How climate change can impact GDP and jobs

Rising temperature, climate change risks, plastic pollution and high carbon emission not only impact lives and jobs, but also commodity prices, especially food. Is India prepared to commit more investment towards a green economy?

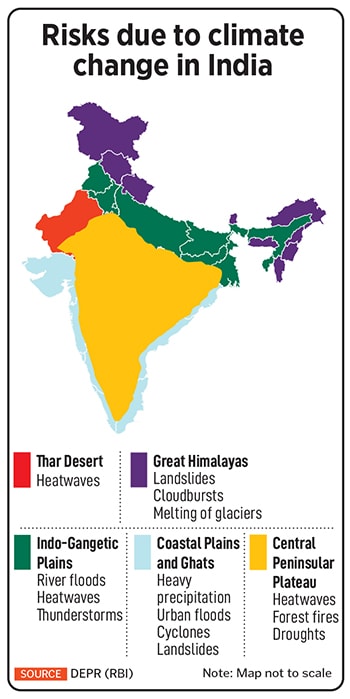

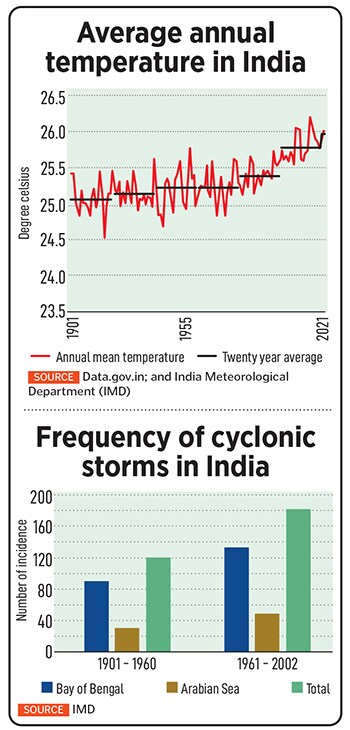

As India continues to face climate-related crisis like extreme heat temperature, scanty monsoon, floods and rising sea levels, the impact on overall macro and social environment is likely to be immense.

Illustration: Chaitanya Dinesh Surpur

As India continues to face climate-related crisis like extreme heat temperature, scanty monsoon, floods and rising sea levels, the impact on overall macro and social environment is likely to be immense.

Illustration: Chaitanya Dinesh Surpur

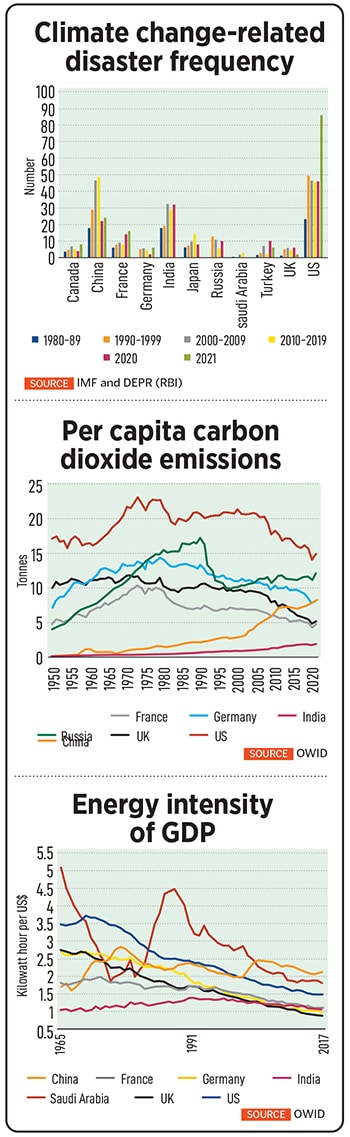

With change in climate threatening sustainability of life, livelihood and the ecosystem, economists and policymakers worldwide are sharpening their focus on mitigating such risks. However, it is a rather steep task, as India is among the top 10 economies in terms of vulnerability to climate risk events and is already suffering the adverse impact of climate change.

As India continues to face climate-related crisis like extreme heat temperature, scanty monsoon, floods and rising sea levels, the impact on overall macro and social environment is likely to be immense. The Reserve Bank of India (RBI) estimates up to 4.5 percent of India’s GDP could be at risk by 2030, due to lost labour hours from extreme heat and humidity.

Climate change due to rising temperature and changing patterns of monsoon rainfall in India could cost the Indian economy 2.8 percent of its GDP and depress the living standards of nearly half of its population by 2050, RBI’s Department of Economic and Policy Research (DEPR) says in its latest report on Currency & Finance 2022-23. India may lose anywhere around 3 to 10 percent of its GDP annually by 2100 due to climate change in the absence of adequate mitigation policies.

The warning signs look scary. Indian agriculture (along with construction activity) as well as industry are particularly vulnerable to labour productivity losses caused by heat-related stresses. India may account for 34 million of the projected 80 million global job losses from heat stress associated productivity decline by 2030, according to World Bank estimates.

Statistics show India’s growing risk with dangers of rising global warming, higher carbon emission and plastic pollution. In 2019 alone, India lost nearly $69 billion due to climate-related events, which is in sharp contrast to $79.5 billion lost over 1998-2017. Floods in India during 2019 affected nearly 14 states causing displacement of around 1.8 million people and 1,800 deaths. Overall, around 12 million people were impacted by the intense rainfall during the monsoon season in 2019 with the economic loss estimated to be around $10 billion.

Statistics show India’s growing risk with dangers of rising global warming, higher carbon emission and plastic pollution. In 2019 alone, India lost nearly $69 billion due to climate-related events, which is in sharp contrast to $79.5 billion lost over 1998-2017. Floods in India during 2019 affected nearly 14 states causing displacement of around 1.8 million people and 1,800 deaths. Overall, around 12 million people were impacted by the intense rainfall during the monsoon season in 2019 with the economic loss estimated to be around $10 billion.

Perishable vegetables like tomato, onion and potato (TOP) are more exposed to extreme weather events, such as cyclones and unseasonal rainfall during the post-monsoon period. Economists’ estimates show that usually it is the combination of TOP prices that move in tandem and price volatility in these three key items impact food inflation.

Perishable vegetables like tomato, onion and potato (TOP) are more exposed to extreme weather events, such as cyclones and unseasonal rainfall during the post-monsoon period. Economists’ estimates show that usually it is the combination of TOP prices that move in tandem and price volatility in these three key items impact food inflation.

The survey conducted by Deloitte Touche Tohmatsu India LLP (Deloitte India) was rolled out to 150 organisations (with over 70 percent of them listed in Indian stock exchange) to assess their readiness for ESG requirements (policies, regulations, disclosures, and compliances) and evaluate their ESG strategies and efforts. Over 70 percent of these organisations are also listed on the Indian stock exchanges.

The survey conducted by Deloitte Touche Tohmatsu India LLP (Deloitte India) was rolled out to 150 organisations (with over 70 percent of them listed in Indian stock exchange) to assess their readiness for ESG requirements (policies, regulations, disclosures, and compliances) and evaluate their ESG strategies and efforts. Over 70 percent of these organisations are also listed on the Indian stock exchanges.