Why India's defence sector is booming

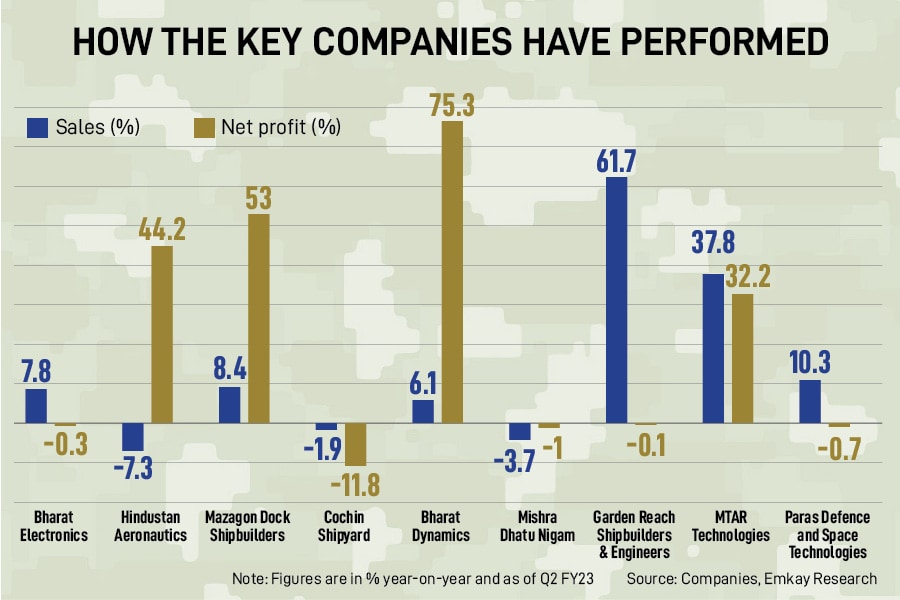

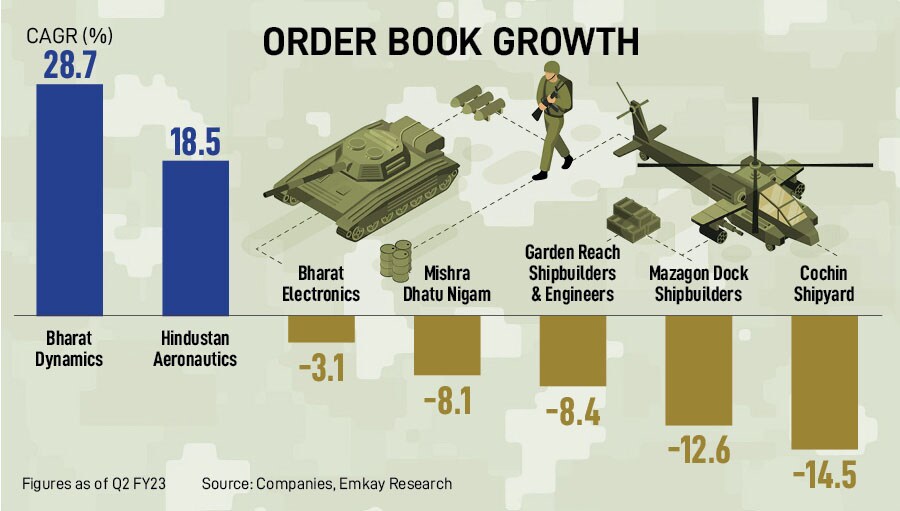

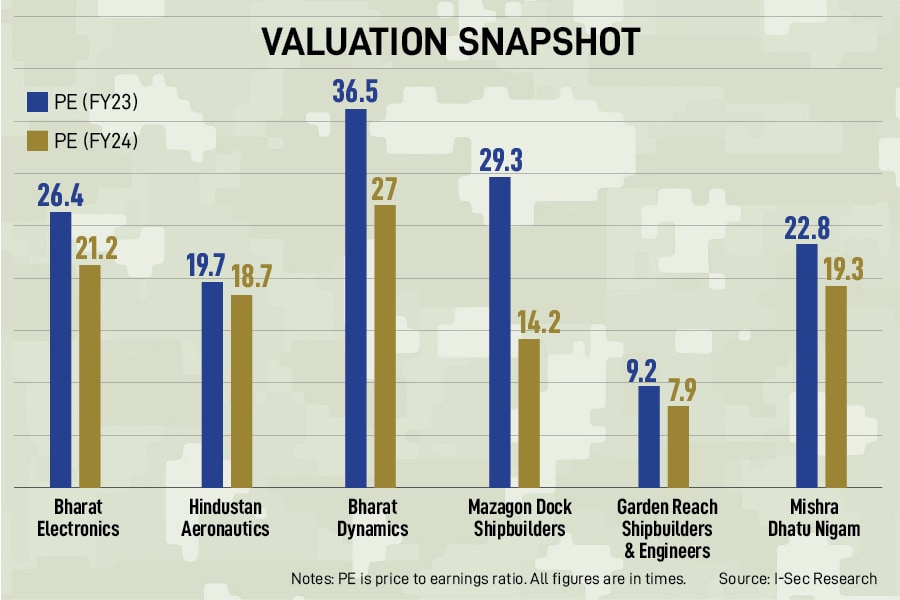

Despite formidable stock returns in the defence sector, analysts feel there is further steam left in it on the back of robust order books and improving earnings quality

India’s defence sector has undergone major reforms as the government is trying to strengthen the nation’s defence prowess by reducing dependence on imports.

India’s defence sector has undergone major reforms as the government is trying to strengthen the nation’s defence prowess by reducing dependence on imports.

Buoyed by healthy order books, revenue expansions and the government’s major push for localisation, India’s defence sector has turned attractive for investors. However, analysts caution that steep valuations, execution hiccups, competition pressures and cash flow generation risks may poise threats to the bumper rally defence stocks have seen recently.

Sachin Trivedi, head of research and fund manager, Equity, UTI AMC, believes that the defence sector is still favourably placed, given the opportunity size (domestic and export) and potential growth over many years. Recent conflicts closer to India, Europe, and other parts of the world strengthened the urgency and need to increase capex and localise production, which made the sector attractive to investments.

“In recent conflicts, we have seen the importance of new defence equipment such as drones, anti-drone systems, missiles, air-defence systems, etc. Countries at war have struggled to get reliable supplies during a tough time. Therefore, India can’t afford to rely on the external supply of equipment and critical components. Thus, pushing for localisation of production is essential, which will generate large and sustainable opportunities for domestic players,” Trivedi says.

India’s defence sector has undergone major reforms as the government is trying to strengthen the nation’s defence prowess by reducing dependence on imports. Measures such as simplification of procedure for procurement of defence products, provision for funding of up to 70 percent of development cost by the government, and a hike in foreign direct investment (FDI) to 74 percent through the automatic route are expected to further boost investments in the sector.

“In addition, the Ministry of Defence has banned the import of several components over a period of time, thus encouraging indigenisation. This clearly shows the favourable tilt of policy framework for defence companies,” says Gaurav Dua, head, Capital Market Strategy, Sharekhan by BNP Paribas. Indigenisation in the defence sector refers to increasing manufacturing capacity within the country, create research and development, and boost exports.