The number of scams per brand soared by 211 percent in APAC region last year

As per the latest findings from Group-IB, scammers show the highest interest in brands from the APAC and MEA regions

There is an uptick in the number of scams as well as the number of people engaged in scam activity. Image: Shutterstock

There is an uptick in the number of scams as well as the number of people engaged in scam activity. Image: Shutterstock

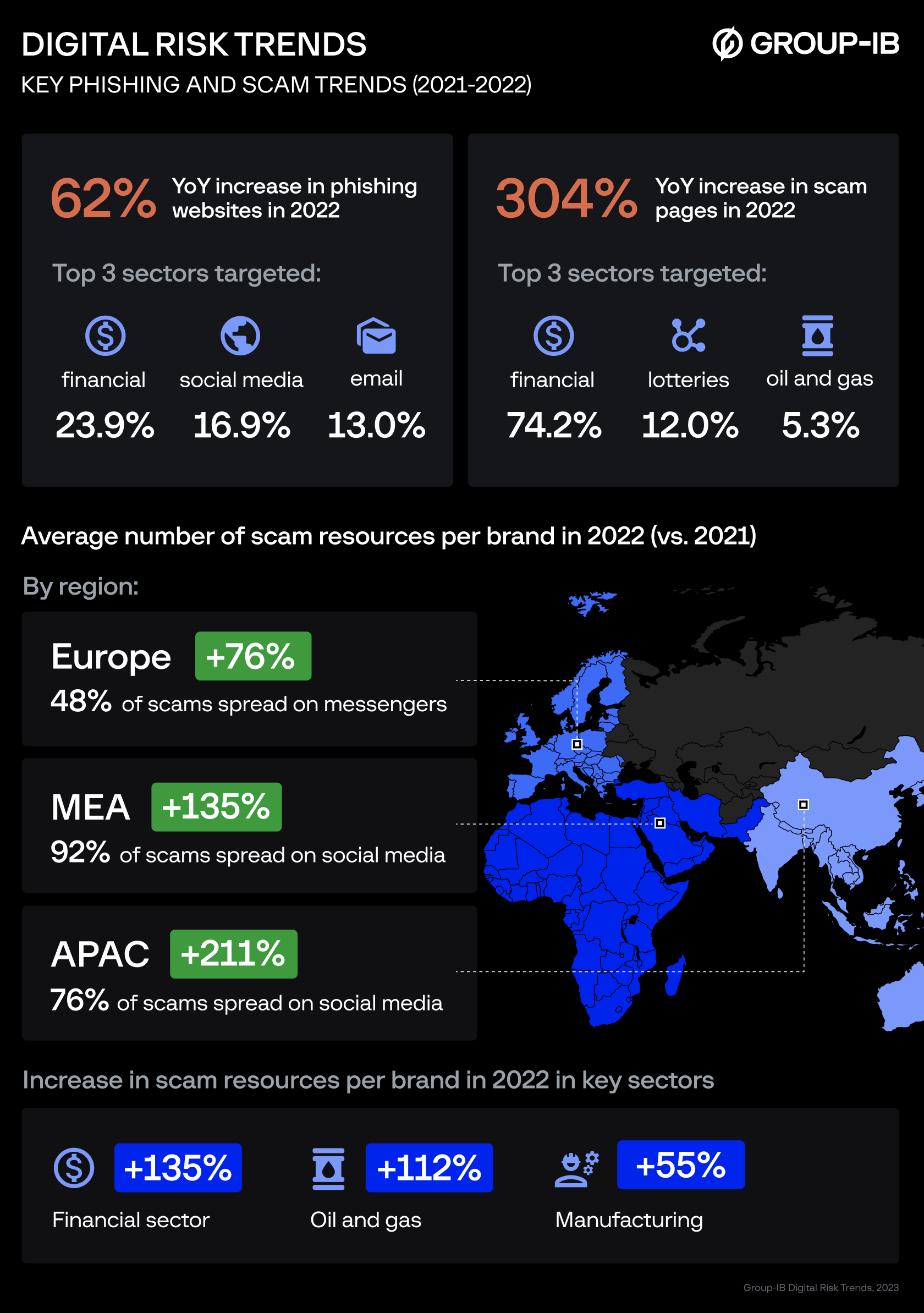

Scams continue to be the most common form of cybercrime, overtaking phishing and other cyber threats such as malware, ransomware, and distributed denial-of-service (DDoS) attacks. Scammers are highly interested in brands from the Asia-Pacific (APAC) and Middle East and Africa (MEA) regions, according to the latest report by global cybersecurity firm Group-IB.

The average number of scam resources created per brand, defined as the number of instances in which a brand's image and logo were appropriated for use in scam campaigns, across all regions and industries, more than doubled year-on-year in 2022, up 162 percent. In the Asia-Pacific region, the rise was even more significant, with this number spiralling 211 percent compared to 2021. According to the findings, scams caused over $55 billion in damages, and the so-called scamdemic shows no signs of slowing down.

There is an uptick in the number of scams as well as the number of people engaged in scam activity, both driven by the more frequent use of social media to spread scams and the growing automation of scam processes. For instance, in the prominent Classiscam scam-as-a-service scheme, more than 80 percent of operations are now automated. Social media is often the first point of contact between scammers and victims, and this was apparent in the APAC region last year. The Group-IB analysts found that 58 percent of scam resources targeting companies in seven core economic sectors were created on social media.

In the APAC region, 76 percent of scam resources targeted companies in seven sectors: Financial institutions, banks, telecommunications and media, oil and gas, aviation, insurance, and manufacturing, and these were found to originate from social media. A recent example of this in the APAC region includes the discovery of 600 hijacked Instagram accounts used to spread phishing links to Indonesian victims.

"We’re definitely seeing a huge rise in fake or fraudulent websites, mobile apps, business listings, etc. recently. Traditionally, these attacks focussed largely on the BFSI sector with phishing, but now we're seeing much more creative attacks from hackers," says Yash Kadakia, founder of Security Brigade and ShadowMap, which monitor phishing and brand infringement attacks. In India specifically, many consumer brands, like Swiggy, Zomato and Dunzo, are targeted with fake Google Business sites or Google Ads by scammers pretending to be their support staff. These generally result in a reverse UPI scam, where they send a payment request and pretend it’s a payment, he adds.