One more rate hike possible this year: US Federal Reserve

The US central bank held its benchmark rate at a 22-year high but its hawkish outlook set off market jitters as investors braced for the impact of higher-for-longer interest rates

In the face of slowing inflation and strong consumer spending, the Jerome Powell of Federal Reserve announced that interest rate will be kept steady, holding the benchmark borrowing rate to a range of 5.25% to 5.5%. Image: Chip Somodevilla/Getty Images

In the face of slowing inflation and strong consumer spending, the Jerome Powell of Federal Reserve announced that interest rate will be kept steady, holding the benchmark borrowing rate to a range of 5.25% to 5.5%. Image: Chip Somodevilla/Getty Images

The Federal Open Market Committee (FOMC) voted unanimously to hold the federal funds rate between 5.25 percent and 5.5 percent. This is the second pause in three months after it raised rates by 525 points since March 2022. To be clear, this isn’t a policy reset. It reiterated, one, the need for price stability and, two, the fair possibility of a soft landing.

"The chances of a soft landing are likely to diminish to the extent that policy needs to be more restrictive or restrictive for longer. Nonetheless, we’re committed to getting inflation back down to 2 percent—because we think that a failure to restore price stability would mean far greater pain later," US Federal Reserve Chairman Jerome Powell said.

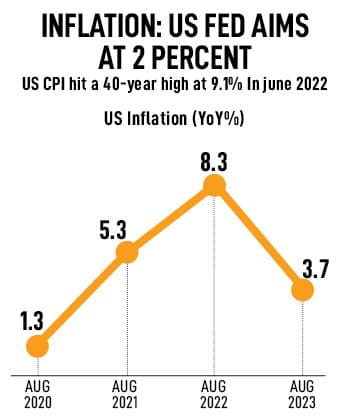

The US Federal Reserve indicated another rate hike of 25 basis points later this year and fewer rate cuts—50 basis points versus 100 basis points projected in June—next year. The central bank’s outlook for the fed fund rate inched up to 3.9 percent, from 3.4 percent earlier, for 2025 and 2.9 percent for 2026. The US Fed expects to achieve its inflation target of 2 percent in 2026.

The US central bank expects the unemployment rate to rise to 4.4 percent next year. But US Federal Reserve officials increased their GDP forecast to 2.1 percent this year and 1.5 percent next year versus 1.8 percent and 1.1 percent projected earlier. This suggests that the bank does not expect an economic recession in the coming quarters. In fact, in the policy statement, the FOMC described economic activity as “expanding at a solid pace” versus “moderate” in the last meeting. Data suggests US consumer spending remained resilient even as savings dwindled with credit card debt crossing $1 trillion for the first time ever.

The policy statement shows the rate-setting committee is far more confident of growth picking up. This is driving its call for fewer rate cuts in 2024 as it does seem to be less worried about the rise in inflation. “Inflation has moderated somewhat since the middle of last year, and longer-term inflation expectations appear to remain well-anchored as reflected in a broad range of surveys of households, businesses and forecasters as well as measures from financial markets,” Powell said.

The policy statement shows the rate-setting committee is far more confident of growth picking up. This is driving its call for fewer rate cuts in 2024 as it does seem to be less worried about the rise in inflation. “Inflation has moderated somewhat since the middle of last year, and longer-term inflation expectations appear to remain well-anchored as reflected in a broad range of surveys of households, businesses and forecasters as well as measures from financial markets,” Powell said.

However, some market watchers see the September policy in different light and are more optimistic given the reduced chances of a recession in the world’s largest economy.

However, some market watchers see the September policy in different light and are more optimistic given the reduced chances of a recession in the world’s largest economy.