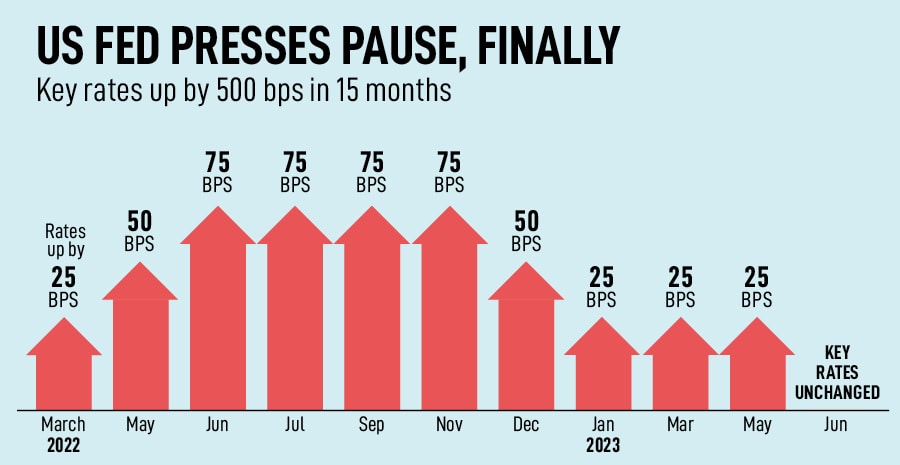

Coming up: Two more rate hikes by the US Fed this year

The Federal Open Market Committee voted to hold rates at 5-5.25 percent in June to assess the impact of the past 10 cumulative rate hikes of 500 bps, but ruled out rate cuts for the next couple of years until inflation comes down meaningfully. July's policy decision remains uncertain

Federal Reserve Chairman Jerome Powell

Image: Kevin Lamarque / Reuters

Federal Reserve Chairman Jerome Powell

Image: Kevin Lamarque / Reuters

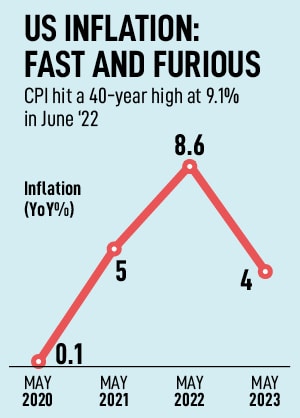

The US Federal Reserve’s decision to keep the benchmark rate unchanged at around 5.1 percent, its highest level in 16 years, after cumulative rate hikes of 500 basis points over 15 months, came as a respite for the markets. But the respite was rather short-lived as investors were left wondering if the move to hold rates was a ‘skip’ or a ‘pause’ as the central bank’s June dot plot—an outlook for monetary policy—indicated two more rates hikes ahead this year.

“Nearly all committee participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year. But at this meeting, considering how far and how fast we’ve moved, we judged it prudent to hold the target range steady,” Federal Reserve Chairman Jerome Powell said.

The policy outcome was interpreted as hawkish by investors, and stocks lost early gains in trade, but recovered after the central bank reiterated that the committee would assess the impact of the rate hikes so far as the effects of policy tightening and demand in interest rate sensitive sectors such as housing and investment would take time to bear an impact on inflation.

“We have raised our policy interest rate by 5 percentage points, and we’ve continued to reduce our security holdings at a brisk pace. We’ve covered a lot of ground and the full effects of our tightening have yet to be felt,” Powell explained.

The Federal Open Market Committee (FOMC) said holding the target range steady at this meeting allows the committee to assess additional information and its implications for monetary policy. Importantly, it signalled that the rate cut cycle is far-off even though Powell suggested that the conditions that would be needed to get inflation down are coming into place.

Deepak Agrawal, CIO- fixed income, Kotak Mahindra AMC, says, “The FOMC surprised markets with a hawkish pause, projecting two rate hikes in 2023, contrary to the expected one rate hike. We expect a final hike in July to 5.25-5.5 percent, but anticipate a subsequent hold for the rest of 2023 because core inflation would have come meaningfully lower.”

Deepak Agrawal, CIO- fixed income, Kotak Mahindra AMC, says, “The FOMC surprised markets with a hawkish pause, projecting two rate hikes in 2023, contrary to the expected one rate hike. We expect a final hike in July to 5.25-5.5 percent, but anticipate a subsequent hold for the rest of 2023 because core inflation would have come meaningfully lower.”