Hindenburg report 'malicious', confident of growth plans: Gautam Adani

By Nasrin Sultana| Jul 18, 2023

Chairman and founder of Adani Group slams Hindenburg Research report as "deliberate and malicious attempt" at AGM, and stays confident of company's governance and disclosure standards

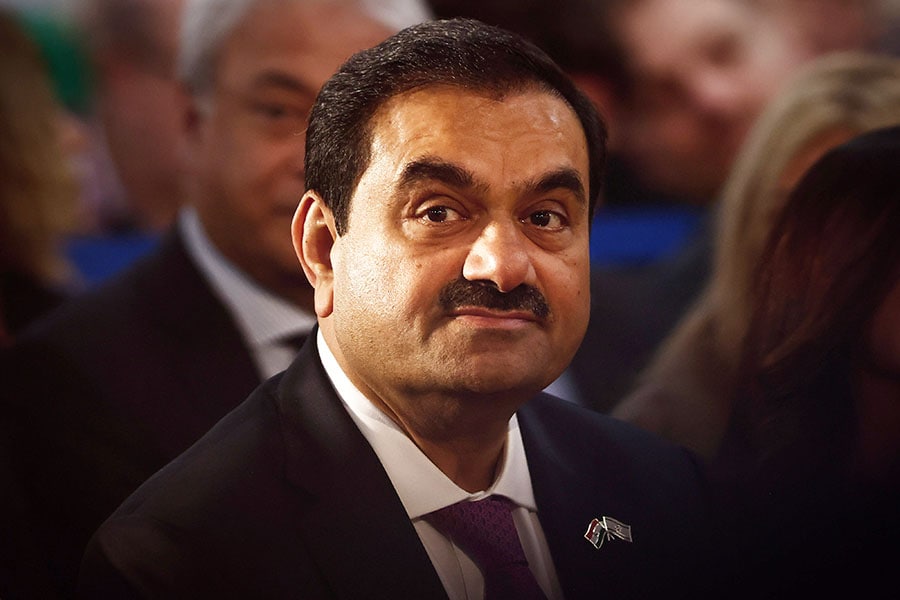

[CAPTION]Gautam Adani, chairman and founder of Adani group

Image: Kobi Wolf/Bloomberg via Getty Images[/CAPTION]

[CAPTION]Gautam Adani, chairman and founder of Adani group

Image: Kobi Wolf/Bloomberg via Getty Images[/CAPTION]

Gautam Adani, chairman and founder of Adani Group, remains unperturbed about the shock and jitters the companies experienced in the beginning of this year as an investigative report by US-based Hindenburg Research raised questions on its financial health.

He remains confident of the growth plans of his companies, even as stock prices of Adani Enterprises are yet to fully recover after a massive sell-off dragged them down nearly 70 percent. Slamming the Hindenburg report, Adani says it is a combination of “targeted misinformation and discredited allegations”, dating from 2004 to 2015. “They were all settled by the appropriate authorities at that time. This report was a deliberate and malicious attempt aimed at damaging our reputation and generating profits through a short-term drive-down of our stock prices,” Adani says, addressing the annual general meeting on Tuesday. While the company had promptly issued a comprehensive rebuttal, various vested interests tried to exploit the claims made by the short-seller, he says, adding that these entities “encouraged and promoted false narratives across various news and social media platforms”.

_RSS_In February, Adani Enterprises had unexpectedly withdrawn its follow-on public offer (FPO) worth Rs 20,000 crore, a day after it had successfully closed the offer. The decision triggered a 28 percent sharp sell-off of shares, and the company returned money to the FPO investors. What followed was nothing short of a roller coaster ride as investors continued to dump its shares, along with shares of other group companies like Adani Total Gas, Adani Transmission and Adani Green Energy.

Currently, the share price of Adani Enterprises is still down by more than 20 percent from 24 January, a day before the Hindenburg report was released. The stock had slipped to Rs 1,017.1 on February 3 and has picked up gradually since then.

The Hindenburg report also led to further probes on Adani Enterprises in India, which included the Supreme Court constituting an expert committee; the committee’s report was made public in May. “The expert committee did not find any regulatory failure. The committee’s report not only observed that the mitigating measures undertaken by your company helped rebuild confidence but also cited that there were credible charges of targeted destabilisation of the Indian markets. It also confirmed the quality of our group’s disclosures and found no instance of any breach,” Adani tells shareholders.

While market regulator Securities and Exchange Board of India (Sebi) is yet to submit its report, Adani is confident of their governance and disclosure standards. “It is my commitment that we will continue to strive to keep improving these, every single day,” he adds. What also gives Adani confidence is that even during the crisis "not only did we raise several billions from international investors, but also that no credit agency, in India or abroad, cut any of our ratings.”

Also read: Inside the shaken house of Adani

The total Ebidta of Adani Group companies grew by 36 percent to Rs 57,219 crore in FY23 on an income growth of 85 percent at Rs 2,62,499 crore, while net profit surged 82 percent to Rs 23,509 crore. The Group’s accelerating cashflow improved net debt to run rate Ebidta ratio from 3.2 times to 2.8 times. In March, Adani Group executed a secondary transaction of $1.87 billion with GQG partners.