Bitcoin 'wholecoiner' wallets surge by 13k in the past week

The total number of 'wholecoiner' wallet addresses has increased to 865,254 in the past week

Image: Shutterstock

Image: Shutterstock

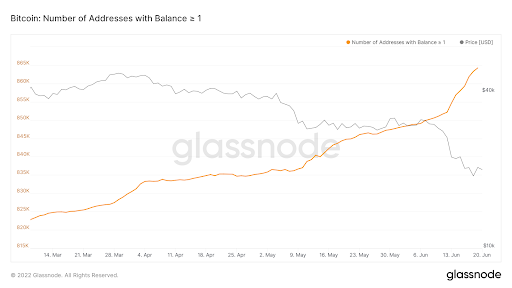

Small wallet addresses continue accumulating Bitcoin despite the bear market blues. The number of Bitcoin wallet addresses with one BTC or more rose by 13,091 in the past week. The continued enthusiasm for the largest crypto reflects the optimism in the market, notwithstanding the 2/3rd value drop Bitcoin has witnessed since its November ATH (all-time high).

The downtrend has been accompanied by the number of wholesalers skyrocketing, as represented by the hockey stick growth in the graph below.

Since June 10, the graph has surged steeply. Christian Ander, founder of the Swedish exchange BT.CX said, “This is good for the ecosystem that it’s growing from the ground up because it wants the economy to be bottom-up. People have a strong belief in the future of the Bitcoin network and the value of the currency.”

These stats indicate that small investors are accumulating Bitcoin and still have faith in the coin's future. Glassnode data also revealed that the number of wallet addresses holding 0.1 BTC has also jumped in the last ten days. The sharp rise was observed in tandem with the Bitcoin falling below its psychological resistance of $30,000. This occurred for the first time on May 11, 2022. Since then, over 14,000 Bitcoin wholecoiners have joined the Bitcoin supporters’ league.

In contrast, the number of wallet addresses with over 100 BTC has decreased by 136 since May 11, 2022. Bitcoin is floating below its 200-week moving average of $22,700.

Historically, any move below the 200-W MA is seen as a sign of a bounce-back. Retail investors are probably accumulating Bitcoin in anticipation of a price rise, while big whales are looking to cut some of their losses. There are mixed signals in the market, and it is always wiser to wait and confirm the trend reversal before entering the market.