George Foster: Are startups really job engines?

Entrepreneurship can be personally rewarding and good for the economy, if we wipe the stardust from our eyes

Everybody wants to be an entrepreneur. The myth of footloose 25-year-olds changing the world while incidentally becoming deliriously rich has intoxicated a generation. And governments are eagerly handing out tax breaks to help them get started. After all, those new companies are engines of economic growth and job creation, right?

Well, maybe, says Stanford Graduate School of Business professor George Foster. He suggests that policymakers and would-be tycoons alike could do with a sobering belt of reality. In a new multi-country study, he finds that most startups never take off — and among those that do, setbacks destroy a sizable share of the employment and revenue gains in the sector.

“Most of the stories you hear about startups have a very glossy ring,” Foster says. “They talk about all the new jobs created and all these great experiences. It’s always this hockey-stick graph of continuous growth and happily-ever-after. My experience with early-stage companies — and what I’ve heard from all the many entrepreneurs that visit Stanford — is that there’s a lot of carnage, and even the most successful CEOs have a roller-coaster existence. So I wanted to do a systematic study and see what’s really going on.”

Sputtering Engines

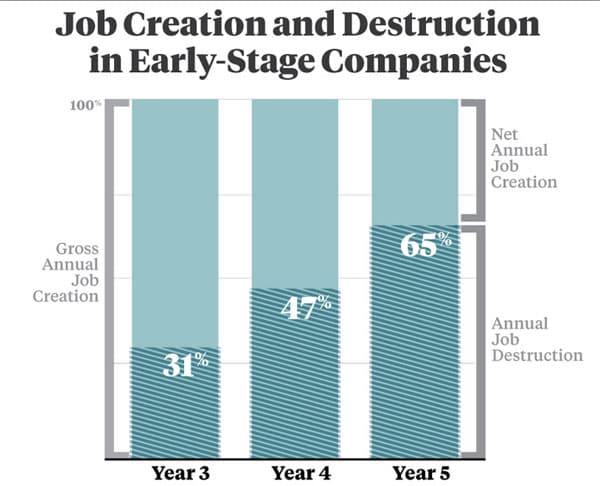

Foster and his collaborators gathered data on more than 158,000 startups worldwide, tracking each company for five years. What they found is that while some young firms enjoy significant revenue and job growth, those gains are substantially offset by losses in other firms. Among companies in their fifth year, for example, total job destruction — declines in headcount among retrenching companies — amounted to 65% of all the new jobs created in that year.

And that estimate on the debit side of the ledger probably understates the bloodshed. It doesn’t count jobs lost in startups that went belly-up or jobs cannibalized when startups take market share from incumbent firms, what economist Joseph Schumpeter called “creative destruction.”

They need to hear it though, because these findings point to a different policy approach, focused not on increasing the number of startups (which may result in companies being founded that never should have been) but on improving their success rate. “To me, one of the big messages is that public policy needs to be more oriented to sustain the scaling of ventures,” Foster says.

Indeed, the numbers show that revenue and job destruction rise as companies age from three to five years, suggesting that promising businesses often have trouble making the transition out of startup mode. “If you’ve gone to 200 or 300 employees in a few years, you’re probably stretching the limits of management systems and executive mindshare,” Foster says. “If you don’t get a scalable infrastructure in place, you can get derailed and plummet very, very fast.”

But then, most entrepreneurs would love to have the problem of managing growth. Among five-year-old firms, the top-performing 10% provide roughly 80% of gross revenue and job creation, the study shows. An even smaller percentage account for most of the declines — because, as Foster points out, you can only lose ground if you’ve previously gained ground. “The majority of startups start small and stay small, so there’s nothing to destroy.”

He emphasizes that the study’s findings on early-stage companies are consistent across countries — the data set covers 10 developed nations in Europe and Asia (but not the United States, due to weaker reporting requirements) — and across industries. The numbers vary, but the patterns are the same no matter how you slice the data: “There is revenue and job creation, but it comes from a relative handful of firms, and there’s a lot of destruction going on at the same time,” Foster says.

Snakes and Ladders

Another common myth about startups is that good ideas are rewarded with consistent year-on-year growth. No doubt that’s why so many first-time entrepreneurs have those hockey-stick graphs in their pitch deck, anticipating launch as something like a jetliner taking to the sky. In reality, Foster says, continuous growth is more the exception than the rule in young companies.

The researchers looked at each of the 158,000 startups in the sample and classified their annual revenue and job growth in years three, four, and five as either positive, negative, or unchanged. They found that 64% of all firms — nearly two-thirds — had at least one year of actual revenue decline. On employment the most common trajectory in years three to five was zero job creation. Among firms that did add jobs in any given year, fewer than half added any more the following year. Only 8% increased headcount in all three years.

“That hockey-stick world is a fantasy,” Foster says. “The reality for most startups is a lot of jarring ups and downs, more like a high-speed game of snakes and ladders.”

Killing the Romance

64% of all firms had at least one year of actual revenue decline

But is there anything wrong with a little naïve optimism? “Romanticizing it does no one any good,” Foster says. “Building a viable business is brutally hard. It takes enormous perseverance to drive through to success, and even then so much is beyond your control — even great ideas may fail. At least if you’re going into it with your eyes open, your chances are better.”

For one thing, he says, entrepreneurs must be alive to potential dangers. “You may have created an exciting new market and face little competition at first. Well, big powerful companies are going to see that and try to take it away from you. A little early success makes you the bull’s-eye, so you better be ready with a plan.”

There’s also a personal reckoning to be made, and here it’s equally crucial to be realistic, Foster says. “The life of an entrepreneur isn’t for everyone. There are personalities who can handle the roller coaster; for others, taking on that level of risk and stress isn’t good for them, it isn’t good for their families, and in the end it isn’t good for the firm.”

There’s no question that building your own business can be enormously rewarding. And for policymakers, encouraging dynamic new ventures is smart economic strategy — though perhaps more for bubbling up innovative ideas than as a sort of jobs program 2.0, as it’s often sold.

But we can improve the prospects for sustained success, Foster says, by starting with a healthy respect for the hill to climb: “Inspired ambition combined with a grounded understanding of the challenges and possible ways of overcoming them is a great pairing for an entrepreneur.”

George Foster is the Konosuke Matsushita Professor of Management at Stanford GSB and the director of the Executive Program for Growing Companies.

This piece originally appeared in Stanford Business Insights from Stanford Graduate School of Business. To receive business ideas and insights from Stanford GSB click here: (To sign up: https://www.gsb.stanford.edu/insights/about/emails)