With India's biggest IPO in the rearview mirror, Mankind Pharma sets eyes on new ambition

In May this year, Rajeev and Ramesh Juneja's Mankind Pharma became India's biggest IPO by value. From building the company ground up, Mankind Pharma—which is No 4 in revenue and No 3 in volume terms—has a new target: breaking into the top 3 in sales terms

Brothers Ramesh (left) and Rajeev Juneja at Mankind Pharma’s headquarters in Delhi Image: Nishanth Radhakrishnan for Forbes Asia

Brothers Ramesh (left) and Rajeev Juneja at Mankind Pharma’s headquarters in Delhi Image: Nishanth Radhakrishnan for Forbes Asia

Rajeev Juneja recalls his first day in the pharmaceutical industry in 1984. He was 19 and had dropped out of college to work as a representative for the generic drugmaker that he had co-founded with his family. His older brother Ramesh’s instructions were clear: Leave the house by 8.30 am and don’t come back before 10 pm. Rajeev was to network with staff at a medical college near the family home in Meerut, Uttar Pradesh. “For the first two days, I didn’t have the courage to meet any doctor,” he says. His confidence slowly improved and he started shadowing other reps to see how they interacted with doctors and presented promotional materials.

Fast forward to 2023 and Ramesh, 68, is chairman and Rajeev, 58, is vice chairman and managing director of Delhi-based Mankind Pharma. In May, they staged the biggest IPO of the year so far, by value, according to Delhi-based Prime Database, which tracks IPOs, when Mankind debuted on the BSE (formerly Bombay Stock Exchange) and the National Stock Exchange, fetching ₹43.3 billion ($715 million) for its existing shareholders, including the Junejas, who sold some of their stock. Mankind’s shares have surged 62 percent since then to trade at more than ₹1,700 for a market cap of over ₹700 billion (as of late September). Ramesh, Rajeev and other family members own the bulk of the company. Their wealth has soared 64 percent to $6.9 billion over the past year, thanks partly to the listing, putting them at No 29 on the 2023 Forbes India Rich List.

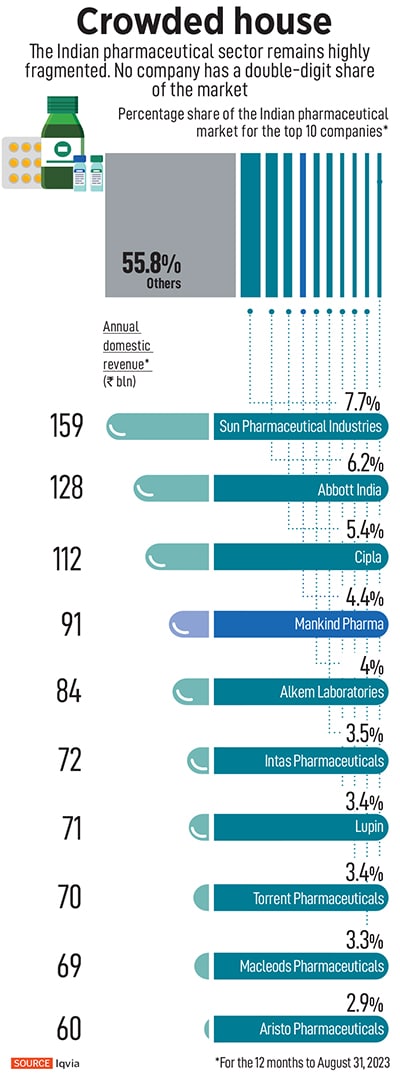

Investor confidence in the company’s prospects is due in no small measure to the brothers’ goal to break into the ranks of the top three pharmaceutical companies (by domestic sales) in India. Today, the three largest are local firm Sun Pharmaceutical Industries, founded by billionaire Dilip Shanghvi, followed by AbbottIndia, a subsidiary of US-based Abbott Laboratories, and then another domestic firm, Cipla, controlled by billionaire Yusuf Hamied. (Torrent Pharmaceuticals, the No 8 player, owned by billionaire siblings Sudhir and Samir Mehta, is reportedly in talks with private equity firms to make a bid for Cipla; neither firm responded to requests for comment.)

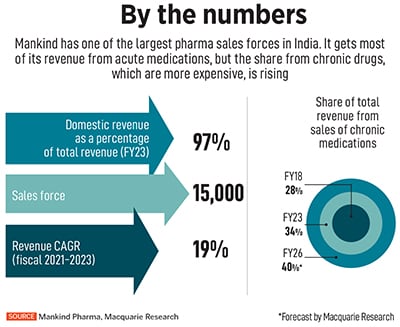

Today, Mankind ranks No 4 in revenue in the domestic market for branded generic drugs and No 3 in volume terms, according to US analytics firm Iqvia. Branded generics, or off-patent medications that are sold under a proprietary name, accounted for 96 percent of the Indian pharma market in value terms in the year to March 31, 2022, Iqvia says. With more than $1 billion in annual revenue and a 15,000-strong sales force, the Juneja brothers are mapping a plan to take on the top three.

Today, Mankind ranks No 4 in revenue in the domestic market for branded generic drugs and No 3 in volume terms, according to US analytics firm Iqvia. Branded generics, or off-patent medications that are sold under a proprietary name, accounted for 96 percent of the Indian pharma market in value terms in the year to March 31, 2022, Iqvia says. With more than $1 billion in annual revenue and a 15,000-strong sales force, the Juneja brothers are mapping a plan to take on the top three.

“It will be a tall claim to say that we want to be the No 1 pharma company in India,” says Ramesh in a July interview alongside Rajeev at the company’s headquarters in an industrial area of Delhi. “But we can definitely achieve No 3 or No 2 in the next few years,” he predicts, while declining to give a revenue target.

A Mankind Pharma research centre in Gurugram

A Mankind Pharma research centre in Gurugram Ramesh says the other big growth driver will be the consumer health care business, which boasts four over-the-counter products that the company says are No 1 (by sales) in the markets for condoms, pregnancy tests, acne treatments and emergency contraception. “Consumer brands make up only 8 percent of our business, but they give us so much brand recognition,” says Rajeev. “But this is a tough space,” he adds. “Ninety percent of brands fail.” He declined to give a forecast for the division, but Macquarie Research says its revenues are growing at a 10 to 11 percent CAGR.

Ramesh says the other big growth driver will be the consumer health care business, which boasts four over-the-counter products that the company says are No 1 (by sales) in the markets for condoms, pregnancy tests, acne treatments and emergency contraception. “Consumer brands make up only 8 percent of our business, but they give us so much brand recognition,” says Rajeev. “But this is a tough space,” he adds. “Ninety percent of brands fail.” He declined to give a forecast for the division, but Macquarie Research says its revenues are growing at a 10 to 11 percent CAGR.