How Tata Consumer Products grew despite the pandemic

By Varsha Meghani| May 5, 2022

TCPL, formed in February 2020 by integrating the Tata's group's food and beverage interests, delivered strong results on the back of innovation, brand building and distribution

[CAPTION]Sunil D'Souza, CEO & Managing Director, Tata Consumer Products

Images: Neha Mithbawkar for Forbes India[/CAPTION]

[CAPTION]Sunil D'Souza, CEO & Managing Director, Tata Consumer Products

Images: Neha Mithbawkar for Forbes India[/CAPTION]

Chaiwalas that dot the roadsides of Uttar Pradesh’s cities—India’s biggest loose tea market –recently became a part of a pilot by Tata Consumer Products (TCPL). Shuddh by Tata Tea, a low cost but high-quality variant, was soft-launched some months ago to help upgrade loose tea users—who make up roughly 35 percent of India’s Rs 26,000 crore tea market—to branded tea.

At the other end of the market, TCPL launched 1868 by Tata Tea, a range of luxury black and green teas paired with fruits and spices for more discerning customers, in March 2021. An online-only brand, 1868 marked Tata Tea’s entry into the fast emerging direct-to-consumer (D2C) segment as well as into the premium tea space.

_RSS_Together, the moves sum up TCPL’s strategy of chasing the mass consumer while still enticing the more premium one. It’s also going after all those in between, hoping to further strengthen its position in the tea market where it commands a 20-24 percent share—a neck-and-neck second to Hindustan Unilever, which sells Brooke Bond tea.

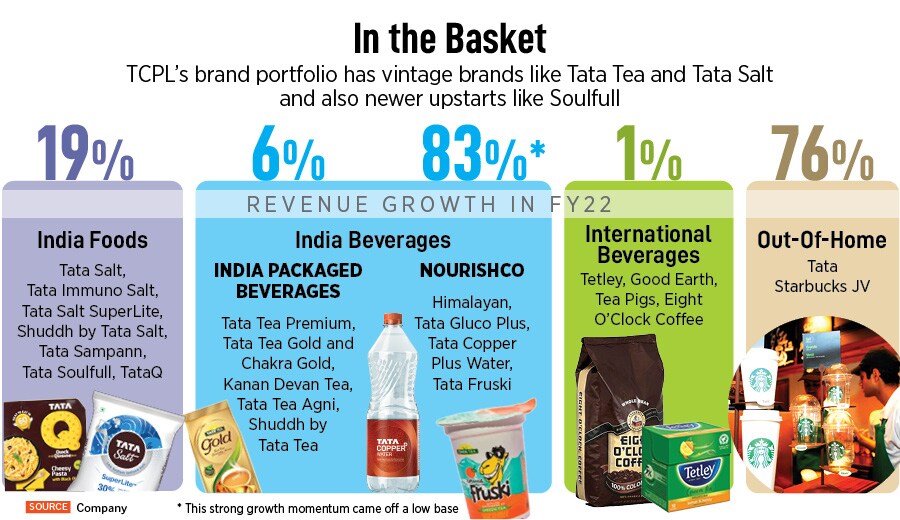

Borne out of a merger between Tata Chemicals’ consumer-focussed arm that sold brands such as Tata Salt and pulses-to-poha-seller Tata Sampann, with Tata Global Beverages, the maker of Tata Tea, TCPL was minted in February 2020. The idea was to integrate the food and beverage interests of the Tata Group into a single company to help drive efficiencies and realise synergies.

“TCPL was formed as an organisation to deliver the aspirations of the Tata group in the FMCG space,” says Sunil D’Souza, the former managing director of Whirlpool India and PepsiCo veteran who was brought in to lead TCPL. But little did he—or anyone—know that a month into the company’s formation, a nationwide lockdown would be imposed as Covid-19 loomed large.  “The last 24 months have been like changing all four tyres of a car while driving at 120 km per hour and by the way giving it a new coat of paint. The good part is that the Tata brand name carries enormous equity in the market. That was the single biggest thing that helped us drive this whole business forward,” says D’Souza.

“The last 24 months have been like changing all four tyres of a car while driving at 120 km per hour and by the way giving it a new coat of paint. The good part is that the Tata brand name carries enormous equity in the market. That was the single biggest thing that helped us drive this whole business forward,” says D’Souza.

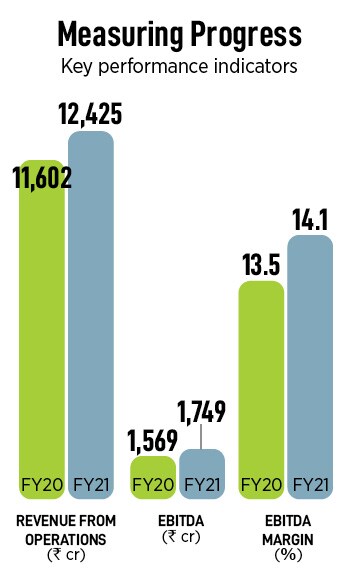

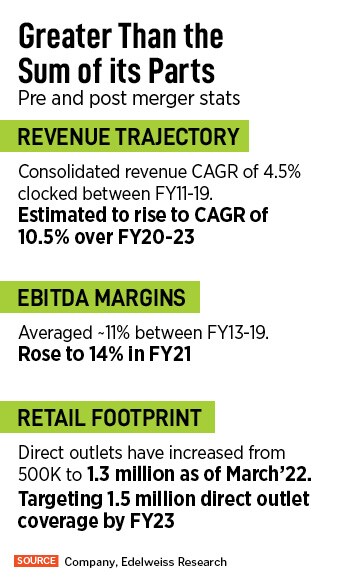

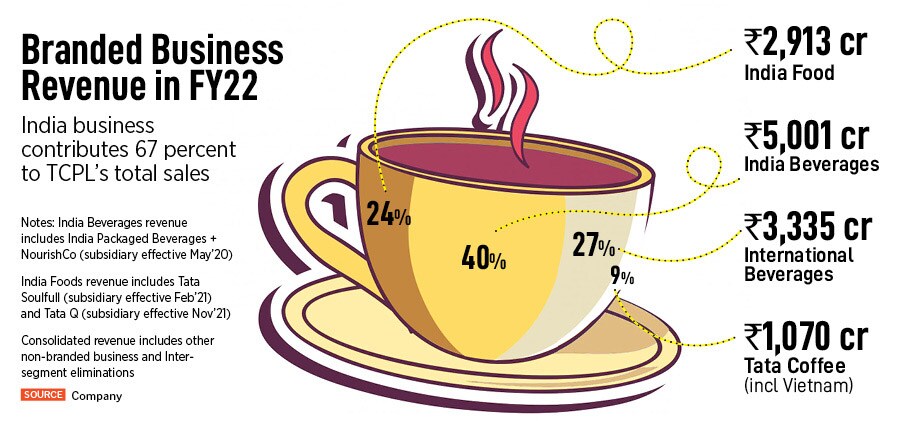

Results are proof: Revenue from operations grew to Rs 12,425 crore in FY22, up seven percent from the previous fiscal. Earnings before interest, taxes, depreciation and amortisation (EBITDA) also rose by 11 percent to Rs 1,749 crore in FY22. Moreover, the company averaged an EBITDA margin of around 11 percent between FY13 and FY19. Post the merger, TCPL’s margin has risen to 14 percent in FY22 and is expected it to rise by another 300 bps by FY23, according to Abneesh Roy, head of research at Edelweiss Financial Services.

So how did TCPL persevere despite the pandemic?

First, it focussed on strengthening its core businesses of salt and tea. It did so by expanding distribution from about 500,000 direct outlets prior to the merger to about 1.3 million today and upping ad spends by almost 42 percent year-to-date, says D’Souza.

On salt specifically, although TCPL is a market leader with 35 percent share of the organised market, 95 percent of Tata Salt sold is the base variant. So there’s plenty of room for “premiumisation” or upgrading consumers from the base variant to higher margin offerings such as rock salt, black salt, crystal salt, double fortified salt and herbal salt—all of which TCPL already has in its portfolio.

But it also launched a slew of other salts in the last two years—Tata Salt Super Lite, a 30 percent low sodium salt, to cater to increasingly health-conscious consumers; Tata Salt Immuno, a zinc fortified salt that is currently being piloted in Delhi; and Shuddh by Tata Salt, a mid-tier portfolio play for the Southern Indian markets where the preference is for solar salt as opposed to the regular vacuum evaporated salt. “So it’s not just about targeting the higher end of the market through premium offerings, but also about converting those in mass segments from local, regional brands to Tata Salt and its variants,” explains Deepika Bhan, president, packaged foods, TCPL.

This ties in with D’Souza’s second strategic imperative of focusing on innovation to help drive TCPL. “We were behind on innovation and in the consumer space, especially in categories like food and beverages, innovation plays a very important role in growth,” he says. The company has doubled its rate of innovation (a number arrived at by measuring the number of innovations against the number of products) from about 1.5 percent of sales last year to around 2.9 percent at present. “This is still not on a par with the industry. We need to increase this by at least 30 percent next year.” Like salt, in the tea business too—TCPL’s other mainstay—the opportunity to grow at both the premium and mass ends is huge, says Roy. Tea in its loose form, as mentioned at the outset, accounts for roughly 35 percent of the overall market. A shift from loose to packaged tea is inevitable, says Puneet Das, president, packaged beverages at TCPL. To that end, TCPL not only forayed into the mass segment with Shuddh by Tata Tea, but also rejigged the marketing mix for its Tata Agni brand of tea, which plays at the slightly higher but still economy segment, by roping in India’s women hockey players as ambassadors.

Like salt, in the tea business too—TCPL’s other mainstay—the opportunity to grow at both the premium and mass ends is huge, says Roy. Tea in its loose form, as mentioned at the outset, accounts for roughly 35 percent of the overall market. A shift from loose to packaged tea is inevitable, says Puneet Das, president, packaged beverages at TCPL. To that end, TCPL not only forayed into the mass segment with Shuddh by Tata Tea, but also rejigged the marketing mix for its Tata Agni brand of tea, which plays at the slightly higher but still economy segment, by roping in India’s women hockey players as ambassadors.

TCPL also launched Tata Tea Gold Care, an innovation it dubs the ‘care series’ that is infused with indigenous herbs like tulsi and brahmi. Positioned as a tea that helps boost one’s immunity, it has been steadily gaining market share pan-India and grown to more than five percent of the Tata Tea Gold mother brand in a short span of time, says Das.

As a consequence of these innovations, TCPL's overall market share in the tea business was up by 160 bps as of December 2021, while its salt market share grew by 400 bps. "Our focus is on growing volume, market share and making sure we gain the rightful share in the premium and mass categories," says D'Souza.

A larger playground

While salt and tea are the mainstay, steady growth drivers for TCPL, the company is targeting newer opportunities too. Tata Sampann, for example, is a massive growth driver, says Roy. The portfolio, which includes packaged pulses, spices and snacks, grew 28 percent in volume in FY22.It’s unsurprising considering the market opportunity: At Rs 150,000 crore, the market size of pulses is almost 5x TCPL’s tea (Rs 26,000 crore) and salt (Rs 7,000 crore) businesses put together. Besides, the share of branded products in the pulses market is a mere one percent. Spices too is a Rs 60,000 crore category and although it has a branded penetration of about 30 percent, thanks to players such as Everest and MDH, there’s still plenty of room to grow. “We believe TCPL can clock revenue CAGRs of around 50 percent and 60 percent over FY20–23E in pulses and spices, respectively,” says Roy.

“What Ashirwaad [by ITC] did with atta—getting consumers to shift from unbranded to branded—Sampann is doing with pulses,” says brand expert N. Chandramouli. “Consumers are used to buying that pao kilo of daal (a quarter kg) from their local kiranas. The Tata brand name evokes trust and credibility like no other, and should get consumers to switch over,” he says.

Although pulses and spices are commodities TCPL’s differentiation comes from quality, says Bhan. The pulses, for example, are unpolished and the spices are intact of their natural oils. “You can’t cheat an Indian housewife on daal. She knows the category super well. I don’t think there is way to win without being good on product,” says Bhan.

Driving synergies

Tata Sampann’s fast pace of growth is also in part due to the distribution reach of TCPL’s existing businesses—established brands such as Tata Tea and Tata Salt—which it is effectively leveraging, explains Roy. Herein, the merger has helped bring home synergies such as expanding distribution by around 30 percent, optimising the supply chain and rationalising costs. This was a third imperative for D’Souza when he took charge of TCPL and its rapidly showing results.Take the case of breakfast cereal maker Soulfull, which TCPL bought out for Rs 156 crore in February 2021. From being available in 15,000 outlets, the product is now available in 150,000 outlets, a 10x jump. The brand uses traditional Indian millets as its hero ingredient; to that end, TCPL has added new snacking options to the brand such as No Maida Ragi Choco Bites. “That has taken off as a real star innovation, helping us expand the availability of Soulfull across general trade and beyond,” says D’Souza.

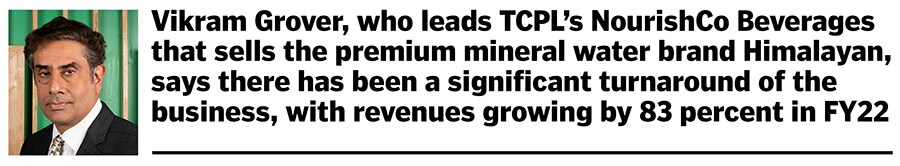

Similarly, premium mineral water brand Himalayan, which TCPL houses since acquiring PepsiCo’s stake in NourishCo Beverages—a 50:50 joint venture between the beverage giant and the Tatas that sold Himalayan and Tata Gluco Plus—was loss-making for years. But in Q2FY22 it broke even and in Q3FY22 it turned EBIT positive.

Under the terms of the JV inked in 2010, NourishCo was allowed to sell its brands only in India’s eastern belt, comprising roughly 30 percent of the addressable market, says Vikram Grover, former president at Tata Global Beverages and now managing director at NourishCo. Since the acquisition in May 2020, NourishCo has not only been able to play at a pan-India level, but the legacy distribution network led by multiple middlemen has been abandoned in favour of directly approaching Himalayan’s end customers. “That has significantly helped us in turning around the business,” says Grover, referring to not just Himalayan but NourishCo, as a whole, which grew revenues by 83 percent in FY22, albeit off a low base.

Says Roy, “The merger has helped in creating a distribution multiplier, which has aided higher outlet coverage as well as throughput—an expanded product range always gives FMCG companies more bargaining power with retailers, especially when products in question are vintage brands such as Tata Salt and Tata Tea.”

The cost savings resulting from the merger have been channelled towards funding TCPL’s digital, innovation and advertising efforts, says D’Souza. The sales and distribution system, for example, was overhauled and the end-to-end supply chain digitised to create a “future-ready organisation”. So when a salesman takes an order at an outlet, he can instantly loop the information back to the team, who, in turn, can monitor secondary sales by SKU, brand or geography in real time. Logistics or procurement can thus be tweaked to drive efficiencies.

Seizing new growth opportunities

E-commerce, as a sales channel, was taken up seriously during the pandemic. From accounting for 2.5 percent of sales in FY20, it now contributes 7.3 percent. The management expects this to grow to double digits on the back of TCPL’s D2C brands such as 1868 by Tata Tea, Sonnets, a premium coffee offering, and its dry fruits play launched under the Tata Sampann master brand via the online-only route.“Through detailed analysis and social listening, we realised there was a trust deficit in this category [dry fruits]. The margins and growth rates are high but there is no large national player,” says D’Souza. So TCPL leveraged Tata Sons’ e-grocery business Big Basket’s procurement expertise to make a play in the space.

Seizing such new opportunities is yet another strategic priority, says D’Souza. For that, TCPL also acquired Tata SmartFoodz, the maker of ready-to-eat (RTE) biryanis, pastas and curries under the brand name TataQ, from Tata Industries for Rs 395 crore in November 2021.

While the current size of the RTE market in India is roughly Rs 150 crore, the export market from India is about Rs 1,700-1,800 crore. “While the preference for convenience food is increasing in India—TataQ is already the number two RTE player in India after MTR—but still, it remains a market that prefers scratch cooking,” says Bhan. “To that extent, a much bigger opportunity we’re excited about is the export market. As a company we already have a good presence in important markets like the US, the UK and Canada, so we have the capability to reach these markets with this offering.”

Can TCPL become a force to reckon with in the FMCG space given its sharp focus on building brands, driving innovation, and expanding distribution?

“They are big in the food and beverage space and will continue to become bigger over the next 2-3 years,” says Edelweiss’ Roy. “However, a larger FMCG play, which would include entry into non-food items like personal care products, is a five-to-10-year play.”

Says D’Souza, “This is only the beginning. Our best is a long way ahead.”