Hinduja brothers, still in arms and lock-step, have eyes on the future

By Manu Balachandran| Nov 9, 2023

The demise of Srichand Hinduja, the eldest brother and the patriarch of the Hindujas, and the subsequent court tussle over property with his heirs haven't shaken the foundation of the storied family and its businesses, say the brothers

[CAPTION]

(From left) Brothers Prakash, Gopichand and Ashok Hinduja are now laying the groundwork for a conglomerate for the next century

Image: KT Watson[/CAPTION]

[CAPTION]

(From left) Brothers Prakash, Gopichand and Ashok Hinduja are now laying the groundwork for a conglomerate for the next century

Image: KT Watson[/CAPTION]

Gopichand Hinduja has a piercing gaze, the kind where he’s often the last to blink.

It’s possibly the handiwork of decades of facing adversities, gruelling negotiations, and countless acquisitions as he and his brothers kept hammering away to build a family business spread across continents. Hobnobbing with powerful politicians and rulers, the brothers built the Hinduja Group into a transnational conglomerate over the past century with business spread across sectors such as automobiles, banking, healthcare, and real estate, employing over 200,000 people.

_RSS_The Hinduja family, of which Gopichand is now the patriarch after elder brother Srichand (or SP)’s demise this year, is worth a staggering $20 billion although admittedly less than what he himself estimates to be their real worth. “We don’t believe in it,” says Gopichand, or GP, as he is popularly known. “Because that’s not the reality. They take listed companies, what happens to the private sector?”

According to the Forbes India Rich List, the Hinduja family is ranked seventh, with their wealth swelling from $12.7 billion to $20 billion in 2023. That’s the highest in a decade for the family. “We are least concerned,” adds Gopichand, a warm and affable octogenarian.

“On the contrary, we see how it can be avoided because the family wants freedom of life so that they can walk and enjoy their life. Otherwise, you will have to carry a few security guards along with you,” says Ashok, Gopichand’s youngest brother.

Family, and walking, are pivotal to the group and its success for decades. It’s on their routine morning walk at St James Park in London that the brothers, particularly Gopichand and Srichand, ideated and even met with potential suitors to strike up deals. Take for instance the acquisition of Winston Churchill’s Old War Office (OWO) in 2014 that the Hinduja family converted into a swanky hotel and private residences in September this year.

The brothers decided to join the fray at the last minute, a decision taken during one of their morning walks. There were seven competitors already, including those from Qatar, and Saudi Arabia, and the Hindujas submitted the last bid. By December of that year, they mopped up the iconic building, situated close to 10 Downing Street and Trafalgar Square, for £350 million. The family, led by Gopichand’s son Sanjay and daughter-in-law Shalini (wife of his other son Dheeraj), spent another £1 billion renovating it and now sells the private residences from between £4 million and £18.5 million.

The brothers decided to join the fray at the last minute, a decision taken during one of their morning walks. There were seven competitors already, including those from Qatar, and Saudi Arabia, and the Hindujas submitted the last bid. By December of that year, they mopped up the iconic building, situated close to 10 Downing Street and Trafalgar Square, for £350 million. The family, led by Gopichand’s son Sanjay and daughter-in-law Shalini (wife of his other son Dheeraj), spent another £1 billion renovating it and now sells the private residences from between £4 million and £18.5 million.

But it’s the family that has seen turmoil in recent times with its fair share of drama, and the public washing of dirty linen. Once a close-knit family, the Hindujas, with nearly 40 members, have been a divided house with the heirs of Srichand taking the remaining brothers to court over dividing the family wealth.

For a century, the brothers had worked around a principle laid out by their late father, which said everything belongs to everybody and nothing belongs to nobody. “We have a common concept, and that cannot change,” says Ashok. “You see when one individual gets into a medical problem and their children take charge, the problem comes.”

Srichand passed away earlier this year, after years of struggle with dementia, something Gopichand is still to come to terms with. “Very much,” Gopichand told me, his hands shaking and voice choking, as he recalled his brother. “It’s a big loss,” he added before Ashok stepped in to console his elder brother. The brothers were inseparable, often comparing themselves to the four brothers of Ramayana, with one soul and different bodies.

Between them, the roles were always defined. SP was the man with the ideas, Ashok says, Gopichand, the implementer, Ashok the number cruncher, and Prakash the global networking in-charge. They also divided their responsibilities based on the regions. While Gopichand is the group chairman and lives in London, Prakash is the chairman of Hinduja Europe and Ashok oversees the Indian market.

This year, a family settlement seems to have put the divided house in order, but the tussle is far from finished. That was obvious at the Hinduja residence, in London, where the brothers and their heirs live across four interconnected houses, in what used to be King George IV’s family residence. While the three brothers and their heirs met journalists, Srichand’s daughters were notably missing. Srichand’s daughters and grandson had challenged a letter earlier signed by the four siblings that said assets held by one of them belonged to all.

“We believe in planets, and when the wrong planets come, some of the characters deviated from them. But when the right planet comes, they will come back,” Ashok says about the ongoing feud in the family. “Everything is moving well, and it will get resolved.”

Resolving issues is crucial, especially as the group now lays the groundwork for what it reckons will be a conglomerate for the next century, with a focus on areas such as renewable energy, technology, electric vehicles, battery infrastructure, and banking. “In our lifetime, whenever good opportunities come and if we find a good partner, we go ahead. If not, then we internally see, is it something which is good for our group or not?” Gopichand says.

Also read: Shamsheer Vayalil: Building the largest hospital network in the Gulf

Building from scratch

The Hinduja family, a stickler for traditions and religious beliefs, traces its roots to Shikarpur in Pakistan.Parmanand Hinduja, a young trader in 1914, packed his bags from Shikarpur in the Sindh province of Pakistan (then undivided India) to Mumbai in 1914 to become a moneylender, before venturing into importing and exporting dried fruit and tea to Iran. Soon, he diversified into jute and distributing Indian films, dubbed into Farsi. The brothers joined the business one by one from 1952 onwards after completing their education. They also had an elder brother, Girdhar, who passed away in 1962.

Over the next few decades, Iran became the group’s base and was deeply trusted by the administration, which had even tasked the group with procuring potatoes and onions from India, transiting them through Pakistan, as the oil-rich nation went through a food shortage.

Over the next few decades, Iran became the group’s base and was deeply trusted by the administration, which had even tasked the group with procuring potatoes and onions from India, transiting them through Pakistan, as the oil-rich nation went through a food shortage. In 1971, Parmanand passed away, reportedly leaving behind some $1 million, and Srichand took over the reins. By 1979, the group had moved base from Iran, following the Iranian revolution, to London, where it continues to be headquartered. While the group continued to focus on trade, it also diversified into new frontiers, with the acquisition of Ashok Leyland, the truck manufacturer headquartered in Chennai, and Gulf Oil’s business outside of the US from Chevron.

The group also forayed into banking, with the launch of IndusInd bank, in addition to health care, real estate, and information technology. “We have always been driven by our five core philosophies,” says Ashok. “Work to give, word is bond, act local, think global, partnership for growth and advance fearlessly.”

The next phase

Now, almost 110 years old and missing its long-reigning patriarch, SP, the group under GP is readying itself for the next phase of transition.

That means taking risks, and diversifying into newer frontiers, even as it lays out plans to unlock value and wealth for shareholders. “One of the key thrusts is to ensure that all the businesses move in the digital age, and move with the right technologies,” says Dheeraj, Gopichand’s son and Ashok Leyland’s executive chairman. “We were in thermal power and we are moving very fast and growing the business in renewables. From an automotive side, we are moving into the electric vehicle side. With Gulf Oil, we are moving away from lubricants into charging.”

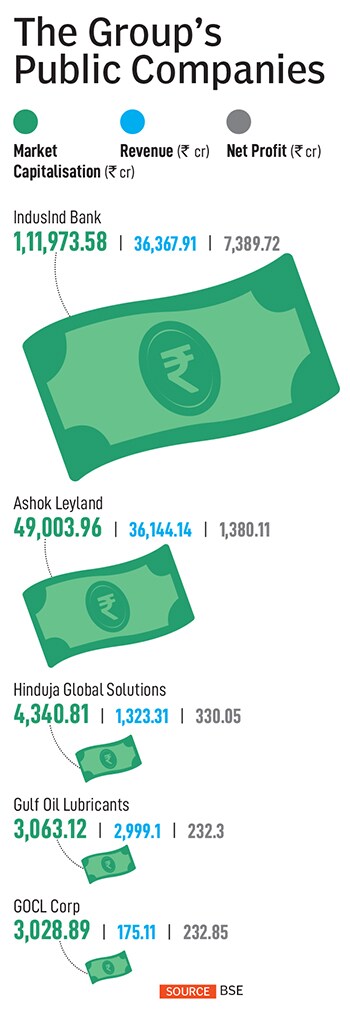

Last year, Ashok Leyland, which the Hinduja family bought in 1987, posted consolidated revenues of ₹41,672.60 crore. The company corners a little over 30 percent of the domestic medium and heavy commercial segment and has manufacturing facilities in nine countries including the UAE, Nigeria, and the UK, apart from India. Ashok Leyland is now firming up plans to foray into other South Asian countries, including the Philippines, Malaysia, and Indonesia.

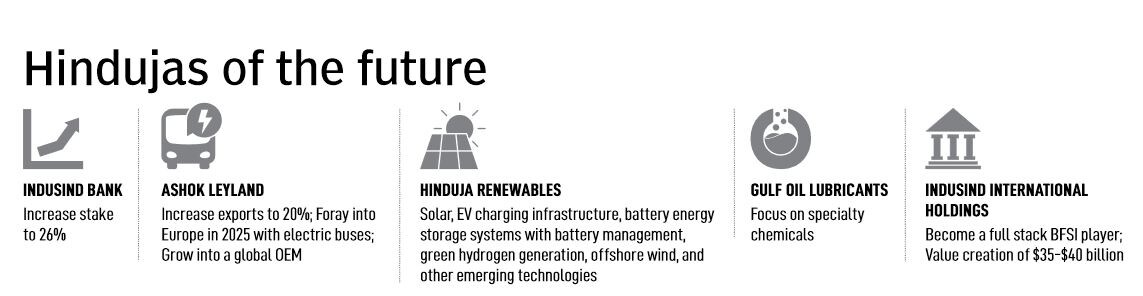

“So, I would say barring Europe, US, Japan, we are looking at all parts of the world and we will enter Europe with electric buses in 2025,” Dheeraj says. “At the moment, we do about 10-11 percent of exports and within the next five years, our target is to be over 20 percent. That’s also because the Indian market has substantial room for growth.” Already, the company is investing ₹1,000 crore towards setting up a plant in Uttar Pradesh.

But even then, the group has no intention to foray into passenger cars where electrification has been rocketing. “The competitive environment in passenger cars, including electric, is going to be far more fierce, and how we are positioned in Ashok Leyland and the opportunities I think it will give us, is much better rather than moving into a different area.”

At Gulf Oil, helmed by GP’s other son, Sanjay, the group is now ramping up its specialty chemical business after the completion of the merger between Quaker and Houghton, to form Quaker Houghton, a global leader in industrial process fluids. Through its subsidiary, Gulf Oil, the family is the largest shareholder in Quaker Houghton.

“We are looking at investments in downstream in India from a specialty chemical angle and we have just now inaugurated a new facility in Dahej for Quaker Houghton,” says Sanjay, the chairman of Gulf Oil. “As far as Gulf Oil is concerned, our first plant was in Silvasa and a second plant in Chennai. We’re now looking at maybe a third plant.”

Sanjay was also in charge of renovating the OWO with Shalini, Dheeraj’s wife, and reckons that the group could replicate OWO’s model when it comes to luxury offerings from the group. “If something luxury, iconic, and heritage comes up, whether in India or France or wherever, we will look at it,” Sanjay says. “It has to be something different, something unique, not just run-of-the-mill hotel. That’s not of our interest.”

Also read: K.P. Ramasamy: Playing the long game in garment exports

Down to the bank

Still, the big thrust over the next few years will be in the banking and financial services sector (BFSI) where the group is the largest shareholder in IndusInd Bank. The bank is India’s sixth largest by market capitalisation with over ₹36,000 in annual revenues.

IndusInd bank had begun operations in 1994, with the Hindujas now holding 16.47 percent of the company through IndusInd International Holdings Ltd, a Mauritius-based company. The family is currently in the process of raising its stake from 15 percent to 26 percent in the bank, with the Reserve Bank of India giving its approval. “We have already started to raise the capital,” Ashok says. “We will get a billion dollars to go into phases, and will be completed by November 15.” The Hinduja Group also owns Hinduja Leyland Finance and Hinduja Bank (Switzerland).

But it is the group’s acquisition of debt-ridden Reliance Capital, earlier promoted by Anil Ambani, that will help the Hindujas’ transformation into a full-stack BFSI player. That acquisition, led by IndusInd International Holdings Ltd, has been in the works for almost 15 years. The group had bid over ₹9,600 crore to acquire the company that has been undergoing insolvency proceedings. But the acquisition has been stuck since Ahmedabad-based Torrent Investment sought a stay on the takeover, something the group hopes to tide over this month.

“Once that is done, you have life insurance, general insurance, and health insurance under that,” Ashok says. “You have ARC, broking, and securities also under that. So that will cover part of it. What’s left out is mutual funds and wealth management. By the end of this financial year, we will cover 95 percent of the BFSI sector.”

The group is now looking to unlock value worth $35-40 billion in the BFSI sector in the next five to seven years, which will also mean acquisitions. “The first phase will start and the objective of the holding structure, which is Mauritius-based IndusInd International, is to grow into the BFSI sector to complete the full stack,” he said. The Hindujas will also list IndusInd International by mid-next year.

Diversifying growth

Automobiles and BFSI aside, the Hindujas are also readying their war chest to slug it out in new sectors that it had traditionally shied away from.

Of this, the group sees enormous opportunities across its renewable business, led by Ashok’s son, Shom, and a global wealth management subsidiary. Hinduja Renewables is already looking at investments into EV charging infrastructure, battery energy storage systems, green hydrogen generation and offshore wind.

In addition, the group is also betting on its technology platform, Hinduja Global Solutions (HGS), a media distribution and technology company with a focus on artificial intelligence, cloud computing, and generative AI. That also means more acquisitions in the years to come across its newer businesses. “When we target something, then irrespective of anything, it comes to us,” Ashok says. “We have seen this from Ashok Leyland onwards.”  [CAPTION]The Hinduja family acquired Winston Churchill’s Old War Office (OWO)in London in 2014 and converted into a swanky hotel and private residences[/CAPTION]

[CAPTION]The Hinduja family acquired Winston Churchill’s Old War Office (OWO)in London in 2014 and converted into a swanky hotel and private residences[/CAPTION]

Last year, HGS acquired the group’s arm NXT DIGITAL, which delivers television services through a dual delivery platform consisting of digital cable and the country’s only Headend-In-The-Sky (HITS) satellite platform. There’s also the global wealth advisory that the company has set up, which is into asset management.

“So we look for the opportunities where to invest,” Ashok says. “We have invested in a lot of startups and a lot of startups have proven very well.” That includes the likes of Pavegen, a startup that converts the kinetic energy of footsteps into electricity and data using specially-designed paving slabs, and Swiss company MindMaze, which specialises in using virtual reality for faster rehabilitation of patients with neurological disorders.

All that means the group is busy treading a slightly different path, especially with the younger generation now stepping in, and leading the foray into newer frontiers. The older generation, the brothers say, is taking a step back, and moving into a guiding role. That may be easier said than done. “Our eyes and ears are always open,” Ashok says. “Even when walking in the garden, relaxing on the beach, some ideas will come.”

In the process, while there may not be a clear-cut succession plan in place, the Hindujas are banking on their time-tested philosophy to carry forward the family legacy without any hiccups. “Our parents have given certain sanskars,” Ashok says. “We, in turn, have given them to our children. And within the family, out of 35-40, if one or two gets deviated, no problem, we’ll bring them back.”

But that doesn’t entirely mean that the family may not see a repeat of the recent troubles. “We cannot predict that,” Gopichand says without batting an eyelid. “But in our family, we love everyone. Unity is the real strength,” GP says as he slips into a Mohammad Rafi song. “Insaan bano, insaan bano, duniye se chale jaaoge, kya rah jayega? Ek naam rah jayega (be human, be human. If you leave this world, what will remain? A name). That’s why, keep in mind, we are all servers, none of us are going to survive,” he adds.