CNBC-TV18 & BMR Advisors' Poll results: How ready is India Inc for GST?

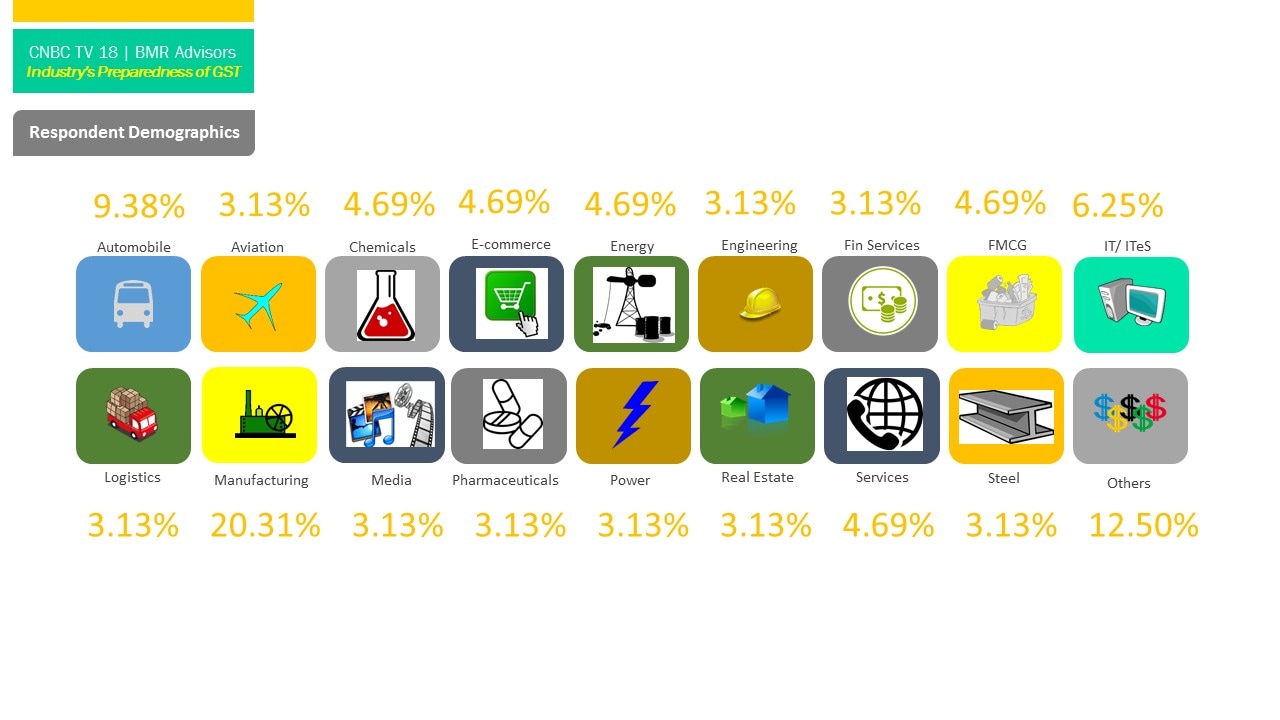

The survey captures the responses of top business and finance leaders across a wide base of industry sectors through a web-based questionnaire

Image: Shutterstock (For illustrative purposes only)

Image: Shutterstock (For illustrative purposes only) The conclusion of the 14th round of the GST council meet has set the pace of events for the final run down to GST and it seems like GST will finally see the light of the day come this July 1 with its nationwide roll out. Given that sufficient information is available now and with things being clearer than before, how ready is India Inc for the historic tax reform?

This survey by CNBC-TV18 and BMR Advisors seeks to assess the preparedness of industry towards GST by capturing responses of top business and finance leaders across a wide base of industry sectors through a web based questionnaire.

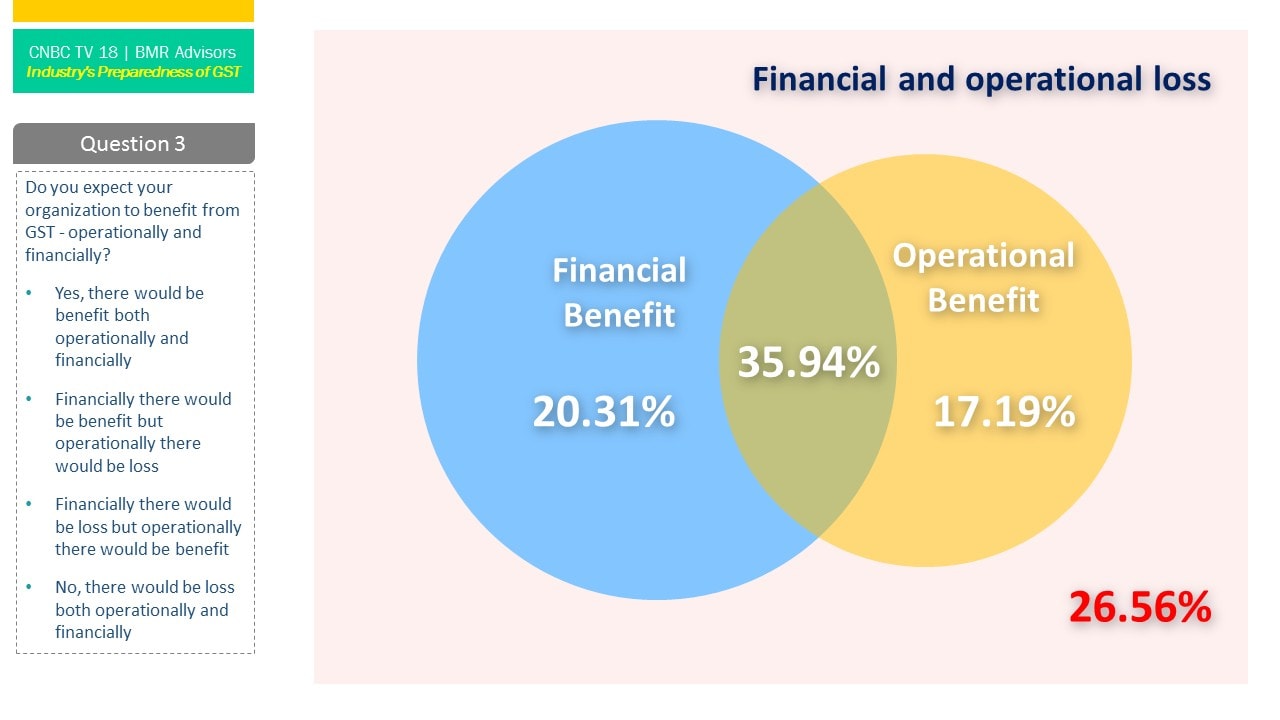

GST boon or bane?

The foremost feature appearing from the results of the survey is the welcoming mindset of the Indian industry towards GST. More than half the respondents believe that GST would bring either financial or operational benefit to their organization and only 27 percent believing GST would lead to a loss both financially and operationally

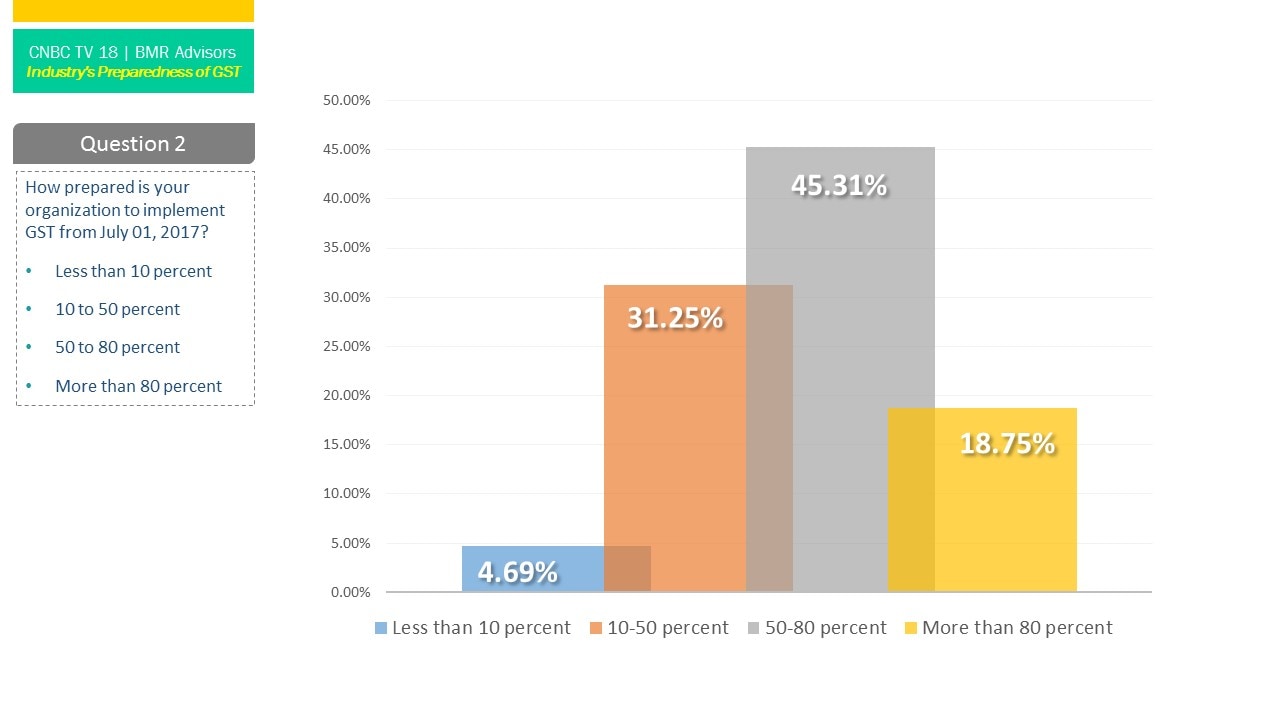

Preparedness

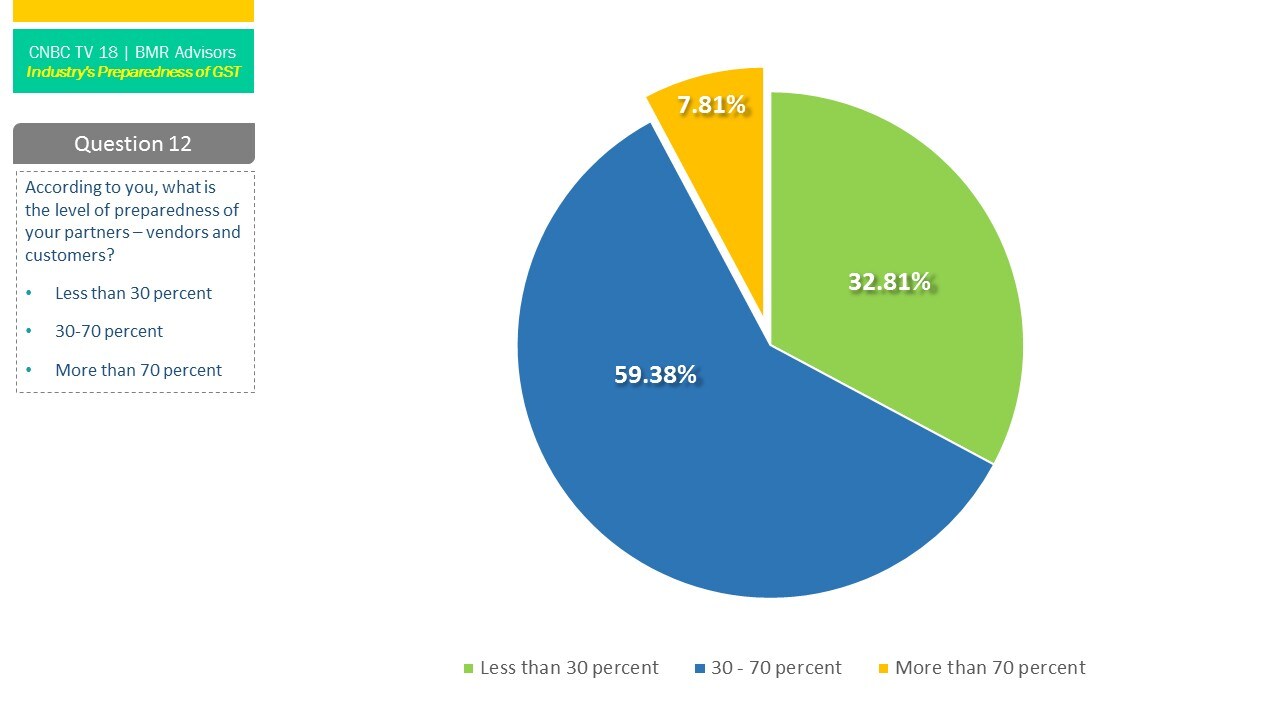

With the countdown to GST implementation getting narrower day by day, around 64 percent of the respondents believe that their organization is prepared at a level marked more than 50 percent for GST implementation from July 1, 2017. However, the respondents were not confident on preparedness of their partners ie vendors and customers to ensure business continuity and minimum disruption. Only 7 percent felt that their partners were more than 70 percent ready and 33 percent believed that their partners are less than 30 percent prepared for GST implementation from July 01, 2017.

Key challenges

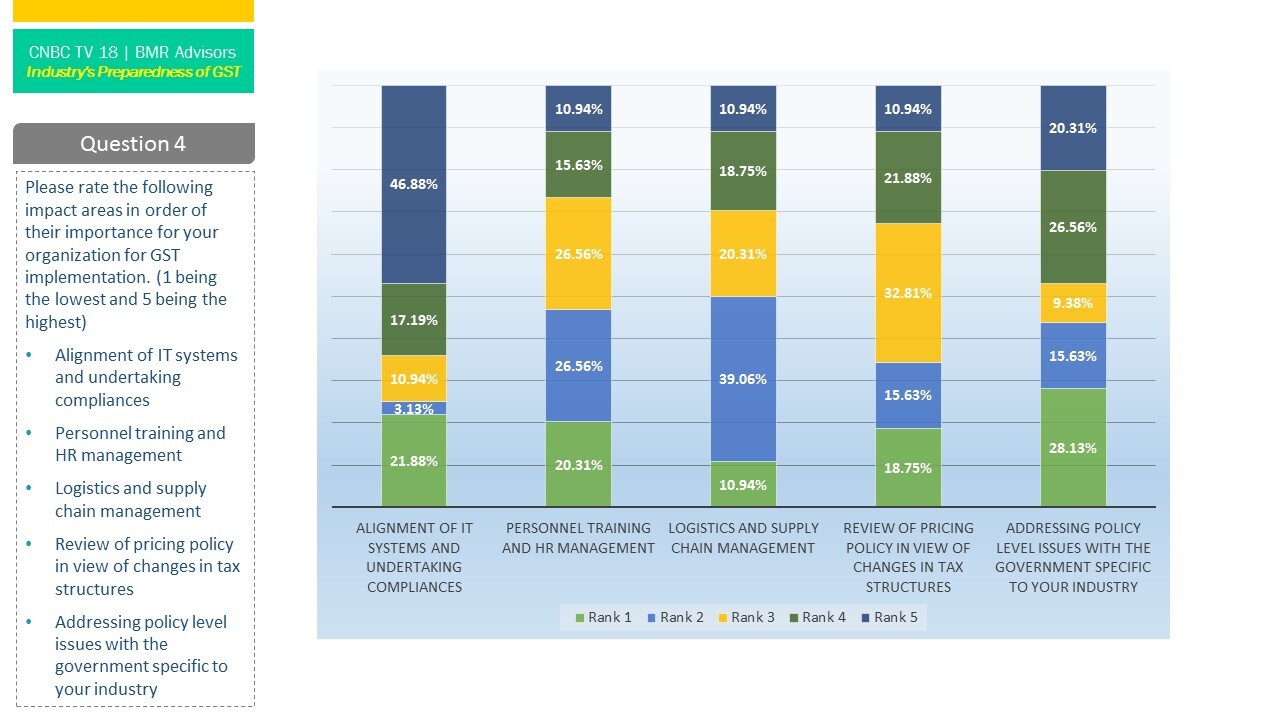

The impact of the revolutionary tax reform is likely to extend to almost all the spheres of business such as tax, finance, accounts, marketing, human resources, IT infrastructure, supply and distribution.

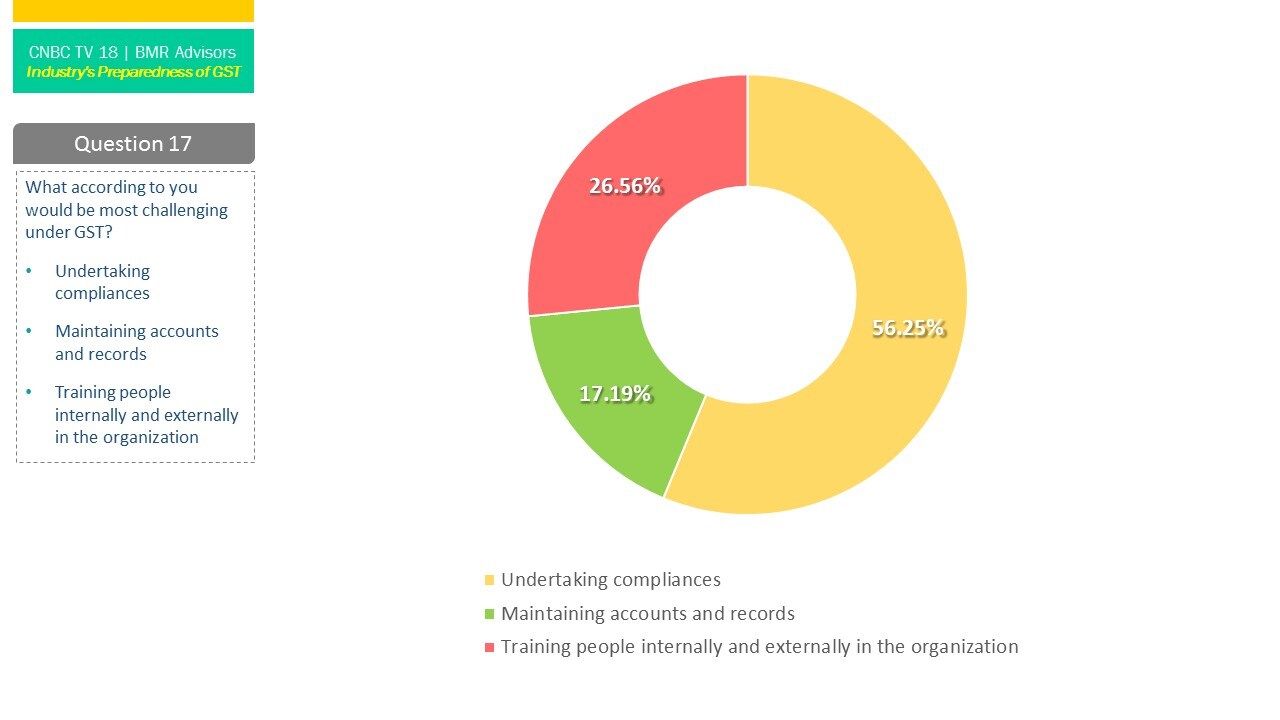

Survey indicates that majority of the respondent’s ranked alignment of IT systems and undertaking compliances as the most challenging job under GST followed by addressing policy level issued with government, pricing policy review, logistics and supply chain management and personnel training and HR management as other major GST impact areas.

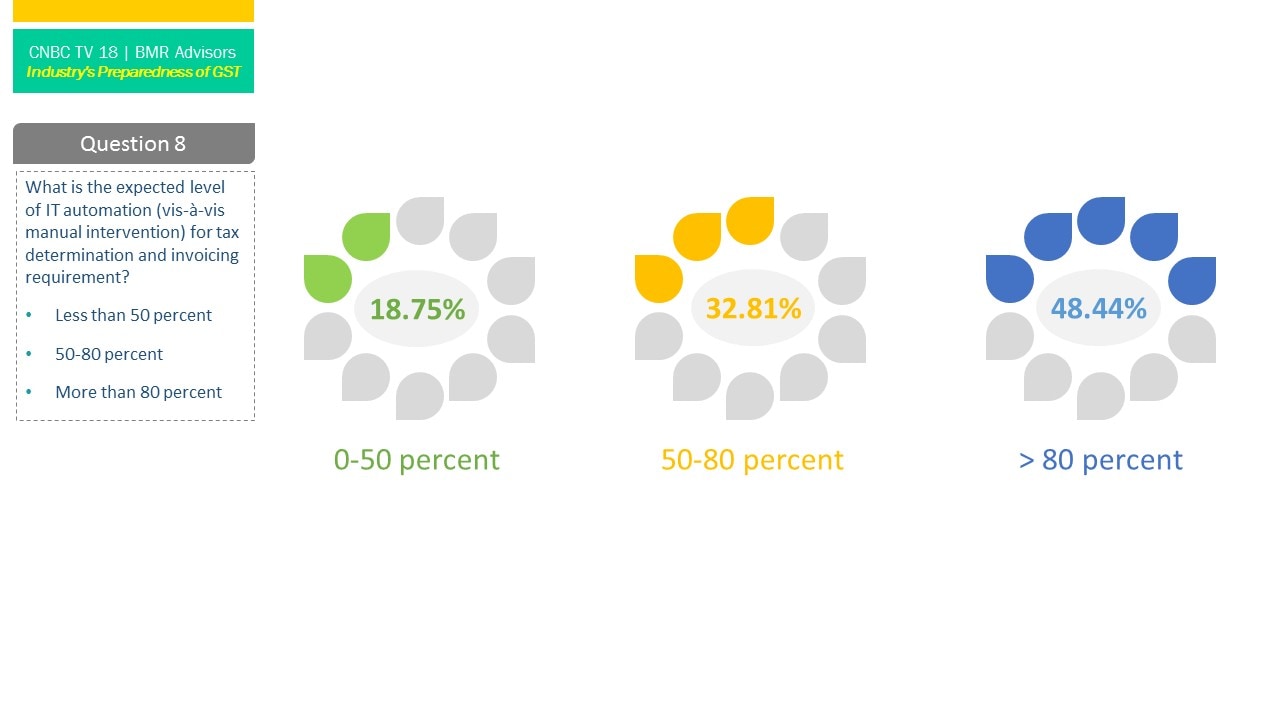

Given that most of the business are skeptical about IT preparedness only 48 percent of populace responding wishes to automate tax determination and invoicing vis-à-vis manual intervention to a level more than 80 percent and around 33 percent wishes it to be at a level between 50 to 80 percent.

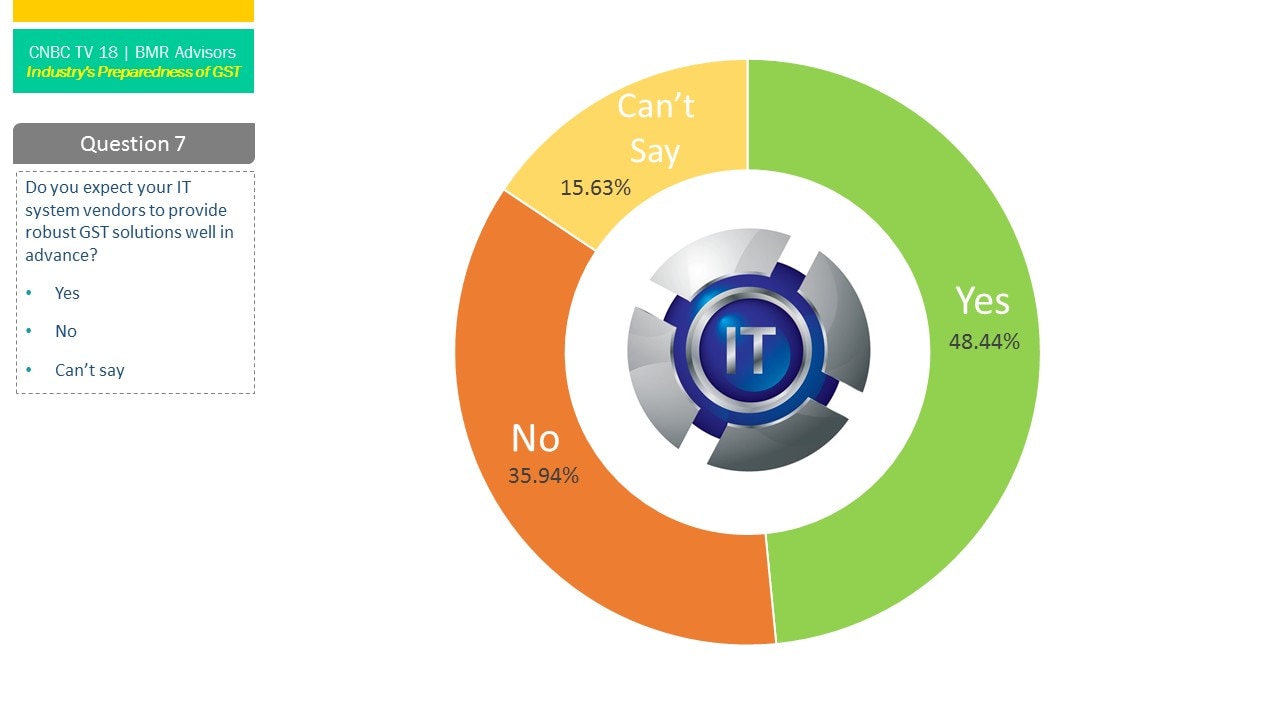

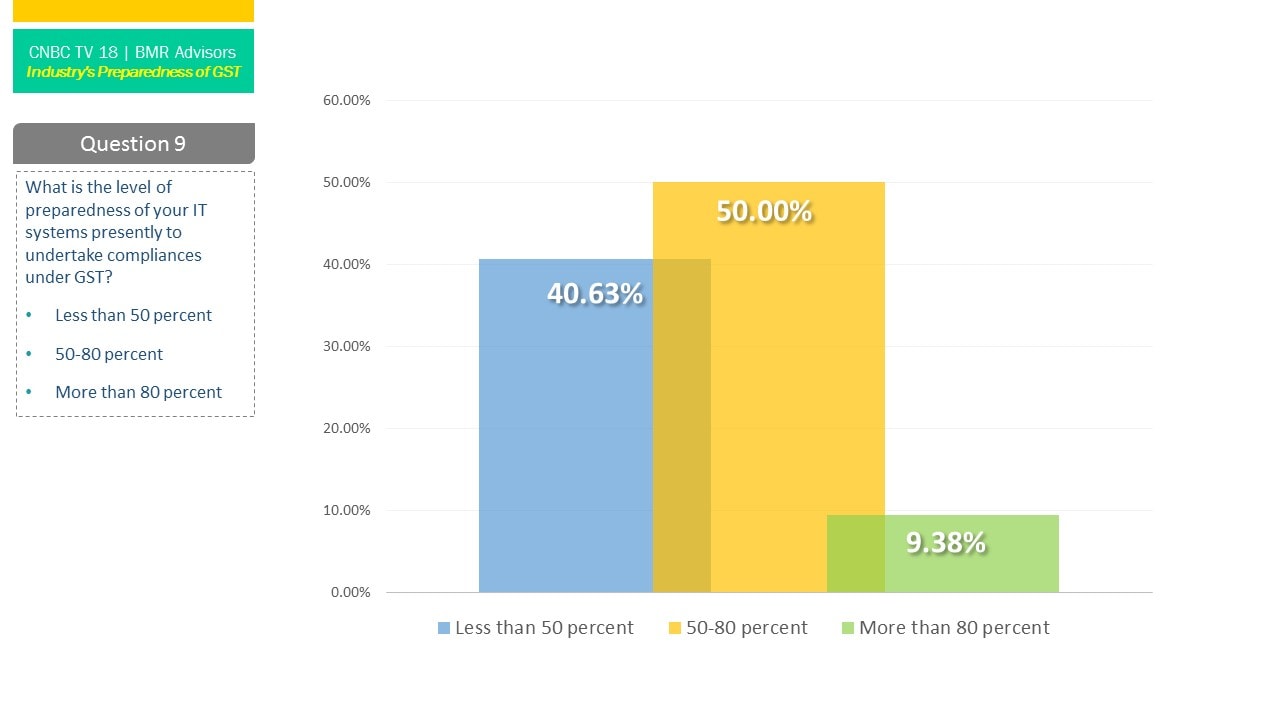

When asked about their current IT preparedness, one half of the respondents believe that their IT systems preparedness is to a level between 50 to 80 percent and only 10 percent believe that their IT systems are more than 80 percent prepared to undertake compliances under GST. Further, only 49 percent expects their IT vendors to provide them with robust GST solutions well in advance.

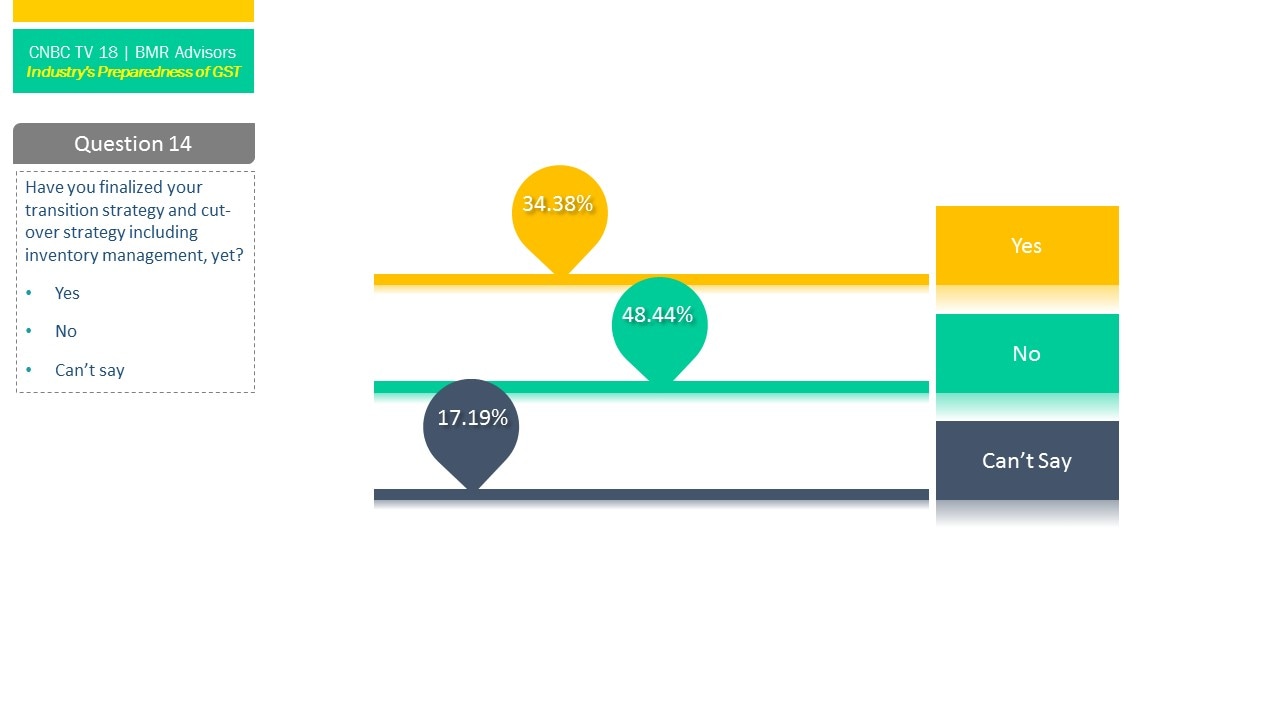

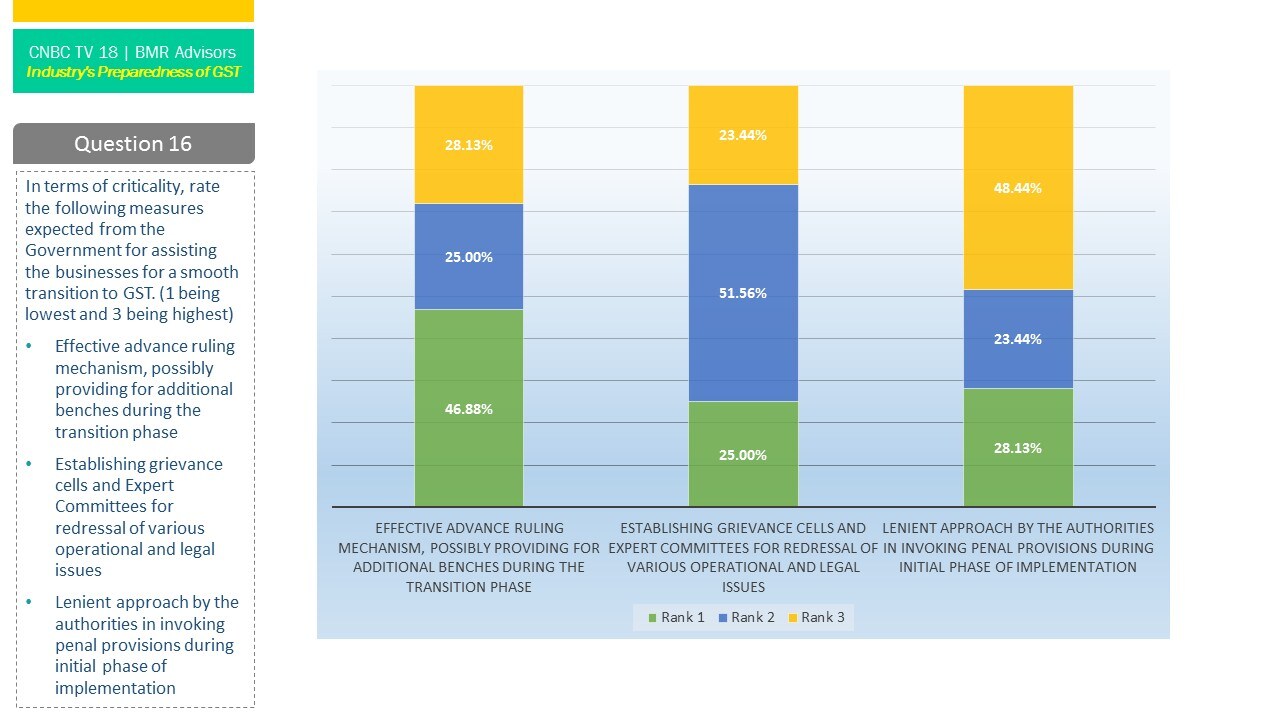

Will it be a smooth transition?

While the government is ensuring to provide more and more materials to business well in advance to avoid any surprises, smooth transition to GST regime still seems to be a distant dream. When asked about whether the business have finalized their transition/ cutover strategy and inventory management, only 34 percent of the respondents replied in affirmative while 17 percent were undecided and 49 percent replying in negative. To ensure a smooth sail to the new regime, key ask of India Inc is that government should adopt a lenient approach in invoking penal provisions during initial phase followed by establishing grievance cells and expert committees for addressing various legal and operational issues during the transition phase.

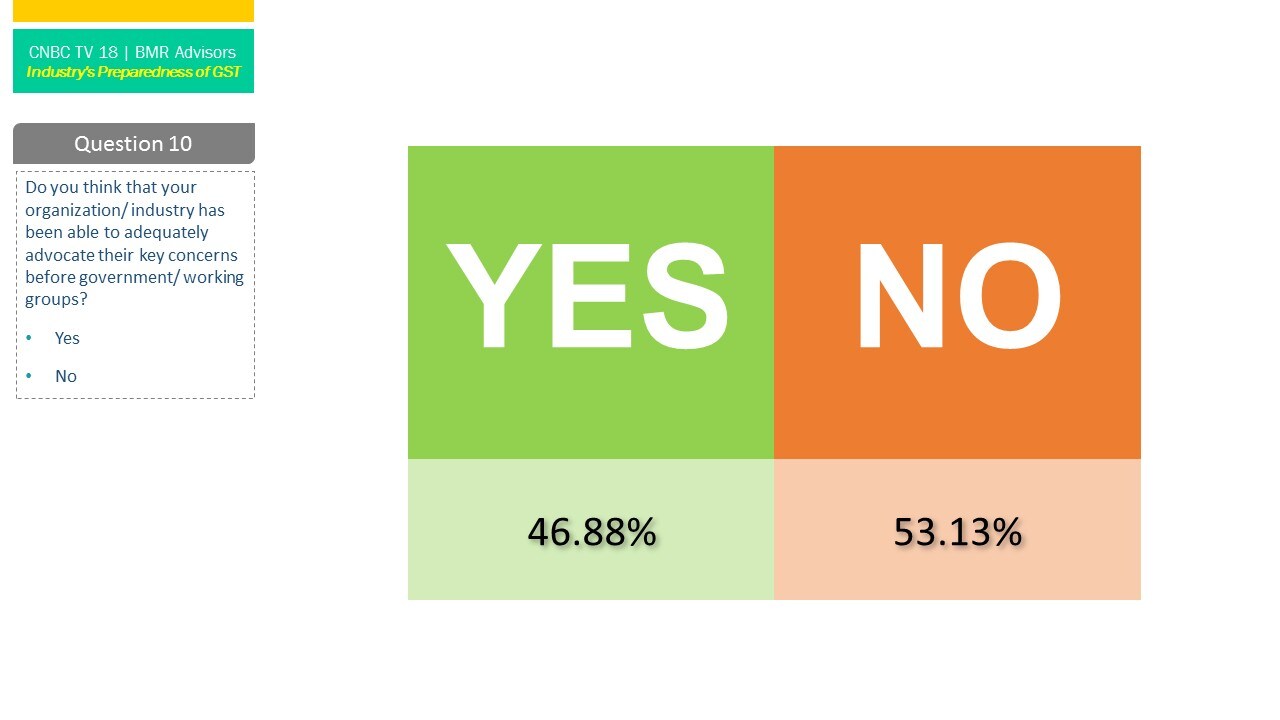

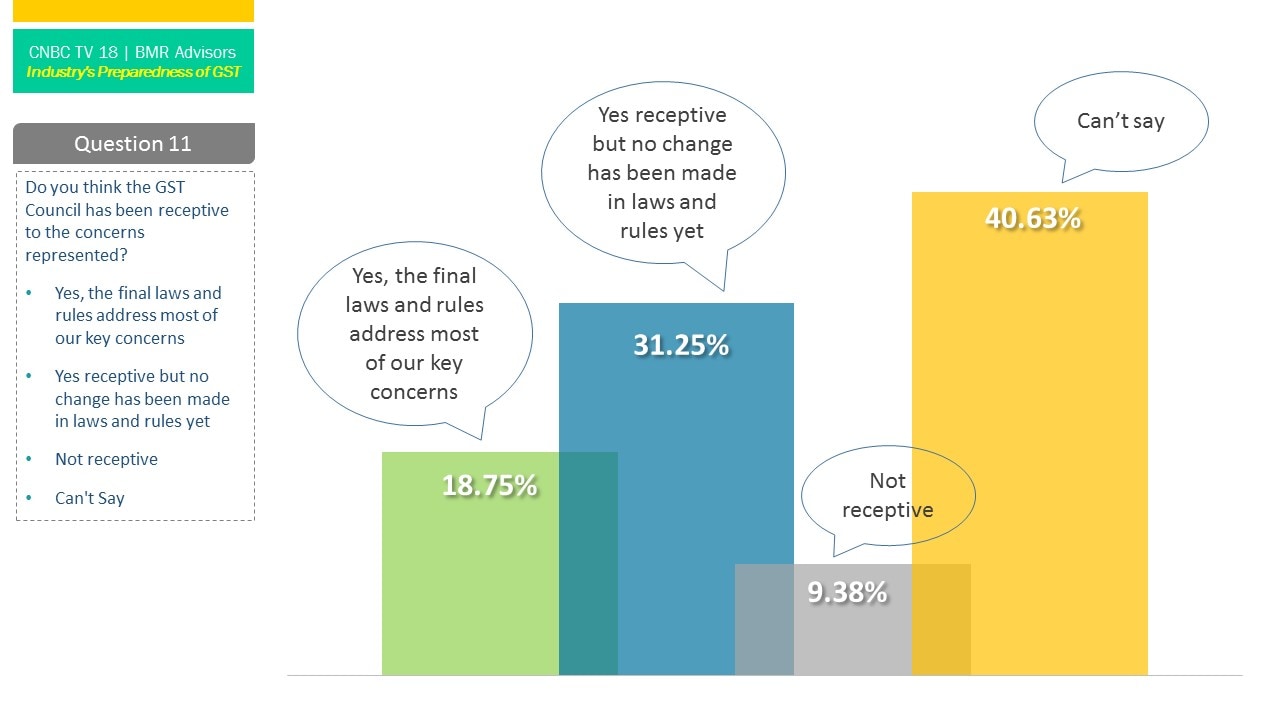

When asked whether the business were provided enough opportunity to advocate their key concerns before the government/ GST council, around 47 percent of the respondents feel that they have been able to effectively advocate their key concerns however, only a meagre number of 19 percent feel that GST council has been receptive towards the concerns represented and effected necessary changes in the final set of laws and rules.

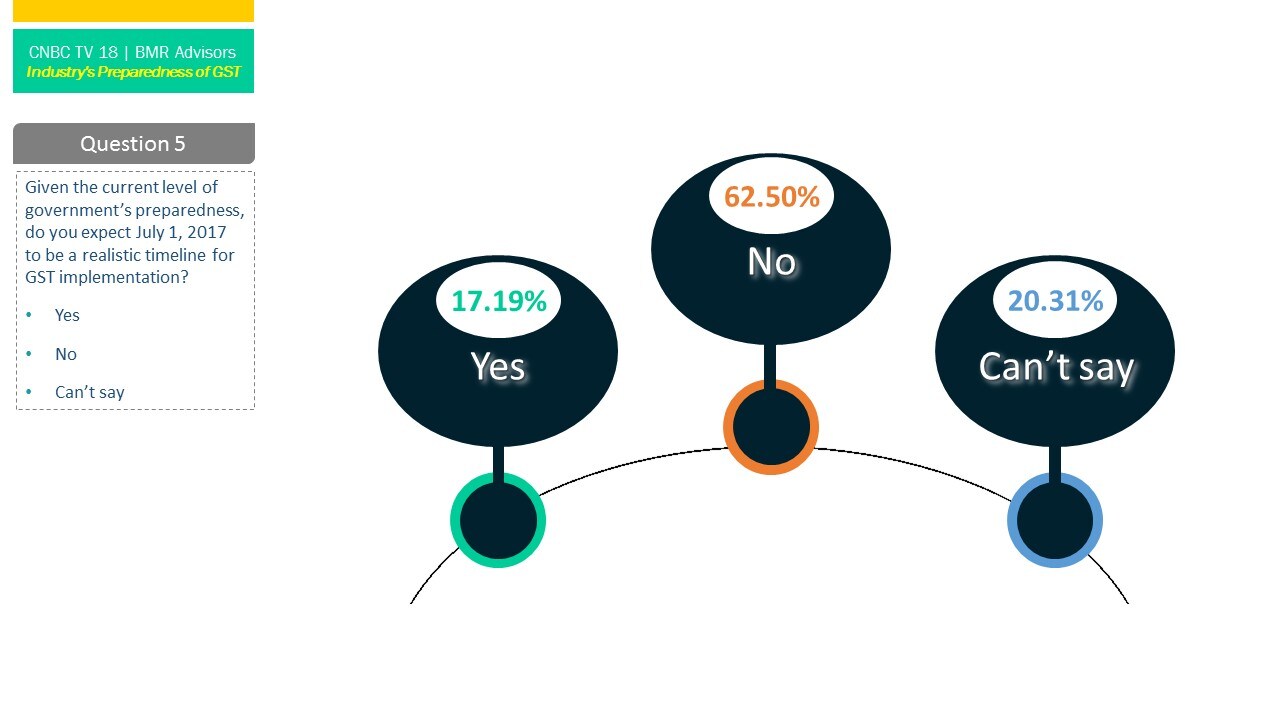

How realistic is July 1, 2017 timeline?

With Revenue secretary making a statement that government has done more than 90 percent of it’s work to ensure roll out of the historic regime from July 01, 2017, most of the top honchos still don’t trust July 1, 2017 to be a realistic deadline for rollout of GST considering the current level of government’s preparedness. This is clearly indicated from the fact that around 62 percent of the respondents are rooting against it and around 20 percent are not sure about it.

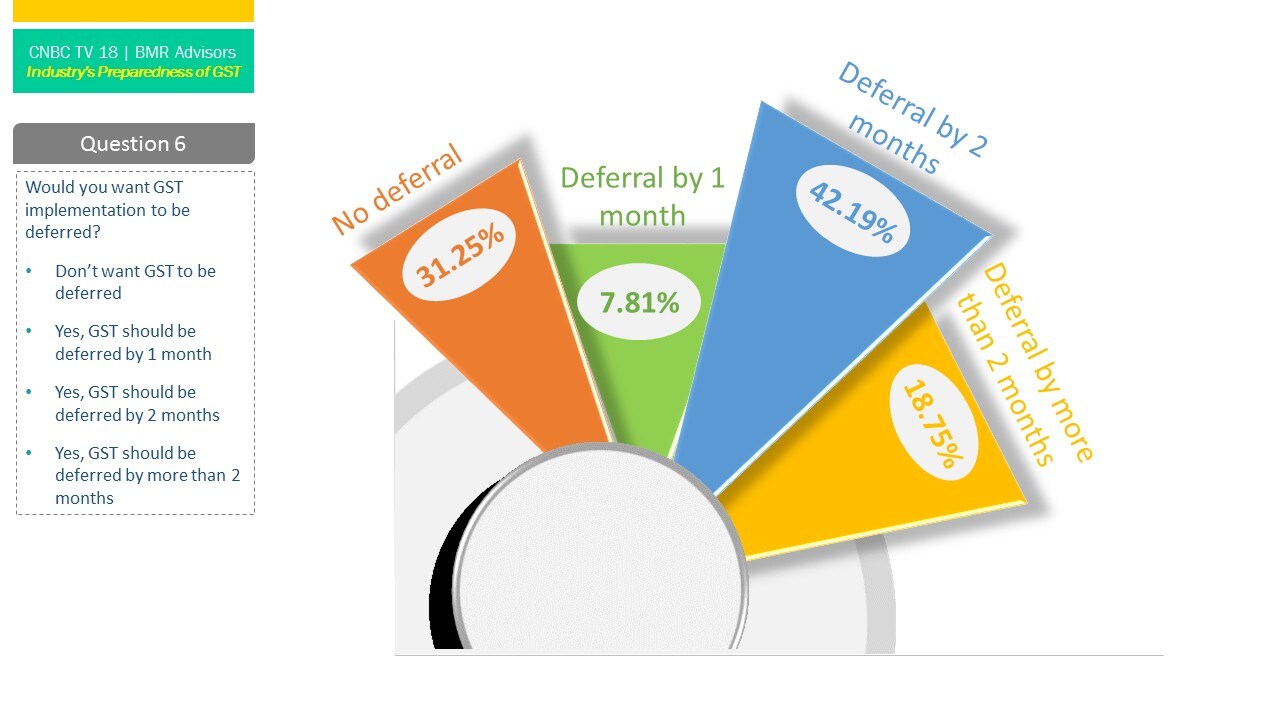

Given the confidence of Indian Inc on preparedness of the government, 43 percent of the respondents wants GST to be deferred by 2 months and 18 percent wants the roll-out to be deferred by more than 2 months.

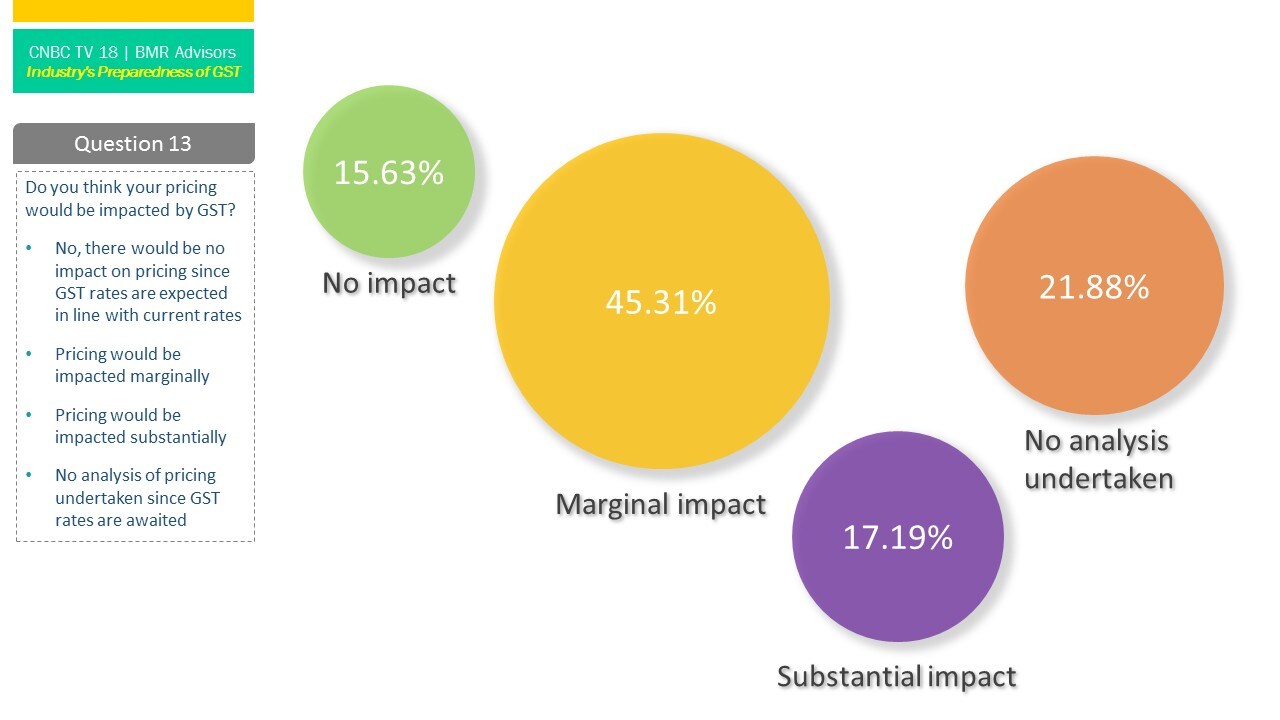

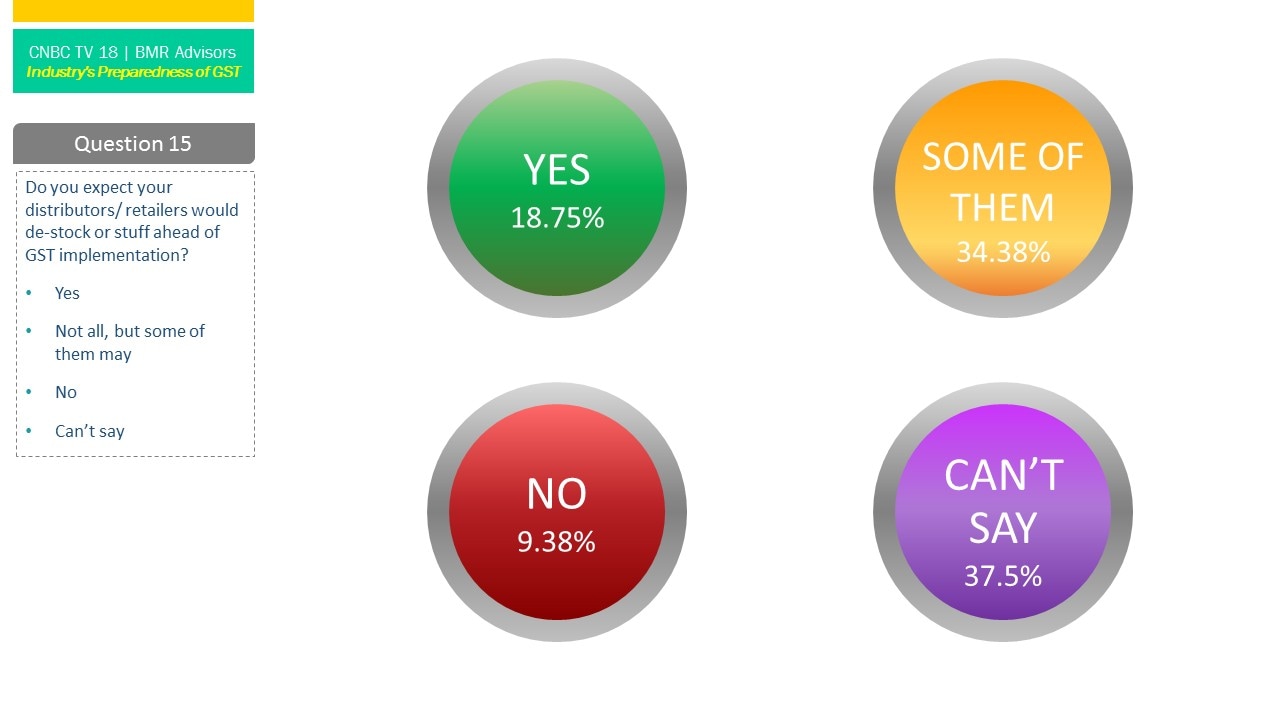

Impact on pricing and stock availability

With government announcing rates for goods and services in their meeting on June 03, 2017, almost 63 percent of the respondents believe that there would be either substantial or marginal impact on pricing while 22 percent are yet to undertaken the analysis.

Given the impact on pricing, the next big question that concerns everyone is that would it lead to any trade disruptions or diversions. To this, almost 53 percent of the respondents believe that their distributors/retailers would de-stock ahead of GST implementation. The government should ensure adequate measures are in place so as to minimize shortages and discomfort to the end customers.

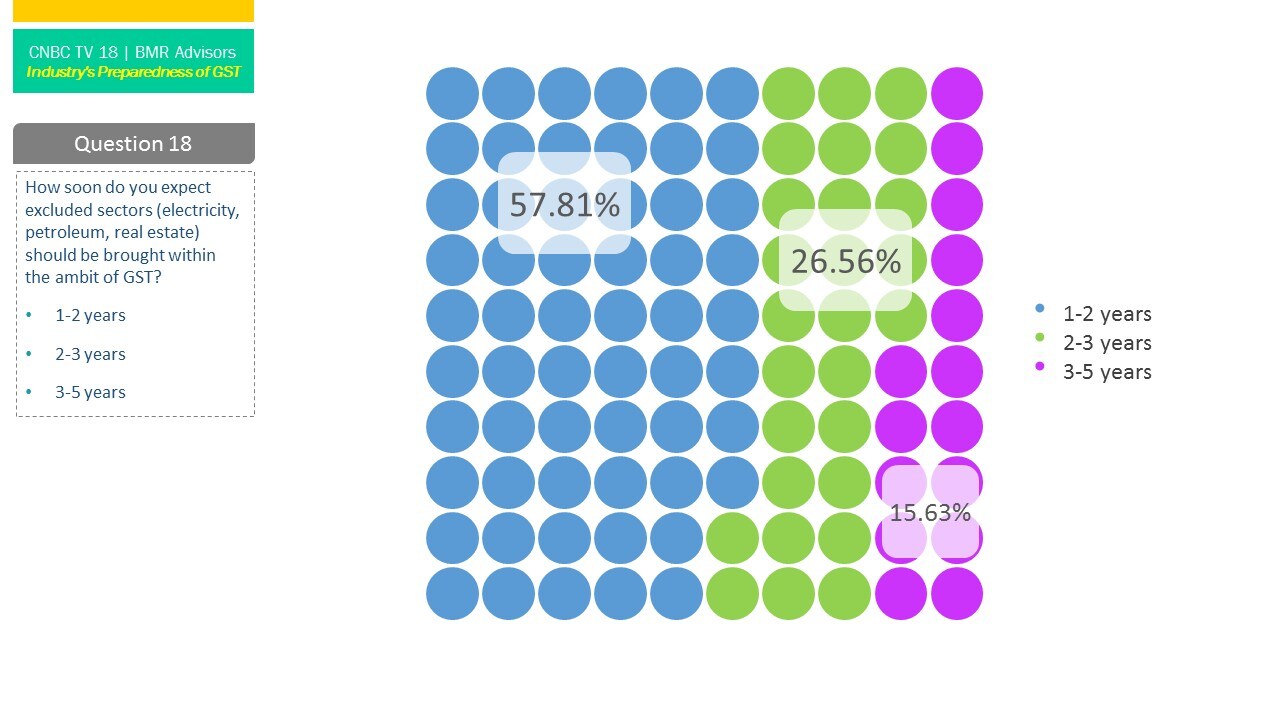

How long to achieve one nation one tax dream

There has been much conjecture as to when the excluded sectors (electricity, petroleum, real estate) will become taxable under GST. The need for it is massive to achieve the dream of one nation one tax and ensure seamless flow of credits across sectors and industries. Survey indicates that around 58 percent of the respondents expect the excluded sectors would be included in GST ambit within a period one to two years. Therefore, majority expects excluded sectors to be included in GST regime soon.

Overall view

While the industry seems to be fairly positive and welcoming towards the revolutionary tax reform, majority have reservations about their preparedness to take the challenge heads on. Industry has some genuine expectations from the Government for an adequate level of support to be provided for an easy transition to GST. It remains to be seen the approach that government would adopt in GST implementation and meeting investor expectations globally.

Methodology

BMR Advisors undertook a poll with an exclusive selection of CEOs, MDs, Chairman, Presidents and CFOs of Corporate India that operate across industry sectors. The poll was designed to garner opinions from business leaders across divergent industries to assess the level of preparedness for GST roll-out in India.

The poll was conducted in May 2017 to gauge what are some of the challenges that needs to be addressed? What opportunities that organizations may expect from GST in terms of supply chain decisions, tax costs, indirect tax litigation, etc.? These are some of the questions that needed to be addressed.

The poll was conducted through an internet based survey portal by circulating a dedicated web link. The respondents were personally contacted to confirm the participation of each respondent. The poll is anonymous in nature. CNBC-TV18 and BMR Advisors would like to thank each one of the participants for their time and thoughtful contribution to the poll.

X