What will it take for MG, Kia Motors to make it big in India?

Amid India's worst automobile slowdown, two new entrants are zooming fast and furious. Can they sustain the success after the initial rush?

“We entered India with exhaustive market and customer research. This has helped us plan our product and services better.”

“We entered India with exhaustive market and customer research. This has helped us plan our product and services better.” Kookhyun Shim, managing director and CEO, Kia Motors India

Image: Nishant Ratnakar for Forbes India

Kunal Doshi, 25, an importer and national distributor of nuts and bolts, booked the Kia Seltos GTX Plus 7 DCT in July 2019 and received the car in November. “The car has a bold style, good engine and performance, is comfortable like premium cars, and is loaded with tonnes of features that no other car in its category has,” says Doshi.

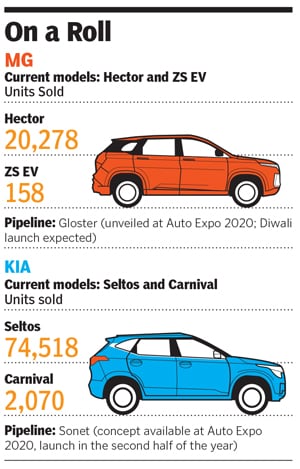

Doshi’s vote of confidence in the Hyundai-owned Kia Motors, South Korea’s second-largest automobile manufacturer, is an exception in an otherwise downcast auto sector that is reeling under its worst slowdown since July 2018. Kia, which entered the Indian market in August 2019 with Seltos, a mid-sized SUV manufactured at their Anantapur plant in Andhra Pradesh, has since delivered 75,000 units, 32,000 of which were booked before its launch.

Not only has Seltos established Kia among the top five manufacturers in India, it has also become the highest-selling SUV in the country since its launch. The success of the Seltos managed to create enough buzz for the launch of Kia’s second, luxury multipurpose vehicle (MPV) Carnival, at Auto Expo 2020. The seven-seater, along with Seltos, led to “record-high” sales of 15,644 units for Kia in February.

Kia emerged third beating market leaders and established automobile players like Tata Motors and Mahindra & Mahindra for the month of February 2020. With a 6.24 percent marketshare, Kia followed Maruti Suzuki and Hyundai Motors with 53.33 and 15.96 percent market share respectively.

Another international car maker that has begun its India journey with a bang, thereby bucking the trend in the country, is Chinese-owned British automaker Morris Garages (MG). MG set up its India subsidiary MG Motor India in 2017 in Gujarat’s Halol. The company, which launched Hector in June 2019 in India, has received over 50,000 bookings and 22,000 cars have already been delivered, averaging about 2,000 retailed vehicles a month. The numbers come at a time when the overall sales of vehicles, including passenger vehicles, saw a 13.77 percent decline in 2019, at 2,30,73,438 units, falling from 2,67,58,787 units in 2018. This is said to be the steepest decline since the Society of Indian Automobile Manufacturers (SIAM) started maintaining the sales records in 1997.

MG has also invested heavily in its two flagship stores in Delhi and Mumbai to provide a seamless retail experience to customers. The two stores house a café, an LED video wall that runs the company’s brand videos, and are decked up with British-themed props like the Union Jack, the Big Ben and iconic London phone booths. The Delhi outlet also has a 1956 MG Midget to reflect its heritage.

Kia too has tied up with telecom services provider Vodafone Idea to set up internet connectivity in a vehicle through a smartphone app. Christened UVO Connect, it enables features like remote locking, navigation and switching the engine on and off, among others, through the app.

Another reason for Kia’s success is the market research done by Hyundai, its parent company. “We entered India with exhaustive market and customer research and we identified the unmet needs of the customers here. This has helped us plan our product and services better. Seeing the response, we can say our research was right on point,” says Kookhyun Shim, managing director and CEO of Kia Motors India. The company has invested $1.1 billion in its manufacturing plant in Andhra Pradesh that has a production capacity of 300,000 units per annum.

With the second largest market share in India, analysts agree that Hyundai’s research and results pushed Kia to further succeed in the Indian market. “Kia is close to Hyundai, and Hyundai has [globally] established itself as a passenger vehicle brand,” says Mitul Shah, vice-president, research, Reliance Securities. “The numbers for Seltos have continued to improve in the last six to eight months. Even when the numbers have become slightly lower [in December, when the car makers typically cut down production as buyers prefer newer units in a new year], Kia performed reasonably well selling 4,645 units.”

While MG has left no stone unturned to provide a technologically advanced product for the Indian market, its product assurance also stood out. “We have packaged the entire product under a scheme called MG Shield, where even the cost of ownership is going to be reasonable,” says Chaba. With MG Shield, the company assures customers a buyback price of minimum 60 percent after three years apart from providing various after-sales services and warranty.

Kia, too, is focussed on after-sales service. When the horn in Doshi’s car malfunctioned, it was promptly replaced in the first service, he says.

Both Seltos and Hector gain with competitive pricing, starting at ₹9.89 lakh and ₹12.74 lakh (ex-showroom) respectively. It gives the two brands an edge in India’s price-sensitive market against vehicles like Jeep Compass and Mahindra XUV500, which start at ₹16.49 lakh and ₹12.31 lakh respectively. While Hyundai Creta and Maruti Suzuki Vitara Brezza come cheaper, at ₹9.99 lakh and ₹7.34 lakh respectively, Seltos and Hector score higher over these two brands with their sophisticated technology offerings.

Says Shim of Kia: “The success of both Seltos and Carnival is proof that the love between Indian consumers and good cars hasn’t faded away despite the slump in the industry.”

“Our product offering, customer experience, product assurance, all had to be different, and we had to connect the whole thing back to technology.”

“Our product offering, customer experience, product assurance, all had to be different, and we had to connect the whole thing back to technology.” Rajeev Chaba, president and managing director, MG Motor India

Image: Amit Verma

While both MG and Kia started off well in India, recent global factors have dampened their initial euphoria. Hector’s sales have pared down a bit in February, for instance. The company sold 1,218 units, a dip from their average of over 2,000 units sold per month. Says Shah of Reliance Securities: “The initial response for any product is high and it slowly goes down in most of the cases.” One of the cars caught fire on the road in Delhi and brought bad press for MG, while Kia is said to have been facing problems with the availability of spare parts and quality service in India. Forbes India could not independently verify this claim.

Add to that the raging Covid-19 pandemic in China and Europe that might disrupt the supply chains for both these companies, as it has for their Indian counterparts. While China is on a recovery trajectory, the epicentre of the pandemic has moved to Europe, where multiple cities have gone under lockdown and the economy is expected to wobble for several months now. Says Chaba: “We have a global supply chain, where some components come to India through both Europe and China. If the coronavirus continues to wreak havoc in Europe, our supply chain will be affected. But China is recovering and we should be back in action within three to four weeks.”

For Kia, which sold 15,644 units in February, Covid-19 hasn’t yet impacted their production. “But we are keeping a watch on the development to gauge future impact,” says a spokesperson.

Some auto experts attribute the falling vehicle sales in India to the introduction of the stringent BS VI emission norms from April 1 as well as the government’s push for electric vehicles (EVs), auto’s new ‘sunshine sector’.

“ These companies are more similar to Maruti in terms of product range and understanding the consumer compared to a few other MNCs.”

Mitul Shah, vice-president, research, Reliance Securities

MG’s BS IV inventory was close to zero at the time of Forbes India’s interaction with the company. They claimed to have their petrol BS VI available in the market and the diesel BS VI was expected to go on sale later in March.

Kia, right from the launch of Seltos in August 2019 to the more recent launch of Carnival, has complied with BS VI norms in both the petrol and diesel variants.

But MG has caught on to the EV wave pretty early by launching the ZS EV in January across five cities. “When we had just announced the booking and not even the price, we got an overwhelming response. ZS EV has the same connected technology as Hector,” says Chaba. ZS EV has seen over 3,000 bookings in India with 158 units being sold in February; it has a waitlist of almost nine months.

Kia has a thriving presence in the global EV market with cars like Niro and Soul, but it does not plan to launch the products in India yet.

The company claims that its Anantapur plant, with a production capacity of 300,000 a year that it plans to fully utilise by 2022 to be among the top three manufacturers in India, is fully equipped to manufacture EVs. “But,” says Shim, “India needs some more time for EV adoption as there are many aspects like infrastructure, tax incentives and consumer awareness, which play a crucial role in making this transition a success. EVs are not a focus currently for Kia Motors India.”

Once the initial high wears off, how do the two companies plan to hold on to the momentum? By going into overdrive mode to launch new products.

MG wants to launch at least one product every year, with Gloster during Diwali and another in the first quarter of 2021. It is also looking at expanding production at its Halol plant by 2021, up to 100,000 units from its current 80,000.

Kia is eyeing a launch every six to nine months, starting with a compact SUV, Sonet, in the second half of the year.

Says Shah of Reliance Securities, “Kia’s Sonet will compete with cars like Maruti Brezza and Mahindra XUV300. That is a category people have recently shifted to from sedans. That product is likely to impact the market share of all the other products.”

Adds Shah: “The success of Kia in countries like Korea and a few others, in terms of affordability and a few other parameters, is similar to the Indian market. So they would best understand the Indian consumer compared to other companies like Volkswagen.” Both MG and Kia also have deep enough pockets to invest heavily in the Indian market in terms of marketing and brand building, usually a challenge for new entrants.

India has seen companies like Renault and Volkswagen launch cars like Duster and Vento, respectively, with a bang, only to have them fade out. Could MG and Kia also go the same route? It’s too early to predict, but they seem to hold the potential to go the other way. Shah says, “Anything can happen, but it seems like these companies are more similar to Maruti in terms of product range and understanding the consumer compared to Renault and Volkswagen. The latter are present in countries where the products are slightly premium compared to India’s, that’s the reason they were not successful in India.”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)