Waterworld

Massive floods in Thailand have brought hundreds of electronics factories offline, creating a serious global shortage of hard disk drives. Time to rebuild or move out?

It was October 14, and Foamtec International Vice President Alan Lim had just begun his morning meeting at the Singapore main office when the phone rang. It was his company’s factory in Thailand. The message: “The waters are coming in.”

Foamtec makes specialty insulation for hard disk drives and other electronics products at a plant north of Bangkok. Following the worrisome call, Lim dispatched a manager to survey the damage. Two hours later he received confirmation: There was 6 feet of water inside the building, and the Hi-Tech Industrial Estate, where the factory sits, was being evacuated.

Lim was dismayed by the news, but not all that surprised. For weeks he had been monitoring Thailand’s battle to contain the flood waters from monsoon rains draining into the country’s central river valley. Hi-Tech is one of four factory estates in Ayutthaya, a rice-growing flood plain turned industrial suburb. After nearby Rojana Industrial Park was inundated, despite last-ditch efforts by Thai troops to reinforce flood defenses, it seemed only a matter of time. Says Lim: “We knew that if Rojana flooded then we wouldn’t be spared.”

Nearly 500 people have died in what has been the worst flooding in Thailand in 70 years. The financial toll will be severe as well: The Thai economy will contract in the fourth quarter, trimming full-year GDP growth by three percentage points or more, according to Barclays Capital. The floods forced the closure of nearly 900 factories in seven industrial parks with a combined workforce of 460,000 people, dealing a serious blow to Thailand’s reputation as an export manufacturing hub. Auto production in Thailand, the largest car manufacturer in Southeast Asia, is expected to fall to 1.5 million units in 2011, compared with a preflood forecast of 1.8 million.

“It’s a wake-up call for investors that Thailand is no longer safe from these kinds of disasters,” says Santitarn Sathirathai, an economist for Credit Suisse in Singapore.

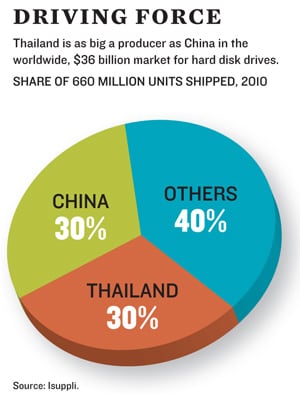

The flood had the biggest disruption on the PC industry, whose fragile supply chain is yet again revealed to be over-reliant on a few parts suppliers. Factories in Thailand spit out a third or more of global drive production, centred on a handful of factory zones outside Bangkok, where skilled labour, affordable land and tax incentives have attracted the biggest drivemakers, names such as Western Digital and Toshiba, along with their key component producers. One of them, NIDEC, makes 80 percent of the spindle motors used in disk drives. NIDEC suffered flooding at six of its seven plants in the area.

Western Digital warned in October that the flooding had shut down several of its plants in Thailand. Its shipments will fall from 58 million drives in the September quarter to somewhere between 22 million and 26 million in the December quarter.

Rival Seagate has been luckier — its own plants in Thailand are still dry — but its component manufacturers have not been spared. Due to the resulting parts shortages, Seagate now sees its own drive production for this quarter in the 40 million to 45 million units range; Chief Executive Steve Luczo says the company otherwise would likely have shipped 55 million drives.

The resultant shortage has triggered a cascade of warnings from Hewlett-Packard, Dell and others over the impact of tightening supplies of hard disk drives. Last year, the tech industry shipped 660 million hard drives. Thomas Coughlin, a consultant on data storage systems (and an online contributor to Forbes), predicts that output could drop this year by 50 million to 60 million units, with a further 3 percent fall in 2012, as shortages persist into the second half of the year.

While PC manufacturers hold inventory and have already shipped products for Christmas sales, a supply crunch could start to bite next year. Market research firm IDC predicts that under a worst-case scenario PC shipments could fall over 20 percent in the 2012 first quarter. PC companies say suppliers are responding quickly to flood-related disruptions in Thailand, but there’s still uncertainty over when lost capacity will be replaced.

“Supply problems are happening to so many companies,” says Yasunari Kuwano, a spokesman for Minebea, which produces HDD spindle motors in Thailand. Even if PC manufacturers can secure the necessary volume of hard drives, says Fang Zhang, an analyst at IHS iSuppli, they will be paying up to get them. “The price has increased, and that will impact their overall business,” she says.

Some areas in Thailand are still inundated, making it impossible to assess damage or restart operations. Thai Industry Minister Wannarat Channukul said recently that the four industrial parks in Ayutthaya could reopen in December, while two sites in an adjoining province would take longer to reclaim. At the Hi-Tech site a row of pumps drains the floodwaters surrounding a Canon factory, the company’s red logo reflected in the stagnant water. A small boat ferries workers to and from the factory gates.

At Western Digital’s facility in Ayutthaya’s Bang Pa-In Industrial Estate hundreds of workers wearing blue aprons and green plastic gloves were carrying trash from inside a whitewashed factory, on which a brown tidemark at head height showed the flood’s peak. A company of soldiers was clearing a foul smelling ditch where water had collected. A manager who refused to give his name pointed inside a three storey building, one of five grouped in the facility. He said the floods barely reached the raised factory floor and that equipment had been moved upstairs. “We even saved the desktop computers,” he boasted.

But across the street a salvage operation told a different story. A winch lowered six clunky mud-splattered fabrication machines onto a truck, which trundled away into the distance. Dozens of other machines were strewn across the factory floor. Nearby other factories lay dormant behind sandbagged walls. At the entrance vehicles drove cautiously through waist-high water toward the main road to Bangkok, 40 miles away.

While the country struggles to pick up the pieces, a key question hangs over Thailand’s tech sector. Should companies relocate their plants — or stay and rebuild? In the disk-drive sector alone, the total cost of replacing damaged machinery could top $1 billion, according to Coughlin. To replace lost capacity, firms have already shifted orders to plants in China, Malaysia and the Philippines, all of which are vying for more foreign investment.

At least for now tech companies say they’re committed to manufacturing in Thailand and to rehabilitating their plants. “We are working aggressively to restore our and our supply partners’ pre-flood capacities both within Thailand and throughout the region,” says Steve Shattuck, a spokesman for Western Digital. A survey of US companies found that none had plans to relocate outside Thailand due to flooding, says Judy Benn, the executive chairman of the American Chamber of Commerce in Thailand.

But industry sources in Thailand and Malaysia say Western Digital is reluctant to reinvest in its Thai facilities. One source says the company is preparing to increase capacity within six months at its plant outside Kuala Lumpur. CEO Tim Leyden said in October that capacity would be constrained for several quarters and that Western Digital was “pursuing all possible options to maximise our Malaysian facility’s throughput.”

A wider supply chain, both inside and outside Thailand, is arguably smarter than a production cluster in Ayutthaya. Companies prefer suppliers to set up in the same area, since it cuts delivery time, but this is risky, says Brent Bargmann, who ran Seagate’s Thailand operations until 2007. “The question is whether you can live with a slightly higher cost by gaining a broader supply chain with more risk aversion,” says Bargmann, now a lecturer at the Asian Institute of Technology in Bangkok.

Bargmann says that Thailand remains attractive to disk-drive manufacturers, which will be loath to leave a pool of skilled workers and associated suppliers. Some may relocate to less flood-prone areas in the east and northeast parts of Thailand. But he said that future expansion would be a tough sell to tech corporations. “How is Thailand going to look for your next country expansion after your plant has been under putrid water for six weeks?” he asks.

After Lim’s Foamtec factory in Ayutthaya was flooded he rented a plant at another industrial park in eastern Thailand, where Foamtec already operates. The plant, which supplies insulation materials for disk drives, is running at 80 percent of capacity, but sales have fallen off sharply as disk-drive production in Thailand has seized up. Lim argues that the government’s compensation package should extend to companies outside the flood zone that have been affected by supply chain outages.

Lim is still waiting to see the damage to the flooded plant, but he isn’t hopeful about salvaging much. Says Lim: “It’s almost like you start a new factory.”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)