How Madan Mohanka built Tega Industries into a stakeholders' dream

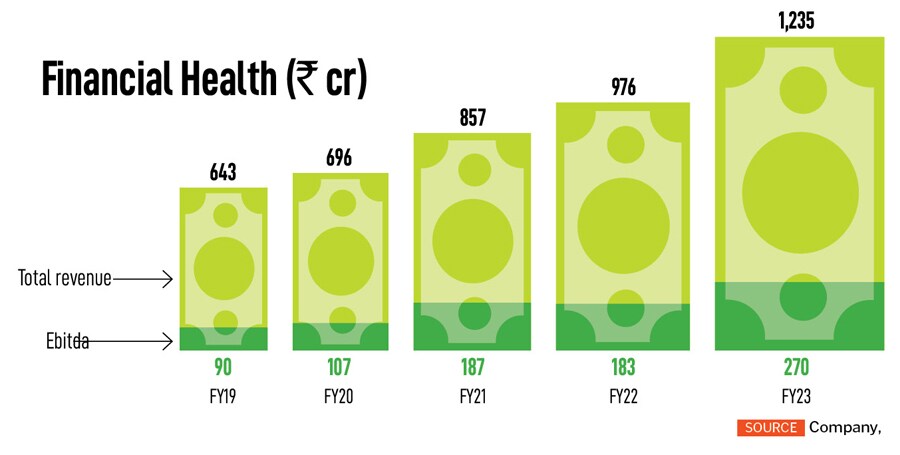

It was difficult for IIM-A graduate and first-gen entrepreneur Madan Mohanka to build an engineering company. But the over-45-year-old Tega Industries has grown exponentially while rewarding shareholders after it went public in 2021

Madan Mohanka, promoter and chairman, Tega Industries, with son Mehul (right), who is MD and group CEO

Image: Debashish Sarkar for Forbes India

Madan Mohanka, promoter and chairman, Tega Industries, with son Mehul (right), who is MD and group CEO

Image: Debashish Sarkar for Forbes India

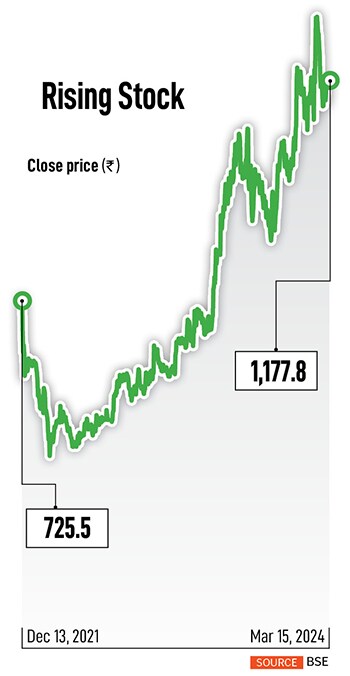

In December 2021, when it was pouring initial public offerings (IPOs) in the primary markets, one issue stood out, both in subscriptions and the first-day listing gains with a long-term promising returns outlook on the stock exchanges. The Tega Industries IPO, which opened for subscription on December 1, 2021, had hit the ball out of the park in a month of the highest number of public issues.

The man behind the over-45-year-old company Tega Industries was beaming with joy. “It was a proud moment for me and the Tega family,” recalls Madan Mohanka.

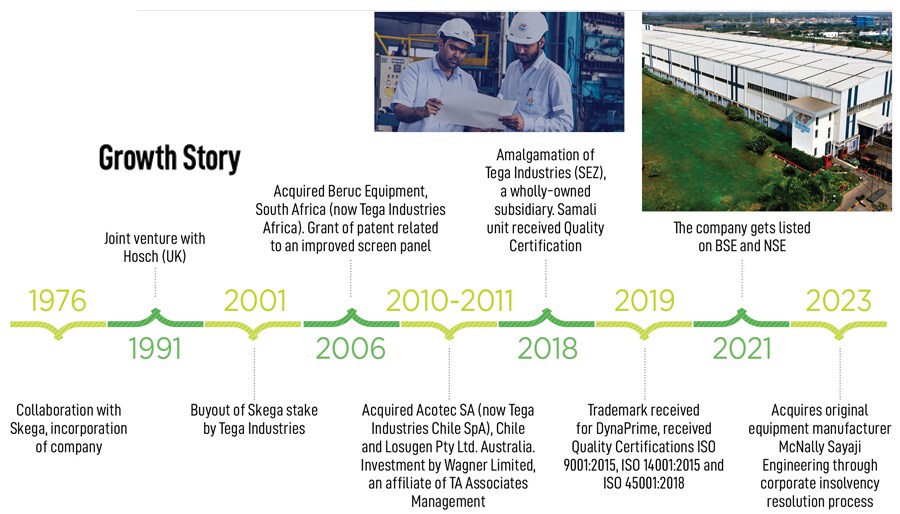

Mohanka, 81, is promoter and chairman of the company that manufactures heavy-duty engineering and mechanical product design for the mineral processing, mining and material handling industries. The Kolkata-based company, which started in 1976, took years to be in the shape and form it is today, built through strategic decisions and some acquisitions.

“It was not easy. I have seen tough days, but I have never disappointed my employees. Even when the company was going through a rough phase in the initial years, I made sure my employees’ salaries were given out on time. I never missed out,” says Mohanka.

But for Mohanka, a first-generation entrepreneur, it was not an easy task to build an engineering company with no experience or exposure. English was one of his early challenges that he took on head-on. After an engineering degree from the Birla Institute of Technology, Ranchi, Mohanka was one of the few early MBAs from the Indian Institute of Management (IIM), Ahmedabad in 1967.

But for Mohanka, a first-generation entrepreneur, it was not an easy task to build an engineering company with no experience or exposure. English was one of his early challenges that he took on head-on. After an engineering degree from the Birla Institute of Technology, Ranchi, Mohanka was one of the few early MBAs from the Indian Institute of Management (IIM), Ahmedabad in 1967.

“The Tega-MSEL combination will enhance synergies related to shared technology, technical knowledge, larger product profile, after-sales service and efficient working capital management. Besides, the acquisition is likely to translate into quicker growth, improved capital access and attractive long-term value-creation for our stakeholders,” says Mehul.

“The Tega-MSEL combination will enhance synergies related to shared technology, technical knowledge, larger product profile, after-sales service and efficient working capital management. Besides, the acquisition is likely to translate into quicker growth, improved capital access and attractive long-term value-creation for our stakeholders,” says Mehul.