Global wealth saw record acceleration in 2020, a crisis year. Could it be a reason to celebrate?

Covid-19 brought terrible suffering, economic pain, geopolitical tension—and the greatest acceleration of wealth in human history. Why this pandemic paradox could become a cause for celebration, not concern

Twenty-nine-year-old Sam Bankman-Fried has promised to put virtually all of his $8.7 billion fortune into causes he believes in

Twenty-nine-year-old Sam Bankman-Fried has promised to put virtually all of his $8.7 billion fortune into causes he believes in

Image: Virgile Simon Bertrand for Forbes

On March 18, 2020, the United States registered its 150th coronavirus-related death while trying to gauge, along with most of the world, just what was happening. Major market indices fell 5 percent after jumping 6 percent the previous day. Spring breakers partied blithely in Florida while officials decided to close the border with Canada. And a statistical team at Forbes locked the numbers for our 34th annual ranking of the world’s billionaires, unwittingly creating a snapshot of global wealth at the precise moment the world lurched into its most disruptive 12 months since World War II.

Over the ensuing year, those 150 US deaths swelled to 550,000; some 3 million souls were lost worldwide. Tens of millions of jobs evaporated, along with hundreds of thousands of small businesses. Remote work went from exotic to standard. The suburbs went from dull to desired. The death of George Floyd triggered a reckoning concerning race and social justice. The presidential election tested democratic norms. Simultaneously, though, many individuals, industries and investments thrived.

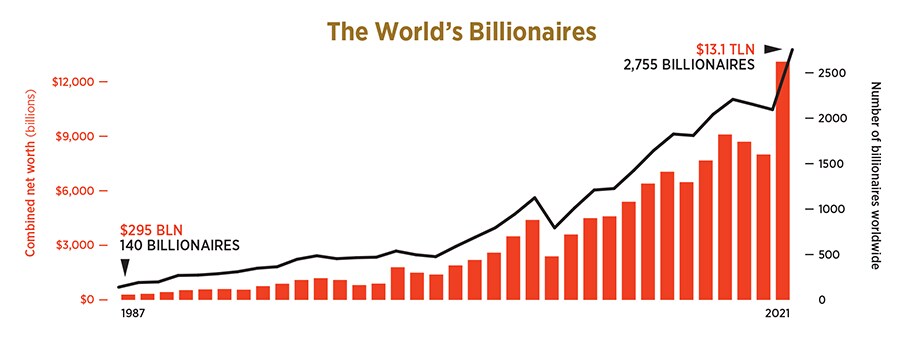

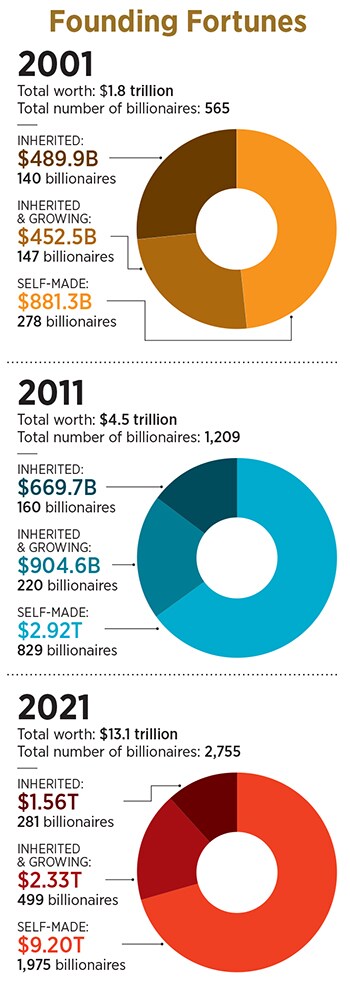

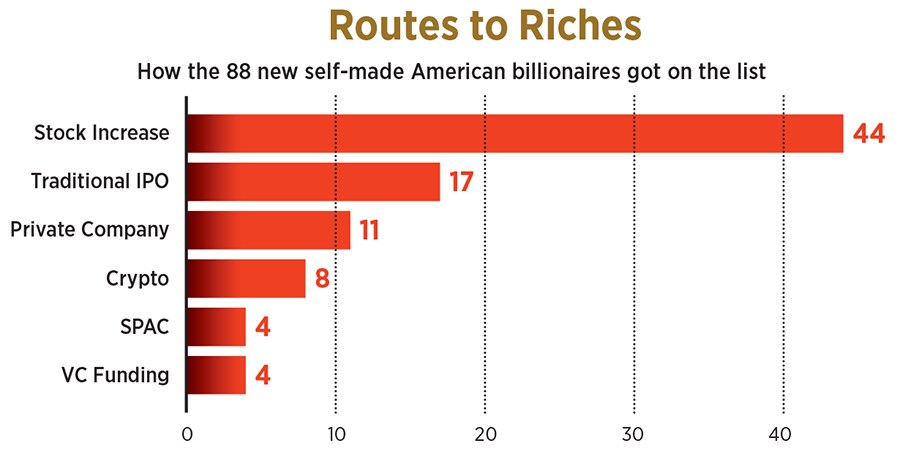

One year after that fortuitously timed snapshot, we repeated our March billionaires audit, taking the measure, at the point of the pyramid, of the past year’s seismic changes. The results defy hyperbole. Over the past 12 months, 493 people worldwide joined the Forbes list—a newly minted billionaire every 17 hours. Rising asset prices vaulted another 250 previous drop-offs back over the ten-digit mark. Amid widespread economic insecurity, precious few billionaires fared worse financially: Just 61 dropped off the list for reasons other than death, representing the lowest percentage of drop-offs for any year on record. All told, Forbes estimates that there are now 2,755 billionaires globally, up from 2,095 last year, and the notion that the rich get richer has never been more apt: They’re worth, in aggregate, $13.1 trillion—a staggering $5.1 trillion more than at the start of the pandemic.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

John Arnold was the first billionaire to get behind a new ‘Give While You Live’ promise—a public commitment to grant at least 5 percent of his personal net worth to good causes each year

John Arnold was the first billionaire to get behind a new ‘Give While You Live’ promise—a public commitment to grant at least 5 percent of his personal net worth to good causes each year

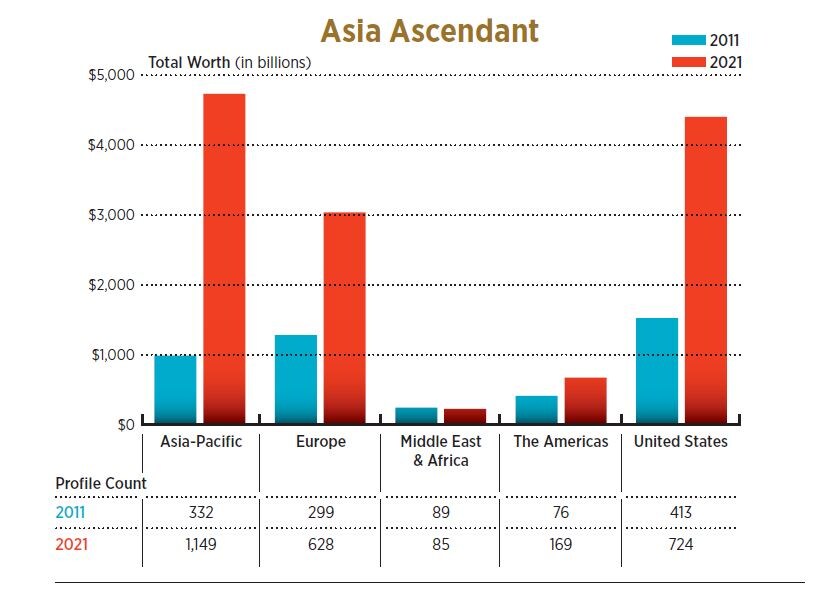

And while in America extreme success remains disproportionately white, the global business aristocracy increasingly reflects the world itself. China alone, including Hong Kong, added a staggering 210 billionaires this past year. Factor in 19 new faces from India, 14 from Japan and multiple debuts from seven other Asian countries, and people of colour made up a majority of new billionaires worldwide.

And while in America extreme success remains disproportionately white, the global business aristocracy increasingly reflects the world itself. China alone, including Hong Kong, added a staggering 210 billionaires this past year. Factor in 19 new faces from India, 14 from Japan and multiple debuts from seven other Asian countries, and people of colour made up a majority of new billionaires worldwide.

That group evolved into the Initiative to Accelerate Charitable Giving. Its primary targets: The $142 billion in donor-advised funds, or DAFs, which allow donors to take upfront tax deductions for parking money in community foundations or financial-services firms, even if there’s no mandate or visibility for when or how the money goes to the public good; and perpetual foundations that try to end-run annual minimal giving requirements by sliding in expenses when they report.

That group evolved into the Initiative to Accelerate Charitable Giving. Its primary targets: The $142 billion in donor-advised funds, or DAFs, which allow donors to take upfront tax deductions for parking money in community foundations or financial-services firms, even if there’s no mandate or visibility for when or how the money goes to the public good; and perpetual foundations that try to end-run annual minimal giving requirements by sliding in expenses when they report.