Dasari Uday Kumar Reddy—the billionaire founder who swears by his 4 am regime

In bed usually at 8 pm, and up at 4 am daily, two hours in the gym, and a non-existent social life—Reddy's steadfast focus and determination to build a business, has led Tanla Platforms to become a success story that processes over 169 billion messages per year and has a market share of 40 percent in the category

Dasari Uday Kumar Reddy, Chairman and chief executive, Tanla Platforms Limited

Image: Vikas Pureti for Forbes India

Dasari Uday Kumar Reddy, Chairman and chief executive, Tanla Platforms Limited

Image: Vikas Pureti for Forbes India

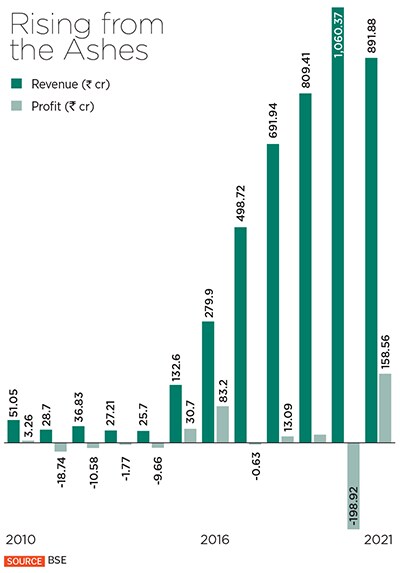

Dasari Uday Kumar Reddy is as battle-hardened as one can be. If anything, Reddy, chairman and chief executive of the $320 million cloud communications company Tanla Platforms Limited, has seen his empire built ground-up, burnt down, and like a phoenix rise again from the ashes. The 54-year-old reclusive billionaire debuts on the 2022 Forbes World’s Billionaires List, ranked 2,332 with a net worth of $1.2 billion. As of April 15, his net worth stood at $1.3 billion.

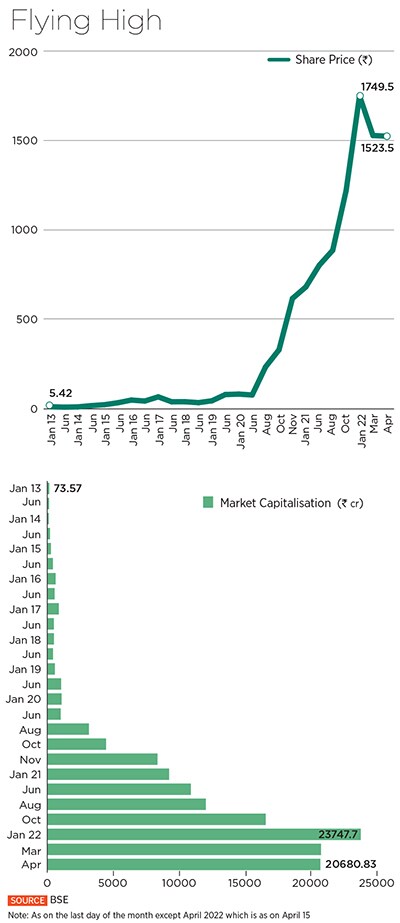

Hyderabad-based Tanla Platforms, a CPaaS (Communications Platform as a Service) company, offers wireless data services for mobile messaging. It saw its shares double during a spectacular rally on the bourses last year. In fact, since March 2014, its share price has grown a staggering 38,000 percent, which means that an investment of ₹1 lakh in the company, would have grown to ₹3.8 crore in eight years.

Tanla currently has a market capitalisation of ₹20,680 crore and is among the few Indian companies that have made massive inroads into the CPaaS space. Over the past two decades, since it first began operations, it has changed its business model a few times before finding success in the Application-to-Person (A2P) messaging business in the past few years.

“I was very clear from day one that I wanted to be in business,” says Reddy from his Hyderabad office that is lined with numerous autobiographies and self-help books. Reddy wakes up at 4 am and spends about half an hour in bed to talk to himself, find solutions to problems, and even find new challenges to solve. He’s a teetotaller, spends nearly two hours at the gym, abstains from eating non-vegetarian food and is often in bed by 8 pm. “My best friend is a clerk at a bank,” he adds. “I don’t socialise… I spend much of my time on building the business. I am here for the long haul.”

His father, a soft-spoken man, was kept away from the lucrative contract business, which largely involved the construction of roads and buildings, and was instead handed agricultural land by his grandfather. “I told him what you’re doing is not fair,” Reddy recalls telling his grandfather as a 10-year-old. “He said your father cannot handle it. I said fair enough, but maybe I can handle it. He told me that I was too young, but I said we will grow one day.”

His father, a soft-spoken man, was kept away from the lucrative contract business, which largely involved the construction of roads and buildings, and was instead handed agricultural land by his grandfather. “I told him what you’re doing is not fair,” Reddy recalls telling his grandfather as a 10-year-old. “He said your father cannot handle it. I said fair enough, but maybe I can handle it. He told me that I was too young, but I said we will grow one day.” Reddy then met up with some friends who connected him to someone who could help him build his

Reddy then met up with some friends who connected him to someone who could help him build his