Are foreign investors bailing out on India or is it just a blip?

Slowdown in FDI raises concerns if India is really gaining prominence as an alternative to China. Will foreign money inflow continue to stay unimpressive as slowdown in FDI flows continues largely due to rise in repatriation of equity capital, global economic slowdown and reduced venture capital funding at startups?

Net FDI in India plunged over 38 percent in the first 10 months of financial year 2024 to $15.42 billion mainly due to a rise in repatriation, shows Reserve Bank of India (RBI) data.

Image: Shuttertock

Net FDI in India plunged over 38 percent in the first 10 months of financial year 2024 to $15.42 billion mainly due to a rise in repatriation, shows Reserve Bank of India (RBI) data.

Image: Shuttertock

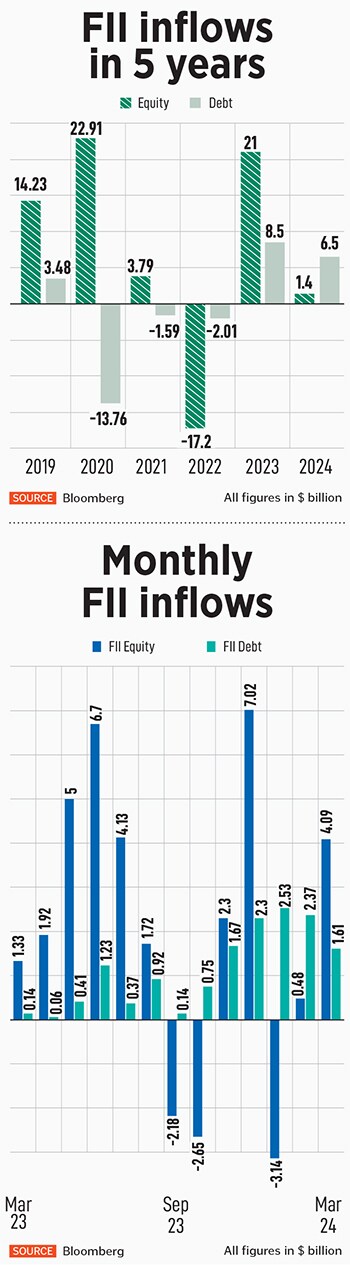

Is India losing its charm among foreign investors? Well, the answer depends on which dataset one is considering. There may be green shoots of mild recovery in parameters like foreign direct investments (FDI) and foreign institutional investors (FIIs) inflows into asset like equities and debt instruments, but the decline in those financial accounts in the previous few months have been acute.

Net FDI in India plunged over 38 percent in the first 10 months of financial year 2024 to $15.42 billion mainly due to a rise in repatriation, shows Reserve Bank of India (RBI) data. In the same period of April 2022-January 2023, FDI in India was at $24.99 billion.

Repatriation and divestment in April 2023-January 2024 increased by 36 percent to $34 billion from $24 billion in year-ago period. Repatriation in FDI terms refers to remitting money back to the host country.

Actually, it was only in January that net FDI climbed to $5.74 billion from an outflow of $3.86 billion, the data showed. Gross inward FDI declined by 3.6 percent to $59.5 billion during April 2023-January 2024 as compared with $61.7 billion during the corresponding period a year ago.

“FDI inflows to India have slowed significantly versus the recent peak (largely due to equity capital repatriation), raising concerns if the country is really gaining prominence in the China plus 1 supply chain shift,” says Tanvee Gupta Jain, chief India economist, UBS Securities India.

Manufacturing, computer services, electricity and other energy sectors, financial services and transport accounted for about two-thirds of the FDI equity inflows during the same period. Around 80 percent of the equity flows were received from Singapore, Mauritius, the US, the Netherlands, Japan and the UAE.

Manufacturing, computer services, electricity and other energy sectors, financial services and transport accounted for about two-thirds of the FDI equity inflows during the same period. Around 80 percent of the equity flows were received from Singapore, Mauritius, the US, the Netherlands, Japan and the UAE. In January and February, we witnessed a significant move of FPI interest from India to other emerging and developed markets, which led to a combined outflow from India. “Some of those outflows started reversing in March 2024 on the back of the correction we witnessed in the small and midcap space, apart from the long-term attractiveness of Indian markets, which offers investors a robust economic growth profile apart from a stable regulatory framework,” says Master.

In January and February, we witnessed a significant move of FPI interest from India to other emerging and developed markets, which led to a combined outflow from India. “Some of those outflows started reversing in March 2024 on the back of the correction we witnessed in the small and midcap space, apart from the long-term attractiveness of Indian markets, which offers investors a robust economic growth profile apart from a stable regulatory framework,” says Master.