Uday Kotak: Going beyond the bank to shape India's financial sector

By Salil Panchal| Mar 12, 2024

India's billionaire banker Uday Kotak, winner of the Forbes India Leadership Award for Institution Builder, shares mantras for new-age entrepreneurs to build a successful venture and sheds light on his new innings and plans to save the planet

[CAPTION]Uday Kotak, Founder and Director, Kotak Mahindra Bank

Image: Mexy Xavier[/CAPTION]

[CAPTION]Uday Kotak, Founder and Director, Kotak Mahindra Bank

Image: Mexy Xavier[/CAPTION]

Uday Kotak sits at his family office, USK Capital, in Mumbai’s Bandra-Kurla Complex, where construction activity continues in the landscape unabated. It is reflective of the fact that India’s celebrated billionaire banker—who successfully founded and built Kotak Mahindra Bank (KMB), India’s fourth-largest bank by market capitalisation in just over two decades—has an “open” canvas in his new journey.

Kotak stepped down as the bank’s managing director and CEO on September 1, 2023, though he remains on its board as a director. He is now looking forward to wanting to add more towards building India’s financial sector through policy, and promoting talent and opportunities, he tells Forbes India.

Giving back for sustainability

Kotak, 64, is working on—as part of the B20 (the official G20 dialogue forum with the global business community)—creating a financial framework to help sustainability and lessen the existential risks to planet Earth. “The existential risk to the planet is much higher than the capability of the business models prevalent on Earth to save it,” Kotak says._RSS_If a project needed ₹100, the viability comes at ₹80 and ₹20 is the loss funding. Kotak has suggested using the backbone of India’s existing CSR model—every profitable company globally gives 0.2 percent of the 2 percent (CSR) of its annual profit, in the form of loss funding each year, towards social development goals to save the planet. The funds collected each year from all corporations could be given to a global institution such as the World Bank to leverage upon.

“If I know as a fund that I am going to get, for example, $100 billion each year, I can do bridge finance for the project right now. And this would solve Earth’s existential problem,” Kotak says.

Kotak had done gap funding through the non-banking finance company (NBFC) Kotak Mahindra Finance (KMFL) in 1990, to take on rival Citibank in car financing. He would pre-book cars—which usually had a waiting period of six months—from Maruti Udyog (now Maruti Suzuki India). Money would be paid to the manufacturer or supplier through lines of credit and cars delivered on the condition they were financed through KMFL.

Maruti got a huge float on which it earned an attractive 16 to 17 percent rate of interest, but KMFL, while gaining market share, took a hit on its profit and loss, as it was not charging a premium for immediate delivery of cars (as was the prevalent practice). “Whatever interest cost came out of the spread we were lending at,” Kotak says. “It is similar here [the B20 sustainability proposal], but in reverse.” Kotak is asking companies to “give back something” considering that every company benefits from the planet’s resources.

Maruti got a huge float on which it earned an attractive 16 to 17 percent rate of interest, but KMFL, while gaining market share, took a hit on its profit and loss, as it was not charging a premium for immediate delivery of cars (as was the prevalent practice). “Whatever interest cost came out of the spread we were lending at,” Kotak says. “It is similar here [the B20 sustainability proposal], but in reverse.” Kotak is asking companies to “give back something” considering that every company benefits from the planet’s resources.It was not narcissism that prompted the coming together of the names Kotak and Mahindra. Kotak had decided early that he would not refrain from putting his reputation on the line. This resolve became stronger when he read numerous books on top financial institutions such as JP Morgan, Goldman Sachs and Morgan Stanley and saw them carry their family names. He, too, decided to put his name, and this thought was reinforced when he visited the US in 1992, by which time the family name was established.

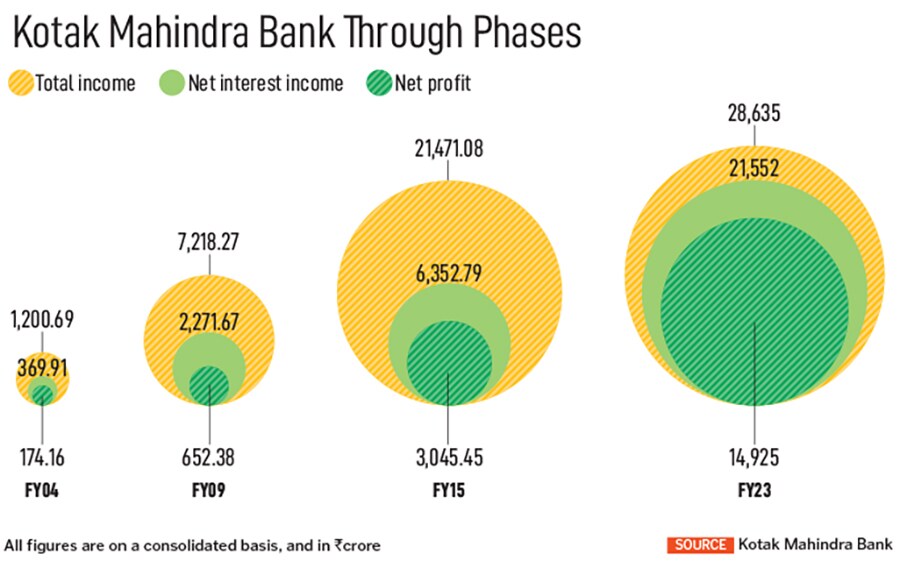

Today, KMB is the only Indian private sector lender which retains the family names of its promoters. It now operates across the spectrum of financial services, including the investment bank, asset management, life and general insurance, alternate assets, vehicle financing, brokerage and research. The consolidated profit for the group stands at ₹4,265 crore as of December 31, 2023.

Also read: India needs more discipline and world-class financial institutions: Uday Kotak at FILA 2024

The startup, creating JVs

Born in Mumbai into a large joint family of 63, Kotak had a keen entrepreneurial spirit, inclined more towards finance than his family’s cotton trading business. After an MBA from the Jamnalal Bajaj Institute of Management Studies, Kotak thought of a financial consultancy firm, but a keen eye for opportunity drew him towards discounting bills of large corporates.He came to know from a friend working at Tata firm Nelco that it borrowed funds for 90 days at 17 percent. Banks lent to companies at 17 to 18 percent, but offered just 6 percent returns on fixed deposits to individuals, making an 11 percent spread. Kotak Capital Management Finance was the startup to develop the bill discounting market in India. “I told my family friends that instead of a 6 percent return, I would give them a 12 percent return,” recalls Kotak, adding that the counter-party risk was the Tata group.

So, he sourced funds at 12 percent and lent onward to reputed companies at 16 percent, making a spread of around 4 percent. The bill discounting business grew, and he formed what was called Kotak Capital Management Finance, which later became KMFL.

During the early days of the NBFC, individuals such as Shanti Ekambaram (now whole-time director and deputy MD from March 1, 2024), KVS Manian (now whole-time director and joint MD from March 1, 2024), Jaimin Bhatt (group chief financial officer), alongside others such as C Jayaram (former joint MD and now non-executive director) and Dipak Gupta (former joint MD) played larger roles as individuals, compared to the NBFC. Later when the NBFC converted to a full service bank, the institution became larger than the individuals.

During the early days of the NBFC, individuals such as Shanti Ekambaram (now whole-time director and deputy MD from March 1, 2024), KVS Manian (now whole-time director and joint MD from March 1, 2024), Jaimin Bhatt (group chief financial officer), alongside others such as C Jayaram (former joint MD and now non-executive director) and Dipak Gupta (former joint MD) played larger roles as individuals, compared to the NBFC. Later when the NBFC converted to a full service bank, the institution became larger than the individuals.In 1995, Kotak struck a joint venture (JV) with Goldman Sachs (their first overseas tie-up) for an investment banking firm Kotak Mahindra Capital, in which Kotak Mahindra held 72 percent and Goldman Sachs the balance. A similar venture was also struck between the two parties to create Kotak Securities.

A year later, Kotak set up two JVs for car finance with Ford Credit International, a Ford Motor company, to finance passenger cars, to take advantage of the global car brands that were entering India. As car financing grew, so did investment banking and stock broking.

The JVs with Goldman and Ford ended in 2005 and Kotak remains pragmatic about how JVs work. “JVs are usually between two competitors… they do not last forever. But we continue with our relationship,” he says. Sixteen years later, Ford Credit handed over its passenger vehicle financing portfolio to Kotak Mahindra Prime, to continue with recovery and collections.

The NBFC’s first test of strength was the 1997-98 Asian financial crisis. The number of NBFCs crashed from 4,000 to about 20, and KMFL was among the 0.5 percent that survived by reducing the size of its balance sheet by half.

Owning the customer

For banks, traditionally, the need for minimum capital requirements meant the concern of low RoEs (return on equity). But Kotak’s conviction was that “ultimately one needs to own the customer”. It was with this belief that he pushed KMFL to convert into a bank.

Fintechs in India continue to struggle with acquiring and owning customers.

KMFL got a banking licence from the Reserve Bank of India in 2003, becoming the first NBFC to be converted into a commercial bank in India’s history.

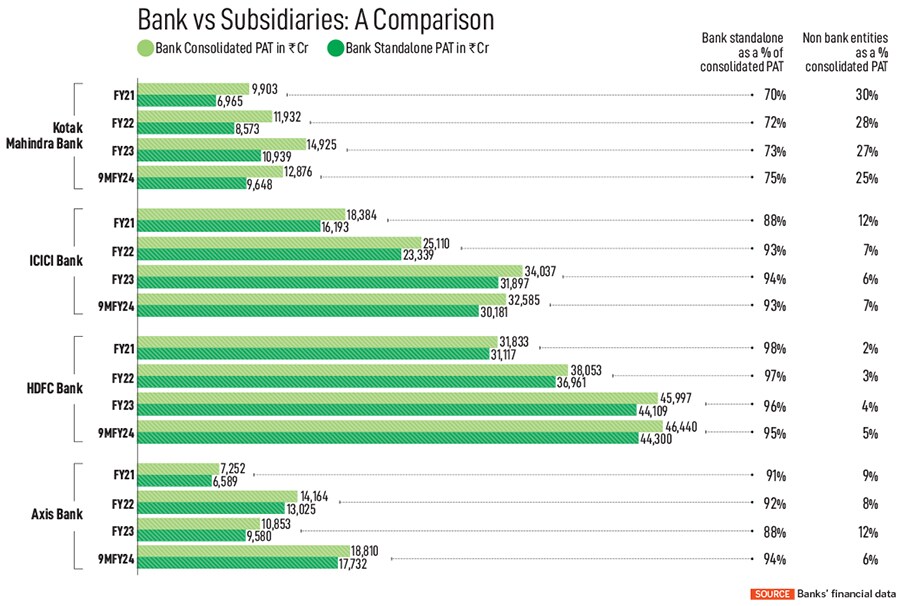

Kotak Mahindra Bank (KMB) is in a unique position at this stage. Unlike India’s top four private sector banks, the profits from the subsidiaries of the Kotak Mahindra Bank group (as a percentage of the consolidated profit) are the highest, while they are lower than 10 percent for the other banks (see table).

In the decade gone by, weak credit risk management, the impact of the slowing economy (post the global financial crisis) and the inability of corporates to pay back hefty loans caused banks’ balance sheets to take a hit. But KMB has proved that appropriate risk evaluation and a conservative approach can bring success in an extremely challenging environment. This comes from one of Kotak’s business mantras: “Do not take an equity type of risk which could bring you debt type of return.” (See ‘Kotak’s 10 Commandments’).

Kotak’s success has come not just from building a successful financial services institution. His leadership has also been well-recognised after he was parachuted by the government to help clean up the books of debt-ridden IL&FS in 2018. In 2023, about ₹61,000 crore (or 61 percent) of the IL&FS Group’s outstanding debt of ₹99,000 crore had been resolved.

Kotak is now India’s 12th richest Indian with a net worth of $13.2 billion, according to Forbes. Kotak and the promoter group combined own a 25.93 percent stake in the bank.

His biggest learning of being conservative and riding through tough times came through the 1997-98 Asian financial crisis. By the time the global financial slowdown of 2008 came, Kotak says, the bank had “done the net practice”. “I read too much of the western media papers and equated that to the situation here,” he concedes. Kotak admits that the bank was too conservative at that time and should have instead sped up growth on branches and customer acquisition. The bank did this much later in 2014-15 when it acquired ING Vysya Bank, in a bid to expand its reach to southern India where Vysya was strong. Even in this case—as with the car finance ventures—Kotak has continued to maintain relationships. Eli Leenaars, a former ING veteran, is now an independent director on the KMB board, offering his experience across institutional banking, asset management, retail banking and insurance.

Kotak speaks about a conversation which his grandfather Amritlal Kotak had with Uday’s father Suresh Kotak. “My grandfather was at the peak of his youth during 1929-1945 (the time of the Great Depression). The mindset was to save money. As a young kid in the 1970s, I remember my grandfather telling my father to be careful about not taking big positions in cotton trading.”

“My father told him that he had a recession mindset, while the world was now an inflationary world,” Kotak says. “The line between lessons of history and baggage of history is very thin,” Kotak recounts and how it influences our minds, and actions change with time.

Though Kotak has been tagged by the media for being a conservative banker, he says he has no problems with taking risk—like most startup promoters backed by venture capitalists do. “I have no problem, but I must get return for my risk. Remember, there is nothing in the world which is risk-free return. But in your chase, don’t end with return-free risk,” he says.

Bank is future ready, accelerating change

Kotak spoke about the bank being ‘future ready’ as it was leapfrogging to a ‘digical’ (digital first supported by physical) world, in the bank’s FY23 annual report. “We have onboarded a new CTO, a chief of customer experience, a head of brand, product and marketing and a chief of retail and commercial risk to drive potentially transformative changes in each of these areas. At the same time, we will grow internal talent, which is future ready,” he said in the note to shareholders.

Commenting on the future of the bank under the new MD and CEO Ashok Vaswani, Kotak says he is comfortable that the bank has a good CEO and the “institution will move forward”.

There are focus areas of customer, products, risk and underlying this, technology, which Vaswani will have to focus on. “There is lot of work to be done on each of these,” Kotak says, adding that he is as excited as he was in 1985.

On the sensitive issue of family members wanting to make a mark professionally in an institution founded by the family, Kotak says: “If the family member is interested in making a career, if they get it on merit to build the career, and it is not imposed from the top [that is fine].” Kotak’s son Jay is now the co-head of KMB’s mobile banking app, Kotak 811, and senior vice president, conglomerate relationships.

Kotak ends the conversation on what entrepreneurs need to learn while building an institution: “The biggest learning in my process of institution building is how well you integrate macro and micro,” he says.