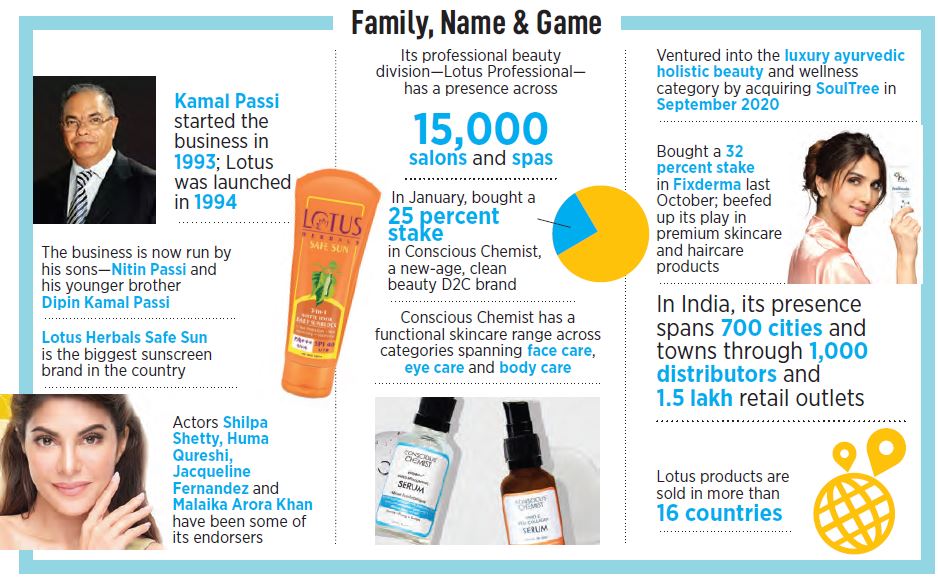

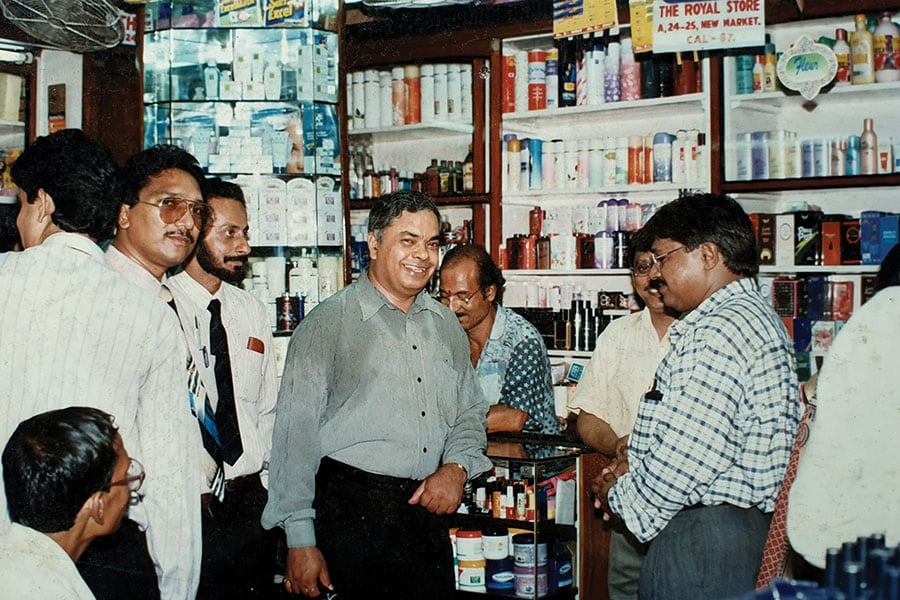

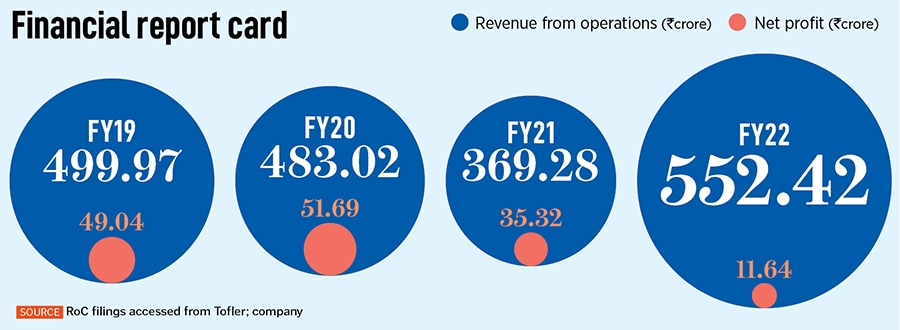

Started by Passi in 1993, Lotus Herbals emerged as a strong regional player in the natural beauty care space across north India over a decade later. Though small in revenue—₹7.8 crore in 2003—the challenger brand managed to give the jitters to a clutch of MNC biggies who started feeling threatened. The result was ‘unwanted’ attention and attempts to not let the Lotus bloom.

Nitin, meanwhile, was vexed with the games played by deep-pocketed rivals. A battery of frivolous legal cases were slapped, Lotus Herbals was dragged to court, and one of the big players flexed its financial muscle to restrict contractors from supplying ingredients to Lotus Herbals. “I could see how big companies were trying to kill a small fish,” recalls Nitin, who was itching to take on the might of the Goliaths. Now came the second advice from Passi. “Don’t take on the MNCs head-on,” were the words of caution from a seasoned entrepreneur whose father ran a cosmetics factory in Jalandhar and sold products under the Pamilla Perfumery brand in the 1970s.

Back in Delhi, the young entrepreneur was not ready to submit meekly. His arguments carried weight. Products of Lotus Herbals and rival foreign brands were sharing the same shelf of retail stores and targeting the same set of customers. “Ultimately, we are competing against them,” argued Nitin, who was also mindful of respecting and obeying his tutor. So, the young lad thought of a strategy which could kill two birds with one stone. The plan was simple. First, Lotus Herbals would not fight with rivals by competing with their core products. Second, Nitin decided to create his own little kingdoms—segments where Lotus Herbals could rule with its blockbuster products such as sunscreen and sunblock. “If they want to fight, they have to come on our turf,” he says.

Back in Delhi, the young entrepreneur was not ready to submit meekly. His arguments carried weight. Products of Lotus Herbals and rival foreign brands were sharing the same shelf of retail stores and targeting the same set of customers. “Ultimately, we are competing against them,” argued Nitin, who was also mindful of respecting and obeying his tutor. So, the young lad thought of a strategy which could kill two birds with one stone. The plan was simple. First, Lotus Herbals would not fight with rivals by competing with their core products. Second, Nitin decided to create his own little kingdoms—segments where Lotus Herbals could rule with its blockbuster products such as sunscreen and sunblock. “If they want to fight, they have to come on our turf,” he says.

A few years later, in 2013-14, the bootstrapped Lotus Herbals decided to rope in a strategic partner. The idea was to infuse capital to expand operations, beef up marketing and advertising, and develop a war chest to stand firmly against the big boys. The company was in the final stages of talks with a listed Japanese entity who proposed either a 50 percent buyout or a 49 percent stake. However, closer to the deal being signed, Lotus Herbals was asked to become a junior partner by selling 51 percent, which would eventually end in 100 percent acquisition. The offer was too tempting to resist. The family was given a blank cheque. “My father declined. He wanted a partner, not a new owner,” recounts Nitin. After the nixed deal, the family decided to continue with its bootstrapped hustle and journey.