Prioritise 'build in India for India' model for deeptech: Vinayak Narasimhan

There's a prevalent VC expectation for deeptech to be made in India for the world; however, what succeeds in India may not necessarily thrive in the US, the writer, a staff scientist at Samsung Semiconductor and an investor with the India-based venture builder platform GrowthStory, writes

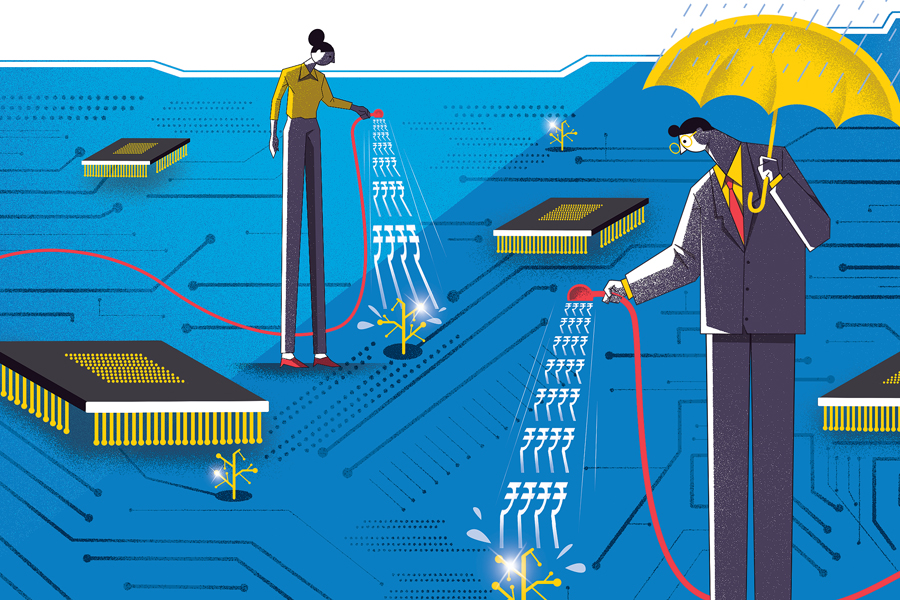

Illustration: Chaitanya Surpur

Illustration: Chaitanya Surpur

The global definition of deeptech focuses on technologies rooted in fundamental sciences or advanced engineering principles aimed at tackling potentially large unsolved market needs. However, this definition doesn’t seamlessly translate to the Indian context due to nuances in venture capitalist’s (VCs) investment outlook.

In lieu of a one-size-fits-all definition, categorising Indian deeptech into strategic buckets proves beneficial for guiding VC investments. These buckets align along two axes—the ecosystem to develop and the ecosystem to deliver. The ecosystem to develop refers to India’s capability to develop and validate deeptech, influenced by the resources and innovation of premier institutions like the IITs and IISc, access to specialised talent, and government support. The ecosystem to deliver represents India’s ability to commercialise and scale deeptech businesses, considering market adoption and willingness to pay.

In lieu of a one-size-fits-all definition, categorising Indian deeptech into strategic buckets proves beneficial for guiding VC investments. These buckets align along two axes—the ecosystem to develop and the ecosystem to deliver. The ecosystem to develop refers to India’s capability to develop and validate deeptech, influenced by the resources and innovation of premier institutions like the IITs and IISc, access to specialised talent, and government support. The ecosystem to deliver represents India’s ability to commercialise and scale deeptech businesses, considering market adoption and willingness to pay.

There’s a prevalent VC expectation for deeptech to be made in India for the world; however, what succeeds in India may not necessarily thrive in the US. Prioritising ‘Building in India for India’ is a viable model, given the potential demand volume and the increasing nationalistic pride around domestic innovation and production.

Lastly, rebranding Indian ‘deeptech’ as ‘emerging tech’ might ease VC apprehensions. For seasoned VCs, this nomenclature subtly shifts the narrative, suggesting a stage of development that feels more immediate and actionable, potentially accelerating investment momentum in the Indian context.

Discipline versus Fluidity

The VC landscape is divided on the merits of a structured investment thesis for Indian deeptech. VCs like Blume Ventures and Pi Ventures embrace robust theses, shaping their long-term strategies. For instance, Blume Ventures has outlined their views in reports on battery innovation and investment outlook and the electric vehicles (EV) ecosystem.