We put interest of the business ahead of that of the family: Adi Godrej

This is how the Godrej Group aims to achieve its ambitious target of increasing revenues by 10 times in 10 years, says Chairman Adi Godrej

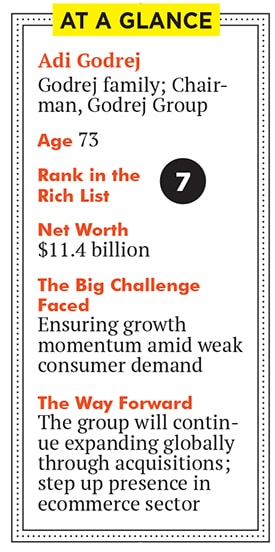

The 118-year-old Godrej Group, with interests ranging from consumer products to real estate, and from aerospace to defence, has been recognised over the years for running ethical and sustainable business operations globally. By building such an impeccable reputation, the group has created value for all stakeholders, including the promoter family, led by its 73-year-old patriarch Adi Godrej. It is little surprise then that Godrej and family rank seventh on the 2015 Forbes India Rich List with an estimated wealth of $11.4 billion.

Godrej also speaks of the dynamics in managing and leading a large and diversified family-run business (his cousin Jamshyd, brother Nadir, and children Pirojsha and Nisa Godrej and Tanya Dubash manage different parts of the group’s operations), and how the conglomerate has been putting the interest of the business before that of the family. Excerpts:

Q. What are the key leadership qualities required to manage a group as large and diverse as the Godrej Group?

One of the very important qualities [needed] is to set clear goals and expectations over a forward-looking period, which can vary depending on what issue is being looked at. It could be a three-year, five-year or 10-year goal. After that, the leadership should work backwards to see if it can be achieved. This is a very important process that our group looks at on a regular basis.

Q. How do you ensure that all family members harmoniously work together for the overall growth of the organisation? How are their roles and responsibilities demarcated?

We put the interest of the business ahead of the interest of the family. Only those family members who are qualified are invited to join the business. If some family members aren’t adequately qualified, they can remain shareholders, but not join the business. So, not all family members join the business. I am a part of the third generation of the family business, which is 118 years old. Now the fourth generation is quite active.

In terms of assigning professional roles to family members, we look to find a match between opportunities within the group, the individual interests of family members and their capabilities. There are also many businesses within the group that are being led by non-family professionals. Family members mainly involve themselves in roles that require coordination between different businesses and companies. For example, my daughter Tanya supervises our strategic marketing group that handles the Godrej brand. It also coordinates marketing between all the group companies. My other daughter Nisa looks at strategy and human resource development. Some of them have executive roles like my son Pirojsha, who is managing director of Godrej Properties, and Nisa, who is executive director on the board of Godrej Consumer Products Ltd [GCPL]. That’s how we try and balance it.

Q. Does it become cumbersome sometimes to manage expectations and egos in a family-run business?

Of course. It isn’t unusual and something particular to only family businesses. Even in businesses completely run by professionals, who aren’t promoters, such challenges are not uncommon. To handle such issues, one needs to have a strong leadership and clear objective of the interests of the business in mind. For example, even while implementing corporate governance within the group, we look at the interests of the business as a whole, and not individual stakeholders like majority shareholders, minority shareholders or promoters. If you look after the welfare of the overall business, you serve the interests of a very wide community, including shareholders, employees, associates, and customers.

Q. The last few years have been difficult for Indian businesses due to economic headwinds. But the Godrej Group has continued to do relatively well. How have you managed to achieve this?

We have very strong strategic and business processes. We focus on outcomes. For example, we use EVA [economic valued added] as our major financial metric and reward a large part of our employees based on improvement in EVA. That has worked very well for us. We have a very strong HR practice, which has helped us attract and retain good employees who are adding a lot of value. So, the various business processes we follow have helped us do reasonably well even when times have been bad. For example, currently, the real estate sector is going through some difficulties. But Godrej Properties and its projects are doing very well.

We also do a lot in terms of innovation, research and development, and brand building, which has helped the group as well. Among Indian business groups, we now have the largest consumer base in India. Earlier, we had about 600 million people using our products; now, we have around 750 million users in India and about 1.1 billion consumers worldwide.

Q. The conglomerate’s businesses, such as GCPL, have been on an international acquisition spree to grow overseas. Is the global expansion strategy now complete or is it still work in progress?

It is most definitely work in progress. We have an objective called ‘10-by-10’ for both GCPL and the group as a whole; that is to be 10 times the current size [by revenue] in 10 years. That is a CAGR of 26 percent in turnover. When we first enunciated this strategy about five years ago, we bettered this growth rate through both organic and inorganic means. In the last couple of years, we have trailed that growth rate because the global and Indian economies have not done that well. But we hope to catch up and there will definitely be more acquisitions.

Recently, GCPL announced an acquisition in South Africa and the acquisition of the remaining 40 percent shareholding of its joint venture partner Cosmetica Nacional in Chile. Godrej Agrovet also announced the acquisition of a listed, agro company Astec LifeSciences in India. We continue to constantly look at inorganic growth.

Around 30 percent of our income as a group comes from outside India. This includes both operations outside India as well as income from exports. In GCPL’s case, approximately 50 percent of its turnover comes from outside India.

In other companies, that ratio varies and several of our companies have operations outside India. The expectation is that the percentage of our revenues from operations outside India will continue to grow in the future.

Q. What will be the businesses of the future for the Godrej Group?

We are in many different businesses and aren’t actively looking to get into many new businesses. But that doesn’t mean we will not look at new businesses at all. We are very strongly interested in expanding into operations that are adjacent to our existing businesses. Ecommerce will be very important to us as a method of retailing since we are very much a consumer products company. We will have very strong partnerships with external entities as well as our own operations. Nature’s Basket, for instance, which is our chain of gourmet retailing stores, has already acquired a small e-tail company and merged it with itself to expand through online retail. Online retail is a very small part of our overall sales at present, but it will grow very rapidly.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)