India's digital-first brands aim for the US stars and vie for global recognition

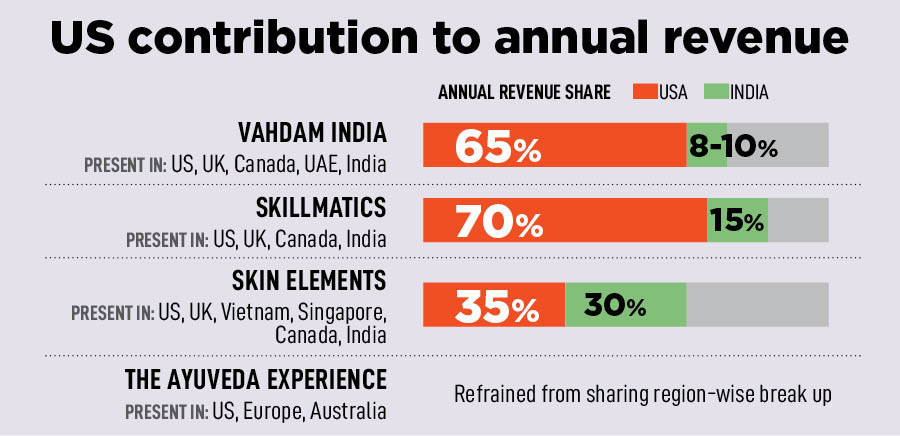

Brands such as Vahdam India and Skillmatics, which have breached the Rs100-crore revenue milestone, are making their presence felt in the US. Experts say product differentiation and quality essential to find success overseas. And apart from spending in dollars, the question hinges on the viability of the model

Bala Sarda, founder Vahdam India, outside a CVS store

Bala Sarda, founder Vahdam India, outside a CVS store

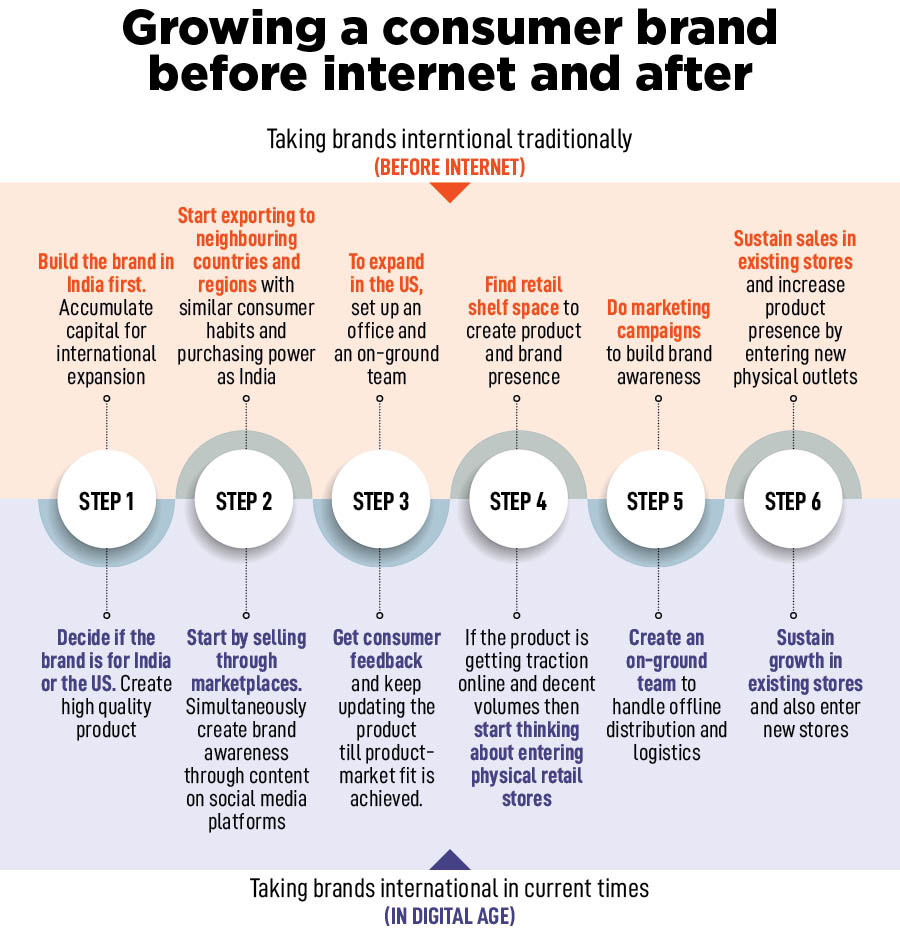

In July, Vahdam India, a tea brand based in Delhi, entered over 4,000 CVS Health Stores in the US. Its founder, Bala Sarda, claims the retail expansion is a natural progression as Vahdam had been selling digitally in the US since it was founded in 2015.

It's a similar tale for Mumbai-headquartered Skillmatics. The PeakXV [earlier known as Sequoia Capital India]-backed firm is selling its educational-based games—for kids—online and across more than 15,000 stores in US-headquartered retail chains, including Walmart, Target and Hobby Lobby.

The Ayurveda Experience, which started operations in 2014 as an ayurveda content platform, started selling serums and cleansers in the US and Australia. And men’s hygiene player Skin Elements gets more than 60 percent of its revenue by selling in the US.

Over the last two decades, India has developed a reputation for being the backend tech support for many American multinational firms. The nation is also known as one of the best software services providers in the world, thanks to Freshworks and Zoho, among other Saas [software as a service] platforms.

But Indian brands have not been able to rule the American consumer market as much as US brands—from food and clothing to bathing—have done in India. From Levi’s and McDonald’s to Cetaphil, every person living in India regularly uses an American brand. “But it was only a matter of time before the trend of selling service from India to the world came for consumer brands,” says Vinay Singh, co-founder and partner, Fireside Ventures.