GSTIN: What is it, format and example of the 15-digit GST number

By Forbes India| May 17, 2023

In this article, we will explore in depth what GSTIN is, how you should apply for a GSTIN, and how to check its legitimacy

GST is a household term in India, not just because it’s a tax levied on most goods and services, but because it’s a relatively new phenomenon that also attracted controversy. But there’s more to it than its oft-repeated controversies. Like GSTIN.

The Goods and Services Tax Identification Number (GSTIN) is a unique identification number provided to firms in India that are registered under the Goods and Services Tax (GST) system.

Significant changes have been made to the Indian taxation system as a result of the implementation of the GST, which has simplified the tax collecting and compliance processes. Businesses must register for GST and get a GSTIN to comply with laws and reap the benefits of the GST system.

Nonetheless, as the number of firms registering for GST continues to rise, it has become vital to check the legitimacy of GSTIN to prevent fraudulent actions.

In this article, we will explore in depth what GSTIN is, how you should apply for a GSTIN, and how to check its legitimacy, assuring a compliant and efficient business operation under the GST regime.

Also Read: Income tax slabs in India 2023-24: Old vs new tax regime, deductions and more

What is GSTIN?

GSTIN (Goods and Services Tax Identification Number) is a unique identifier granted to firms in India that are registered under the Goods and Services Tax (GST) regime. It is a 15-digit alphanumeric code used for a variety of GST-related procedures, including submitting returns, obtaining input tax credits, and making payments. The GSTIN identifies the taxpayer and allows the GST system to follow their transactions.

The first two digits of the GSTIN signify the state code, followed by ten digits of the business's PAN (Permanent Account Number), followed by the entity code and the check digit. Businesses must obtain a GSTIN to comply with India's GST legislation and regulations. Since the 2017 adoption of the Goods and Services Tax (GST), the GSTIN has become required for conducting business in India.

Also Read: GST state code list and jurisdiction details [2023]

GSTIN structure simplified

Here’s another look at the structure of a GSTIN:

| Character | Meaning |

|---|---|

| First two digits | State Code |

| Next 10 digits | PAN allotted to the business |

| 13th digit | The number of registrations in a state |

| 14th digit | Default character |

| Last digit | Checksum digit or number |

- Registrations in the state are represented by the 13th digit. It's a combination numeric/alphabetic code, with digits 0 through 9 preceding the letters A through Z.

- The 14th digit is a default that is determined by the type of company. The letter Z is used to indicate a typical taxpayer.

- The GST department grants a GST Number to an NRTP (non-resident taxable person) who doesn't have a Permanent Account Number. Therefore, the following 10 digits of GSTIN would be the foreign government's tax identification number.

The example of a GSTIN would go like this: 22AAAAA0000A1Z5, where 22 is the state code, which is Chattisgarh, AAAAA0000A is the PAN or the Personal Account Number, 1 is the entity number of the same PAN holder in a state, Z is the default alphabet and 5 is the checksum digit.

Also Read: How to get the GST number?

What is the importance of GSTIN?

Under GST regulations, a business must know its GST number in India, as this is the number that must be included on every invoice from a supplier to receive the correct amount of input tax credit.

Businesses should also collect customers' GST numbers and include them on invoices since these are required for customers to claim input tax credits.

In a nutshell, obtaining a GST number in India is a necessary step for any company. This will aid enterprises in maintaining their market credibility and claiming the right input tax credit.

Who should register for GST?

Under the Goods And Services Tax (GST), all businesses that have a turnover exceeding the threshold limit of INR 40 lakh or INR 20 lakh or INR 10 lakh, depending on the area of operation, must register as a normal taxable person

Here is a list of companies that must register for GST regardless of their annual revenue:

- Input Service Distributor (ISD) or Casual taxable person

- Non-resident taxable person

- Supplier of goods and services to businesses located in multiple states

- Provider of goods through an e-commerce platform

- Any service provider

- Reverse charge method tax liability

- TDS/TCS deductor

- Data retrieval and storage service are offered online

How to apply for GSTIN?

The GST enrollment process encompasses the application for GST. Your business will be issued a GSTIN once your application has been accepted by the appropriate GST officer. You can submit your GSTIN application through one of these two methods.

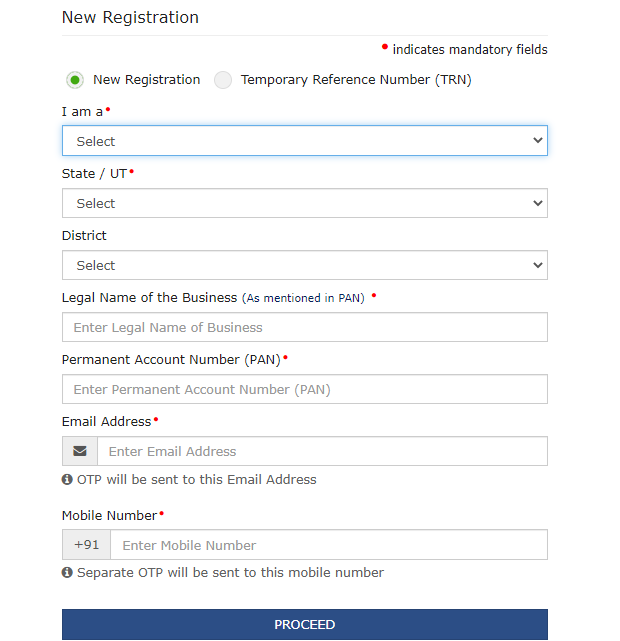

Head to the GST Portal

- To register for GST online, go to https://services.gst.gov.in/services/quicklinks/registration.

- Select "New Registration" and then fill out "Part A of the Application" with your personal information.

- To confirm your identity, the portal will send a one-time password to your phone number or email address.

- An Application Reference Number (ARN) will be sent to your phone or email after the verification procedure is complete.

- Part B of the application can now be completed with the help of the ARN. For this stage, you'll need the following materials:

a) Photographs

b) Proof(s) of the location of the business

c) Bank account details

d) Authorization form

e) Constitution of taxpayer

6. Next, complete the application by entering all requested information and attaching any supporting documents using DSC or Aadhaar OTP.

Once Part B is filed, the GST officer will review your application within three business days. After verifying your application, the officer may either approve it, in which case you will obtain your Certificate of Registration (Form GST REG 06), or request additional information using Form GST-REG-03.

The additional information must be provided within seven business days. Once the details have been submitted, the officer has the right to reject the application and indicate reasons for doing so on Form GST-REG-05.

If the GST officer determines that the information you have supplied is legitimate, your application will be completed, and you will be issued a Certificate of Registration.

GST Seva Kendra

The second method of registering for a GSTIN is to visit a GST Seva Kendra in person. The government has developed a multitude of service centres or "Seva Kendras" to facilitate all GST-related services to make life easier for taxpayers.

The government has established Seva Kendras to aid the transition of many taxpayers to the GST system. These taxpayers are those who do not have access to the service's online site or have little to no knowledge of how to utilize it.

What is the difference between GSTIN and GSTN?

The difference between GSTIN and GSTN may seem baffling at first. Both of these are connected to GST in some way. The GSTIN represents the taxpayer identification number.

On the other hand, GSTN, which stands for "Goods and Services Tax Network," is an information technology system that manages the GST portal. It aids in the successful synchronization of all parties involved in GST, including state and central governments, taxpayers, etc. The government is aided in its efforts to monitor domestic financial activity with the GSTN.

Business owners who exceed an INR 10 lakh/ 20 lakh/40 lakh annual revenue threshold should consider registering their company under the GST rule, depending on the area of operation. Once you've registered, you'll be issued a 15-digit GSTIN that must be included on all GST bills. This figure will help you report the appropriate amount of input tax to the government. In addition, your GSTIN serves as a crucial identifier for your company.

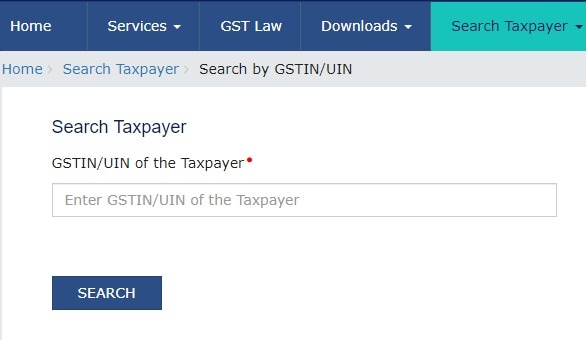

How to verify a GSTIN?

To avoid paying taxes and maximize profits, many businesses that aren't technically registered nonetheless charge GST using what appears to be a legitimate GSTIN. Since issuing a false GSTIN is the same as committing theft, checking the legitimacy of a GSTIN is essential.

The genuineness of a GST number can be quickly and easily verified. Simply perform a search for a GST number on its website. Each invoice includes the company's GSTIN for tax purposes.

Once you've located it, just double-check by doing the following:

- Visit the GST website at https://services.gst.gov.in/services/searchtp

- The entity's GSTIN will be required on the next page when you click the link. Simply type in the GSTIN and hit the "Search" button.

- Enter the correct captcha code and hit the search button.

- You will subsequently be sent to a page that contains the organization's legal information. If prompted to enter a legitimate GSTIN, you are dealing with a fraudulent GSTIN. Ineligible entities include those whose "Taxpayer Type" indicates "Composition." Otherwise, the GSTIN is legitimate and can be used.

- The following step is to verify the accuracy of the shown rates. A business may charge you more than the legal amount of GST. If you are unfamiliar with its rates, you can view a confirmed list of GST rates at https://cbic-gst.gov.in/.

If you have any questions or concerns about GST, you can reach the support desk at 011-21400643 or send an email to helpdesk@gst.gov.in.

Frequently Asked Questions

1. How much does it cost to register for a GSTIN?

The government does not charge a fee to issue a GST Number. However, employing the services of a GST Practitioner or a Chartered Accountant may incur additional costs.

2. In what ways does GSTIN vary from GSTN?

There is no overlap between the two concepts. When a company registers for Goods and Services Tax (GST), it is given a unique identification number known as a Goods and Services Tax Identification Number (GSTIN). On the other hand, the Goods and Services Tax Network (GSTN) is responsible for maintaining the GST Portal's computer systems.

3. Should GSTIN be included on all GST invoices?

Your company's Goods and Services Tax Identification Number (GSTIN) must be included on all GST invoices. In addition, if your client is GST-registered, you must additionally include their GSTIN on the invoice.

More Stories on GST

- How different is the UAE VAT and Indian GST?

- GST: A beginner's guide for companies

- GST 2.0: A glimpse of what should be the next phase in India's transformative tax regime