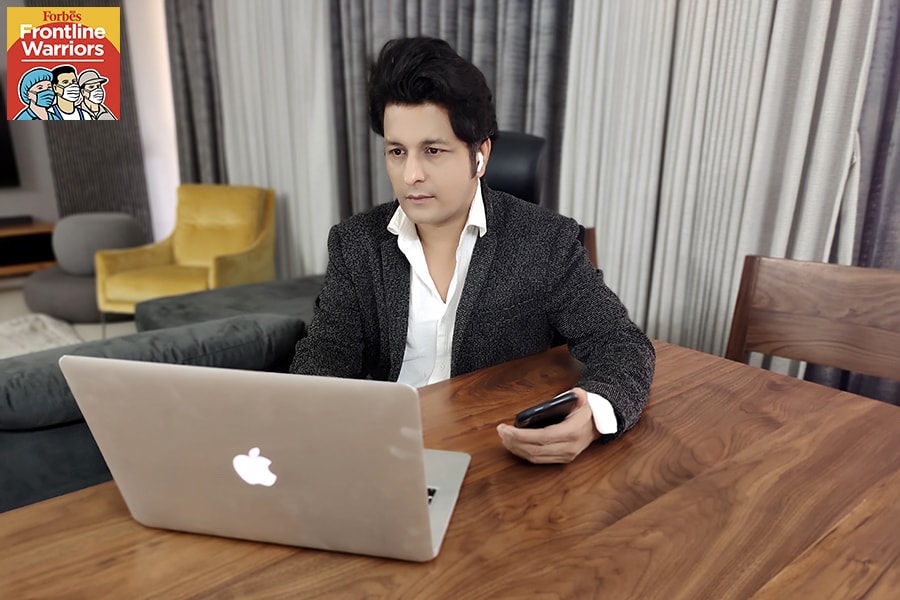

Dealing with death and financial mess? This CA will help you free of cost

With a surge of deaths during the second Covid wave, Rishabh Parakh is helping a number of families sort out complex paperwork

In April, Rishabh Parakh was contacted by a woman who had lost her husband to cancer. Along with the intense grief, she also found herself having to handle complex financial matters. Worried, she contacted Parakh, a chartered accountant, to help her out with the lengthy procedure. It was then that Parakh realised the plight of thousands of families, especially during this pandemic, who have to be hard-nosed enough to secure their futures while, simultaneously, going through personal tragedies. The 39-year-old launched ‘AskRishabh' on YouTube and ‘Mission Care’ on WhatsApp to help these families sort out their financial tangles free of cost.

Another incident also acted as a trigger for Parekh to understand the multi-pronged dilemma that these families are facing. “Recently, my oldest client passed away. He came to visit me a month and a half ago and shared his happiness with my progress. I just got a phone call informing me of his demise; I couldn’t even meet him one last time. His son was in Dubai, unable to handle most proceedings from there, so I am currently helping the family through paperwork,” he says.

“During the first wave, the number of Covid-19 deaths were just statistics. In the second wave, they are known faces. This hit me hard,” Parakh further says. “Then, I started wondering about the children who lost their parents. Not only is it a massive emotional trauma, but most family members don’t understand or are even aware of financial investments. In India, people don’t discuss money with family.”

One of the reasons why financial matters post-mortem are an issue is because wills as a concept are primarily for the ‘super rich’, feels Parakh. “If there is one, it’s smooth sailing. But 95 percent of people don’t have it,” he says. “Worse yet, for most, the nominations are missing. Without nominations, children need to procure a legal heir succession certificate and carry out other legal necessities. People who are already dealing with the loss of a loved one have to run from pillar to post.”

Therefore, Parakh and team decided to step in with the objective of handling the transition and transfer of assets in an easy manner, saving families precious time and stress. They help people get things done in time, which is important because there is a timeline to follow when it comes to life insurance, health insurance claims or the transfer of employment benefits.