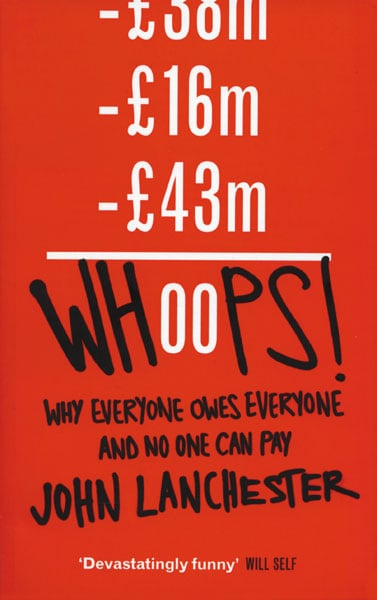

Whoops! Why Everyone Owes Everyone and No One Can Pay

The book has a nice and easy explanation of the banking system, which was the epicentre of the crisis

John Lanchester is a good writer but he is a bit late at the party. The financial crisis is all but over, never mind the Greek debt problem and Spanish troubles. The list of books that seek to explain the crisis too is now pretty impressive. Robert Shiller’s The Subprime Solution offers a great explanation of how the subprime mortgages bought down the world economy. Andrew Sorkin’s Too Big to Fail gives a highly detailed account of what the lead characters of the financial crisis drama were doing as the crisis unfolded. Lawrence McDonald’s A Colossal Failure of Common Sense gives an inside account of how Lehman — the proverbial last straw — went down. Michael Lewis, writer extraordinaire, also has two nice books Panic, which is a collection of articles that cover the crisis, and now The Big Short. Don’t forget another super book, The Greatest Trade Ever, written by Gregory Zuckerman, on John Paulson’s hedge fund, which actually bet against mortgage companies and made huge money for themselves as the crisis unfolded.

So why read Whoops?

The one thing in its favour is that it is written with humour and simplicity.

If you haven’t read any of the books mentioned above then this is a pretty good starting point. The book has a nice and easy explanation of the banking system, which was the epicentre of the crisis. Lanchester differentiates between asset and credit bubbles in a neat way.

Take his explanation of why banks turn insolvent: “…during previous busts in the property market. When that happens you just wait…the trouble is that banks are not households. If banks sit on their hands and wait for valuations to recover, the economy grinds to a halt…that’s the situation in which banks are insolvent but stay in business as a “zombie bank” which are allowed to trade by an overindulgent government.” He then moves on to explain the role played by derivatives in ‘management’ of risk and in spreading the contagion.

Lanchester weaves in a chapter on the ‘Quants’, the guys who do the entire tough math to put the world through some really tough times. Here is Lanchester’s own equation to describe the AIG bailout. AIG+CDS+CDO+TBTF=$173,000,000,000!

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)