A Formula to Seal the GST Debate

It will take some juggling from the central government to get all states on board with the finer details of GST

The way we pay taxes is poised for a big change; the question is when and how. The Indian government has officially announced it will miss the April 1 deadline that Finance Minister Pranab Mukherjee set in the last budget to implement the goods and services tax (GST), a system that is followed by many countries in Europe. Under the current set-up, the effective rate on goods is 26.5 percent (Centre and state combined). The tax on services before the economic stimulus package was announced was 12 percent. In the existing system, the Centre taxes the production side of the business (excise) and the states tax the distribution side (sales). The new system harmonises this, enabling both the Centre and the states to tax goods and services through a uniform tax. One of the main reasons for the delay is a deadlock between the Centre and states over the respective shares of the state tax and the Central tax parts of the combined GST rate.

The First Solution

A task force was set up by the 13th Finance Commission in mid-2008 to decide the ideal rate of taxation. It recommended that states should collect taxes at the rate of 7 percent and the Centre at 5 percent for all goods and services. So the effective indirect tax rate that consumers would pay would be 12 percent.

According to the task force’s calculations, the revenue earned by both the Centre and states from taxes subsumed in GST was Rs. 1.88 lakh crore. The task force suggested a set of rates that would yield this amount of revenue under the GST regime.

But the states have turned down this recommendation because they felt their share of revenue would have been reduced under the new scheme even though the task force recommended rates would have collected just as much revenue on the whole. Reason: At 7 percent state GST rate, most states stand to lose more revenue due to the fall in tax rate on goods (from existing 26.5 percent to 7 percent) than what they would gain from the additional taxation of services. In fact, given that the production of goods and services is unevenly distributed across states, most experts agree that there is no uniform rate that would result in all states collecting the same amount of revenue as they did in the pre-GST regime.

The Alternative Solution

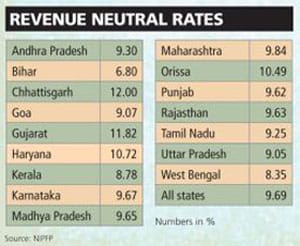

Two National Institute of Public Finance and Policy (NIPFP) researchers, R. Kavita Rao and Pinaki Chakraborty, have trod a middle path to arrive at a rate of 7 percent for the Centre and 10 percent for the states. At that rate, 23 states will be able to protect their revenues or even gain a little. Only five will stand to lose, that too not substantially. This is well illustrated by Maharashtra and Haryana. According to a ballpark calculation done by Forbes India, at 7 percent state GST rate (as suggested by the task force), Maharashtra stood to lose Rs. 13,991.08 crore in revenue per year while at 10 percent (as suggested by NIPFP), it would gain Rs. 999.36 crore per year. Alternatively, Haryana would lose revenue even at 10 percent GST. However, it would reduce revenue loss from Rs. 4,636.54 crore at 7 percent to Rs. 877.19 crore at 10 percent. Rao says that the Centre could choose to reduce its share to 5 percent, instead of 7 percent (which is required to compensate for all the existing revenue earnings) depending on whether it is willing to take a slight cut on its revenue collection.

However, even at 17 percent, India will be in line with the global average in GST rate and as such could be expected to remain competitive. But even if this makes the Centre as well as the states happy, how people perceive this tax burden remains to be seen.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)