Will state election results reprice risks, give wings to stock markets?

By Nasrin Sultana| Dec 5, 2023

State election outcomes can differ greatly from national elections. So, is the exuberance in the markets rational or misplaced?

[CAPTION]Bhartiya Janta Party (BJP) workers and supporters celebrate the victory of Madhya Pradesh, Rajasthan, Chhattisgarh assembly state elections outside BJP headquarter, on December 3, 2023 in New Delhi, India.

Image: Salman Ali/Hindustan Times via Getty Images [/CAPTION]

[CAPTION]Bhartiya Janta Party (BJP) workers and supporters celebrate the victory of Madhya Pradesh, Rajasthan, Chhattisgarh assembly state elections outside BJP headquarter, on December 3, 2023 in New Delhi, India.

Image: Salman Ali/Hindustan Times via Getty Images [/CAPTION]

Nothing works as much magic for stock markets’ exuberance as the playing out of a highly anticipated event just as expected. The reverse too, holds good. The state election results—the Bharatiya Janta Party (BJP) has won three large states—are likely to provide that adrenaline rush to markets, setting the stage for the general election next year.

_RSS_The results may boost the stock markets’ confidence in multiple ways. First, abate political risks for the next five months; second, increase expectations of political continuity in 2024 to bolster sentiments; third, reduce risks or chances of government policies turning populist next year.

However, Rahul Bajoria, MD and head of EM Asia (ex-China) Economics, Barclays feels that the results may add to the perception of political stability in the medium term, but state election outcomes can differ greatly from national elections. He agrees, although, that the state election results are an early boost for BJP. Elections in five states are the last state polls before the 18th general election in 2024, which will determine whether Prime Minister Narendra Modi's BJP gets to serve a third consecutive term. “BJP’s win speaks to Modi’s continued mass appeal, but also reflects the popularity of state-level leaders, the poor showing of the Congress and the ongoing trend of competitive populism,” say Sonal Varma and Aurodeep Nandi, economists, Nomura.

Elections in five states are the last state polls before the 18th general election in 2024, which will determine whether Prime Minister Narendra Modi's BJP gets to serve a third consecutive term. “BJP’s win speaks to Modi’s continued mass appeal, but also reflects the popularity of state-level leaders, the poor showing of the Congress and the ongoing trend of competitive populism,” say Sonal Varma and Aurodeep Nandi, economists, Nomura.

Of the five state election results, the ruling BJP has outpaced its national rival, the Indian National Congress (INC), in three big states (Madhya Pradesh, Rajasthan and Chhattisgarh). Five states held polls in November: The bellwether Hindi heartland states of Madhya Pradesh, Rajasthan, Chhattisgarh, the southern state of Telangana, and the smaller northeastern state of Mizoram. Among these MP, Rajasthan and Chhattisgarh are bipolar contests between BJP and Congress.

The victory validates Modi’s popularity, since he was a prominent figure in all the election campaigns, explains Kapil Gupta, chief economist, Edelweiss Financial Services. These states are in the Hindi heartland; hence, the wins are likely to have a positive rub-off on other states such as Uttar Pradesh and Bihar, he adds.

The elections in these states were keenly watched by market investors, as the results would be considered as indications of the nation’s political pulse. These states cumulatively account for 17 percent of India's population, 15 percent of its gross domestic product (GDP), and 14 percent of seats (82 out of 543) in the Lok Sabha.

The results, branded as a semi-final to the upcoming Lok Sabha elections in May 2024, will provide comfort to the markets as far as political stability is concerned, says Gautam Duggad, head of research, institutional equities, Motilal Oswal Financial Services. The incumbent BJP’s performance in avoiding anti-incumbency and retaining a big state like MP (fifth consecutive term) while managing to regain Rajasthan and Chhattisgarh should provide them with a good tailwind for the 2024 general election.

“Equity markets were justifiably anxious about the outcome of the state polls and what they portend for the 2024 general elections. With the outcome overwhelmingly in favour of the incumbent BJP, the confidence of the market in the current dispensation and political continuity post 2024 Lok Sabha elections will get a boost. This augurs well for macro and policy momentum for India, which, at the moment, is seeing the highest growth among major economies,” Duggad explains. He expects markets’ sentiment to strengthen further and the prospect of a pre-election rally is quite strong now. Following severe volatility, the markets gained over 5 percent in November, with the benchmark index Nifty rising over 11 percent this year. Midcaps and smallcaps outperformed by gaining 5 to 6.5 percent in November; they have surged 36 to 46 percent since January.

Following severe volatility, the markets gained over 5 percent in November, with the benchmark index Nifty rising over 11 percent this year. Midcaps and smallcaps outperformed by gaining 5 to 6.5 percent in November; they have surged 36 to 46 percent since January.

Also read: Oil or bond yields—what spooked Indian stock markets

According to Pranav Haridasan, MD and CEO, Axis Securities, the state election results remove a significant short-term overhang from the markets, and believes that the near-term markets are likely to see strong interest, led by a rebound in industrial growth and a benign interest rate trajectory. “In the medium term, critical market risks remain higher than historical valuation levels and potential global slowdowns, especially in the US, China, and Europe,” he adds.

With expectations of the US Federal Reserve pausing interest rate hike cycles, foreign institutional investors (FIIs) seemed to have returned to Indian equities once again. FIIs turned buyers of Indian stocks worth $2.3 billion in November, after selling for the previous two months. Domestic institutional investors (DIIs), which include mutual funds, insurance companies and banks, pumped $1.7 billion into equities last month, following an inflow of $3.4 billion in October. In 2023, FIIs have poured $14.4 billion into Indian stocks while DIIs injected $20.8 billion.

“These election results are certainly a cut above market expectations. And markets, to that extent, shall cheer the outcome in the near term in our view. That said, eventually, fundamentals—earnings, liquidity and interest rates—shall have an upper hand in shaping the market outlook over medium term,” Gupta adds.

Also read: Gush of hot foreign money set to strike Indian stocks

How influential are election results?

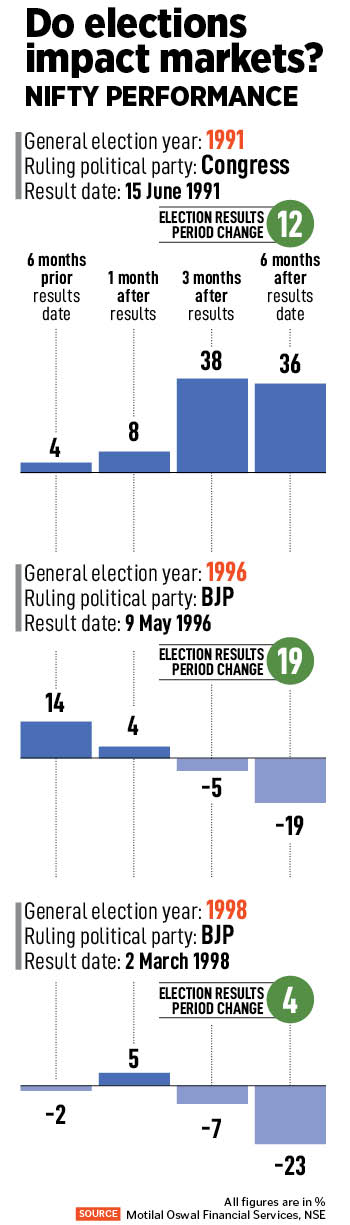

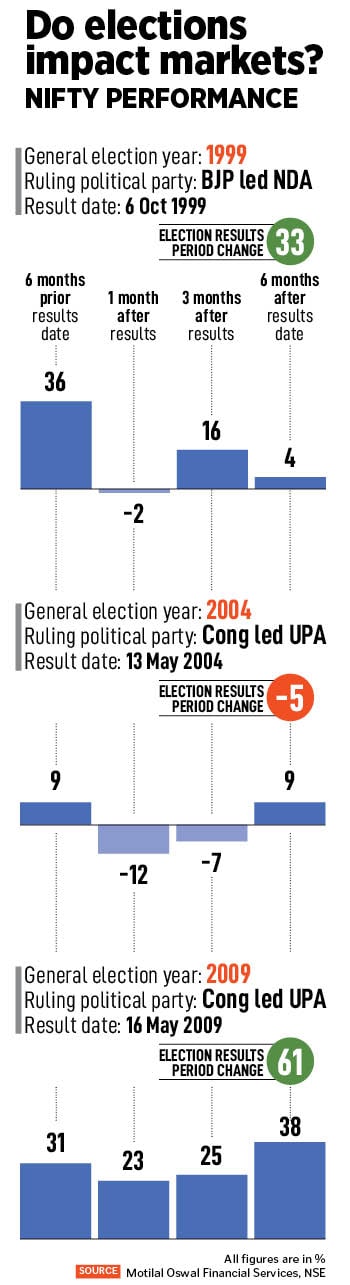

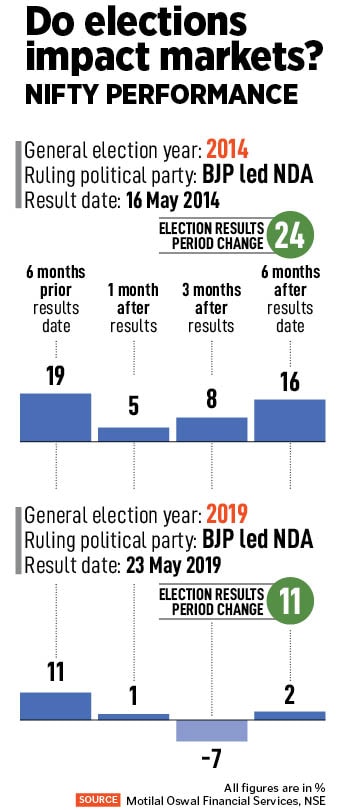

Historically, state election results have shown little or no consequence on the general elections. For instance, in December 2018, BJP was defeated in three states but went ahead to win the Lok Sabha elections in 2019, and with a better majority than 2014.According to an analysis by Motilal Oswal Financial Services, the 50-share index Nifty has surged (9 to 36 percent) six months into the announcement of general election results on five previous such occasions between 1999 and 2019. The six-month period considered for the analysis are November to May.

For general elections between 1991 and 2019, the Nifty rose eight out of nine times. In one of the biggest rallies in the six-months prior to results, the Nifty surged 36 percent in 1999, when the BJP-led NDA formed the government, while in 2009, the Nifty gained 31 percent when the Congress-led UPA came to power.

However, markets have remained low in the one-month period after general election results. Starting 1991, the Nifty has fallen 2 to 12 percent in two of eight occasions. Barring the 23 percent gains of the Nifty in 2009, in all other times the Nifty has seen single-digit returns in the one-month period after general election results were announced.

Varma and Nandi explain that voters have been known to vote differently in general and state elections, with local issues being more relevant in the latter. Also, general elections are still some time away (expected around April-May 2024), and a lot can change in the political landscape by then. Political parties will now train their focus on their national strategies.

Also read: Equity markets may stay difficult around the world: Manraj Sekhon

How does politics impact economy?

As policy stability remains key to keeping foreign and domestic corporate sector confidence buoyant, Chetan Ahya, chief Asia economist, Morgan Stanley, believes that a stable, majority government will be able to continue to push through policy reforms, in order to sustain the shift in boosting private investment. “This naturally turns the attention to the upcoming general elections in May 2024. In our view, the key risk would be the emergence of a weak coalition government, which could result in a pivot back to redistributive policies at the expense of the focus on boosting capex and implementing supply-side reforms,” he elaborates.

“This naturally turns the attention to the upcoming general elections in May 2024. In our view, the key risk would be the emergence of a weak coalition government, which could result in a pivot back to redistributive policies at the expense of the focus on boosting capex and implementing supply-side reforms,” he elaborates.At least four other states are likely to hold elections at the same time as the national elections. These are Andhra Pradesh, Arunachal Pradesh, Odisha and Sikkim.

Considering the differing voting motivations for state and national elections, as well as the different issues that influence the two, Bajoria thinks the recent five state election results are unlikely to lead to the announcement of any major reforms or schemes that could materially alter the government's fiscal position. “A few announcements around the extension of the free food distribution scheme, the moderation in global energy prices and increase in cooking gas subsidies, and targeted schemes for vulnerable groups are unlikely to stress medium-term fiscal dynamics, which are anchored by strong economic growth, relatively high inflation, and significant tax buoyancy,” Bajaoria adds.

Key issues in the general elections are likely to be persistent inflation, particularly swings in food prices, demands for a caste census, temptations for a tilt towards fiscal populism with some state governments opting to go back to a previous pension system, and cultural issues.

Varma and Nandi feel that competitive populism will remain a theme for the 2024 general elections. “Investors were worried that a poor showing by BJP in state elections would increase the risk of more fiscal populism. As such, the actual results should calm such fears, although a BJP victory across most states does not necessarily reduce the likelihood of competitive populism recurring as a dominant theme in the 2024 general elections,” they explain.