Why marrying ecology with economics is important for sustainable living

By CJ Meadows| Oct 3, 2023

We've traditionally left ecology out of our economics, economics out of our ecology, and local people out of both. Here's why we need to reintegrate them if species, environment, and people are to survive

[CAPTION]Nine Tiger reserves were established in 1973

Image: Sandipan Barddhaman/Shutterstock [/CAPTION]

[CAPTION]Nine Tiger reserves were established in 1973

Image: Sandipan Barddhaman/Shutterstock [/CAPTION]

- Dead tiger (2004): $24

- Live-tiger economic value (2017): $2.2 million/yr

When villagers set electric wire or poison traps for tigers, they're usually just trying to kill what they think is a dangerous pest after it's killed a farmer's ox—or worse, mauled a family member. Rural Indian farmers selling the carcass to a poacher could earn up to half their annual income.

How could they know its life-transforming economic power? Do we know?

_RSS_We've traditionally left ecology out of our economics, economics out of our ecology, and local people out of both. We need to reintegrate them if species, environment, and people are to survive.

How can we do that? A good example comes from the "Heritage Trees Case" in India, in which 356 80-plus-year-old trees were in danger of being cut down for new infrastructure. The Chief Justice commissioned a study led by Nishi Mukerji from The Tiger Center, an award-winning NPO. When they added oxygen production, climate change regulation, flooding protection, biofertilisers, micronutrients, and so on to traditional valuation, the results were surprising:

- Traditional valuation for policymakers: timber price

- New valuation: 911 X age in years

- Value of some heritage trees: 122,000 each

The trees were saved, new guidelines were established for economic analysis, infrastructure reuse (e.g. old railway lines, waterways, and so on), new technology (e.g. to move trees), and increased replanting.

What about "purely ecological" decisions? Project Tiger is a case in point. Nine reserves were established in 1973, and the program grew. When budgets had to be allocated, some asked, "Was it worth it?" Studies showed:

- Tiger conservation government spending (1973 – 2017): 180 million

- Annual benefits from 6 reserves (out of today's 54): 23 billion

- Reserve ROI: 35,600%

Also read: Protect India's tigers, it's good for climate: study

No, the ROI above is not a typo. The government has done well but has been under-allocating resources to a super-productive natural asset. When we treat reserves as natural assets, we find untapped potential:

- Kanha Nature Reserve benefits without ecotourism: 200 million

- Kanha Nature Reserve potential earnings: 3 – 7.6 billion

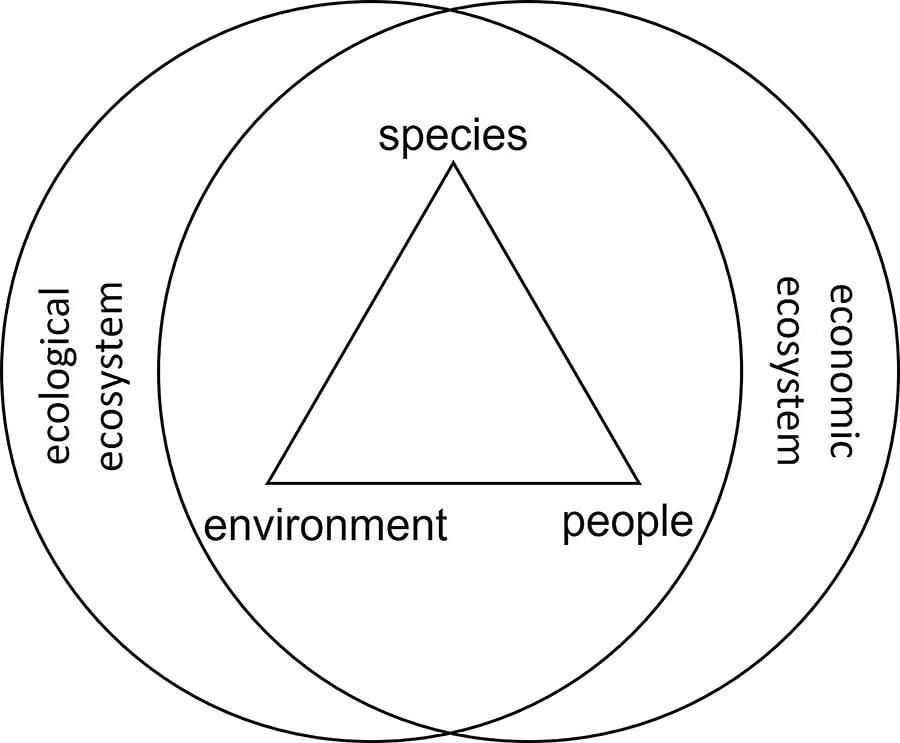

An inclusive model like "The Golden Triangle," first developed at The Tiger Center (TTC), is handy for decision-making. There is space on the fringe of economics and ecology where they do not interact, but most decisions by both affect the other.

What's worked well for TTC and a small handful of similar organisations is to leverage the value of local people as guardians of endangered species and the environment, working in harmony with official forces and technology. Economic opportunities arise because of species and environment, including ecotourism and initiatives like beekeeping, which help people stay out of the forest and out of harm's way. Healthcare, education, and other assistance are given by the organisation named for the species that needs protection.

Sariska Tiger Reserve's tigers were wiped out seemingly overnight, and every villager claimed to have seen and heard nothing. With indigenous traditions of living in harmony with the environment, an economic reason to protect it, and the benefits associated with it, TTC's community is fiercely protective.

Also read: Elephants are also your business if you are in the plantation industry in India

What can we all do?

Business leaders need to ensure their decisions are both economically and ecologically sound. Although we often think they're at odds, examples like green architecture show us it can be cheaper to green our office buildings and eliminate or use waste from our production systems. Get a "green consultant" if you haven't already.

ESG and CSR leaders need to integrate with Chief Strategy Officers and Chief Innovation Officers, probing for synergy. Economic disruption happens at the bottom of markets and beneath them (e.g. people who can't afford to enter the market). Who's closest in your organisation to Base of Pyramid consumers? Use ESG and CSR efforts for growth and innovation.

Policymakers need to set new standards, as in the Heritage Trees Case. Start with integrated studies for better decision-making.

Entrepreneurs and Investors are increasingly interested in "Impact Investing" and "ESG Entrepreneurship," yielding profits and ESG impact. For example, one of TTC's projects is fairly typical—more than 15 percent ROI, catalytic effect on the local economy, and expansion of programs as a global incubator. Look for opportunities to launch and invest. The world is full of them.

We believe the world can also be full of ecologically- and socially-sensitive economic decision-makers. And tigers.

- Extinct species value: 0

- Unliveable environment:0

- Economy on an uninhabitable planet: 0

- People, planet, and profit growing together: Priceless

The Tiger Center is fundraising for impact investment and can be found at tigercenter.org.

CJ Meadows, Prof. Director - Innovation and Entrepreneurship, SP Jain School of Global Management