Emami Promoters Are Friends in Deed

In the minds of RS Agarwal and RS Goenka, the troubles of the past year have only reinforced the need to stick together

Name: Radhe Shyam Agarwal & Radhe Shyam Goenka

Age: 67, 66

Profile: Co-founders of consumer goods company Emami

Rank in Rich List 2012 - 84

Net Worth $675 mln each

The Big Hairy Challenge faced in the Past One Year: With members of the two families implicated in the Kolkata hospital fire case, focus on future growth strategies got diluted. However, current businesses continued to grow despite the setback.

The Way Forward: The two chairmen are giving final touches to a succession plan that will see the next generation taking over the business completely.

The chatter and laughter that fill a joint family is beginning to come back in the households of Radhe Shyam Agarwal and Radhe Shyam Goenka. The two childhood friends-turned-business-partners who founded Emami Group live in Kolkata’s tony Southern Avenue. Their houses are eight buildings apart but inevitably the chatter of one house spills over to the other.

“We have been together for the last 60 years,” says the 67-year-old Agarwal, a year older than his friend. So have their families, through dinners at each other’s homes, lunches in offices, and holidays spent together every year. They don’t look like two families in different houses, but one family spread across many. For those meeting them for the first time, it will be difficult to not call them siblings.

But for nearly eight months since last December, the two friends have been on their toes, trying to keep their flock together. A devastating fire in one of the hospitals in Kolkata that Emami co-owns claimed 93 lives. While Goenka, his son and nephew were arrested, Agarwal’s two children were on the run. Though business continued to grow in the three quarters following the fire, the families’ morale has been low. “It is only now that we have again started meeting together as a family,” says Aditya, Agarwal’s elder son, who was among those implicated in the case.

Though Aditya and his ‘siblings’ still make rounds of courts, it is clear that his father and ‘uncle’ are now planning ahead. If anything, in the minds of the patriarchs, the past few months have reinstated the need to stick together. “We have many businesses and we have a succession plan,” says Agarwal. His friend, sitting close by—and as a norm in a nearly two-hour meeting with Forbes India—nods in approval. Agarwal is known for his marketing mind, and setting the vision for the Group, while Goenka, a man of few words, is the master of execution. “We are in the process of selecting two youngsters [from the second generation] as heads of Emami Group,” adds Agarwal, giving the first hints of the impending succession.

“We are thinking why we shouldn’t change our surnames from Agarwal and Goenka to Emami or Emamiwalas, as is the norm among many families in India. It will remove the duality in identity,” says Agarwal. The two are also talking to their advisors to set up a trust that will manage the two families’ wealth, including shareholding, in Emami’s nearly Rs 6,000-crore businesses, which includes edible oil, newsprint and real estate. Some of the details have already been firmed up, including limiting rights of family members to sell shares in companies unless they have signatures of approval from at least two other members of the trust.

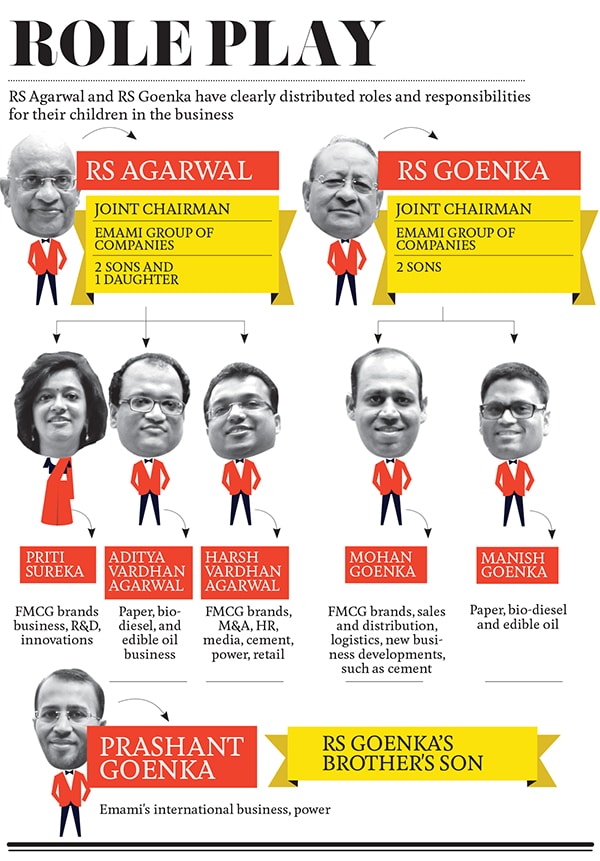

The ‘two youngsters’ means one each from the two families. It is the norm in every business of Emami, where at least one member from each family sits as a director. Whispers in company corridors have put Mohan Goenka and Harsh Agarwal as the favourites to take over the mantle from the founders. The two, along with Harsh’s sister Priti Sureka, now look after the flagship FMCG business, which remains the most profitable segment, though the edible oil vertical is bigger in turnover. Aditya and Manish Goenka, who till recently were responsible for some of the FMCG brands, are now solely looking after the edible oil, newsprint and hospital businesses. Goenka’s nephew Prashant takes care of the international operations of the FMCG business.

While age might play a role in selecting the ‘two’, Agarwal says talent and experience will be equally crucial before the final announcement is made in the next one year. Anand Rathi, founder of Anand Rathi Securities, says: “Over the years, the two founders divided work between themselves, and have worked in perfect tandem. Now they have tried to use the same system to bring the best out of the next generation. It is a unique arrangement in running a family business.” Rathi first met the Emami founders when all three of them were working in the Birla Group 40 years ago; they’ve remained friends since then.

The arrangement has been crucial to growing the business, and keeping the flock together, often mutually exclusive in Indian business families. “It becomes even more complex when a business involves two unrelated families. The complexity is similar to that in the third generation of a single-family business. Usually, a family business doesn’t survive beyond the third generation as the number of cousins increase,” says Mitali Bose of consulting company Hay Group.

GROOMING AND MENTORING

The system has worked till now. Though Agarwal is a chartered accountant, early on he showed interest and ingenuity in marketing and advertising, and took over those functions in the company. Goenka, a law graduate, took over sales and finance. This duality in responsibilities continued with the second generation, each of whom holds a director’s position in the Group (see chart on next page). This structure, though, was preceded by an internship of more than a decade, starting with making rounds of the office after school.

“When I was in school, I would come to office at least twice a week. Father would ensure I was around when he discussed marketing strategies or acquisitions. He would also ask for my opinion,” recounts Priti, who adds with a chuckle that relatives were initially aghast that a girl was joining the business, but her father rallied for her.

When they reached college, the younger lot would be in office after classes. “We would be cutting vouchers and making payments for all kinds of activities in the company. This helped us understand the business,” says Manish Goenka, who is mostly seen with his ‘cousin’ Aditya, their rapport often resembling the company founders’. Or, they would be assisting the two seniors in their office, answering calls, filing letters and making notes of meetings. Goenka asks a question to explain: “How does a child learn that it is through the mouth that one eats? It is by seeing her parents.”

When they reached college, the younger lot would be in office after classes. “We would be cutting vouchers and making payments for all kinds of activities in the company. This helped us understand the business,” says Manish Goenka, who is mostly seen with his ‘cousin’ Aditya, their rapport often resembling the company founders’. Or, they would be assisting the two seniors in their office, answering calls, filing letters and making notes of meetings. Goenka asks a question to explain: “How does a child learn that it is through the mouth that one eats? It is by seeing her parents.”

Advertising guru Alyque Padamsee, who has been advising Emami’s advertising and marketing teams for over a decade, notes, “As long as there is interaction, there will be a meeting ground between the founders and the next generation.” A few of these interactions have taken a formal structure. Attendance at dinners on Wednesdays in either of the founders’ houses is a must. New business plans or office issues are discussed in Friday meetings, where senior company officials are invited when needed. At office, the lunch room is a scene of camaraderie when the whole family takes a break from work, but discusses everything under the sun.

Through these interactions, the two friends were making sure of two things.

ENSURING BUSINESS ACUMEN

One, they want to pass on the wisdom of doing business to their children. “Like their parents, the younger generation is also classically educated. So, there was a need to unlearn. The two seniors are known for their common sense-led business decisions,” says Sumit Ray, who advises Emami on branding. As Mohan Goenka admits, “I don’t think I use more than 2 percent of what I learnt from a management course in the work I do now.”

Agarwal and Goenka have built a business that is known for its nimbleness and out-of-the-box thinking that has often outsmarted competitors, most with deeper pockets. The company’s biggest success story till now has been its fairness cream for men, Fair and Handsome. It was a concept that Padamsee says was for the taking for Hindustan Unilever, the FMCG major whose Fair and Lovely for women is the biggest in the segment. Thirty percent of Fair and Lovely users were men. Instead, it was Emami that launched the brand, which is worth Rs 250 crore now. Similarly, Agarwal and Goenka didn’t baulk when they realised that Fast Relief was a better name than the earlier Pain Relief for their pain balm, and asked their team to make changes even though money had already been spent on packaging.

Like every good Marwari businessman, the founders have also kept a close watch on costs. Though the company’s spend on advertising and marketing has now come down to 18 percent of sales from an earlier 22 percent, it is still among the highest in the industry. This high spend has been balanced by a focus on cutting costs. “Our margins are the highest in the industry,” says NH Bhansali, a close confidant of the family, and CEO, finance, strategy and business development, Emami.

While Agarwal now guides the young directors in launching new brands, and Goenka keeps a strict tab on finance, both have, over the last few years, roped in the best minds in the business to advice them on various fields, from marketing and management to Ayurveda. This includes Unilever veterans V Kasturirangan and Hrishikesh Bhattacharyya, ad guru AG Krishnamurthy and top Ayurveda acharyas from across the country. “As the need arises, we usually spend a few days every month or quarter with them to get their advice and bounce off ideas. Ultimately, it is up to us to take the decision,” says Harsh Agarwal.

SAFEGUARDING THEIR LEGACY

It doesn’t fail to amaze Agarwal and Goenka that even the biggest business families in India have been unable to prevent bickering over wealth. “Even before the father’s funeral pyres cool, fights break out!” exclaims Agarwal. Although he admits that they may not have control over the “unforeseen”, he and his former school buddy are trying their best to ensure their flock remains together. Lunches and holidaying (every October, the two families spend a week together) help create bonding. And to cement that, the senior two have also laid down a formal code of conduct for family members, with help of experts from firms such as Barclays and Ernst & Young.

The dos and don’ts cover everything from investing in shares, perks like buying a Mercedes (need to have at least 13 years of experience), and investments in new ventures, to pocket money for daily expenses, and the number of holidays allowed in a year.

“Even if any woman in the family wants to buy jewellery, permission is needed from Goenka uncle [who overseas family expenses],” says Aditya. Interestingly, none of these guidelines are mandatory but only recommendations. “But we know that it is best for us to follow them,” says Prashant.

That discipline will be crucial for the two families and for the legacy of the two friends. “In two years, we will step away from the business…when we see that they are fully equipped—not only in work but as a cohesive unit—then we will call it a day,” says Agarwal.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)