Romesh Wadhwani: Building up, and giving away

At 74, the Indian-American entrepreneur and philanthropist wants to continue pursuing his passion of building tech companies, and giving back to society

Image: Timothy Archibald Indian-American billionaire Romesh Wadhwani

Indian-American billionaire Romesh Wadhwani

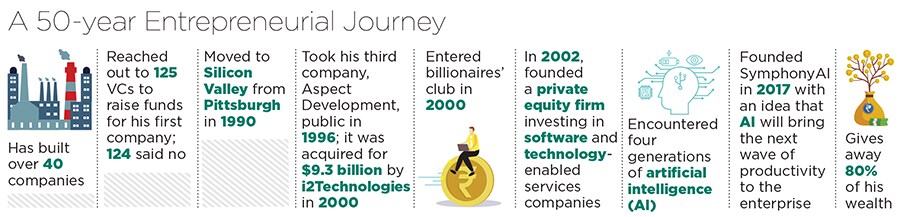

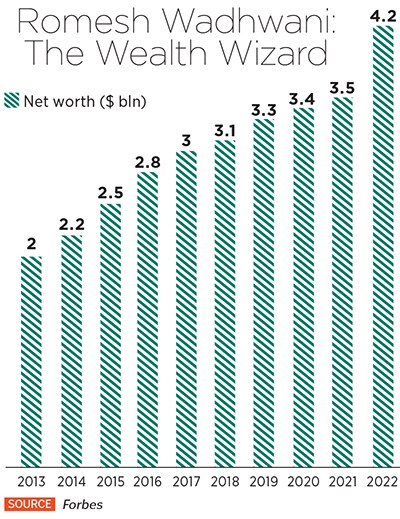

Romesh Wadhwani was born 10 days after India gained Independence in August 1947. He had to leave behind his place of birth, Karachi, now in Pakistan, during Partition, and arrive in Delhi as a refugee, where his family started life afresh. Wadhwani was diagnosed with polio when he was two, a condition he has had to deal with all his life. These challenges have made me even more resilient, says Wadhwani, who, at 74, is one of the world’s richest billionaires. The chairman of SymphonyAI, an enterprise artificial intelligence (AI) firm, and ConcertAI, an AI firm focussed on health care and life sciences, is now worth $4.2 billlion (₹32,000 crore), according to the 2022 Forbes World’s Billionaires List. Wadhwani, who is also the founder of private investment company SAIGroup, has built over 40 companies in his 50-year entrepreneurial journey.

Making his way to Silicon Valley

After obtaining a BTech degree from IIT-Bombay, Wadhwani decided to move to the US in August 1969 to pursue further studies. He arrived at Pittsburgh, Pennsylvania, with barely $2.5 (₹191 today). As an Indian immigrant, it took him a while to settle down in the new country, and he also faced hiccups while managing to secure a student loan. He then got a master’s—followed by a PhD—in electrical engineering from Carnegie Mellon University. During his PhD days, Wadhwani was clear about not working for any firm, and starting his own company instead. With no previous business or management experience, the then-25-year-old decided to take a leap of faith and set out on his entrepreneurial journey.

In the 1970s when the energy crisis had just hit the US, the price of oil and gas was going up. Sensing an opportunity, Wadhwani founded his first company, the Compuguard Corporation, in 1972, to develop and commercialise software for energy management and security in commercial buildings.

There were many roadblocks along the way, but Wadhwani kept going. Raising money for the first company is something he will never forget. He reached out to 125 venture capital (VC) firms all over the US as he needed a capital of $100,000. The first 124 said ‘No’, but the last, Urban National Corp in Boston, agreed to fund the company. He ran Compuguard for 10 years and turned it into a $10-million business before selling it. Wadhwani was among the first few entrepreneurs in Pittsburgh to build high tech companies.

Within business enterprise, there was very little productive use of AI to transform and improve business operations. The fifth generation of AI was what Wadhwani saw as his opportunity to launch SymphonyAI. “I was looking at these first few waves of AI, all of them, fortunately, I had been connected with in some fashion, not commercially and not profitably. But at least I was aware of them. In 2017, I realised the next big wave is going to be in business enterprise. SymphonyAI is the culmination of that journey that started in 1969 when I first met Herbert and Allen at my university. Here I am, 50 years later, actually building a commercially successful group of AI companies, 50 years after first learning what AI was at that time. It feels like I am closing a circle,” he says.

Within business enterprise, there was very little productive use of AI to transform and improve business operations. The fifth generation of AI was what Wadhwani saw as his opportunity to launch SymphonyAI. “I was looking at these first few waves of AI, all of them, fortunately, I had been connected with in some fashion, not commercially and not profitably. But at least I was aware of them. In 2017, I realised the next big wave is going to be in business enterprise. SymphonyAI is the culmination of that journey that started in 1969 when I first met Herbert and Allen at my university. Here I am, 50 years later, actually building a commercially successful group of AI companies, 50 years after first learning what AI was at that time. It feels like I am closing a circle,” he says.