Vodafone Idea: When will it stop playing catch-up with Jio, Airtel?

By Salil Panchal| Oct 7, 2021

The responsibility of turning around VI is back on the company following a government rescue package. Finding new investors to raise capital and raising prices are critical to its survival

Customers stand in a queue outside the Vodafone-Idea mobile network service provider store in Mumbai

Customers stand in a queue outside the Vodafone-Idea mobile network service provider store in Mumbai

Image: Punit Paranjpe / AFP

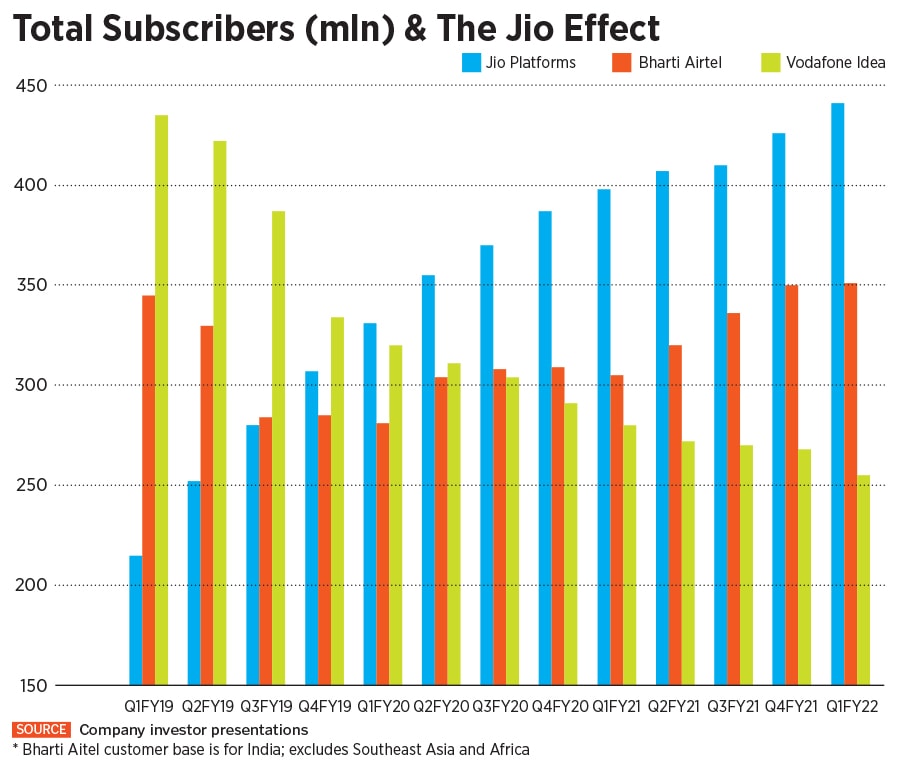

Each week, investors and stakeholders into Vodafone Idea (VI) appear to breathe a little easier when the debt-ridden company gets injected with fresh lifelines. Once the fastest-growing telecom company, VI has, in the last three years, been losing subscribers and market share to leader Reliance’s Jio Platforms and rival Bharti Airtel (see chart).

In October, there are reports that the government plans to withdraw its appeal on one-time spectrum charges against telecom operators, reducing litigation concerns and amounts due. For Bharti Airtel, it means a lowering of liability of around Rs 8,400 crore and Rs 4,300 (check) crore for VI.

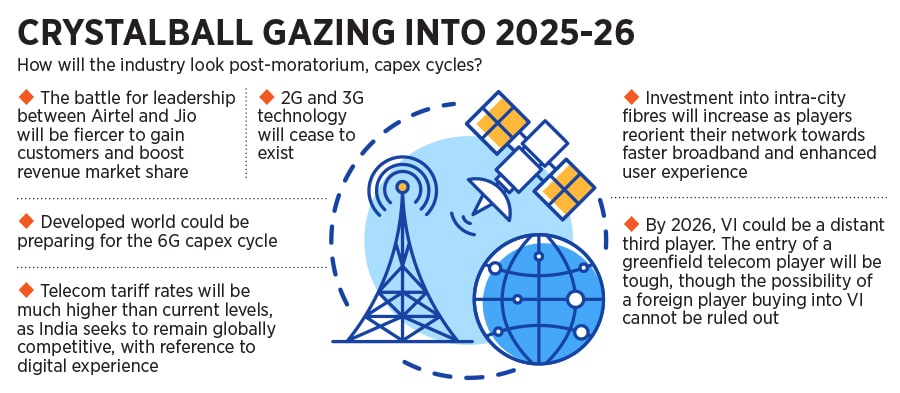

_RSS_Then there was news of VI’s continued 4G technology expansion to Andhra Pradesh and Telangana circles, followed by reports of recording highest speeds during 5G trials in Maharashtra and Gujarat with vendors, expressing a certain amount of commitment towards next-gen technology for subscribers. Jio and Airtel have conducted similar trials on their networks and are “5G ready”.

VI’s management and promoters have now started to make forward-looking statements regarding its survival, finalising a business plan and scouting for fundraising from potential investors. The confidence stems from the fact that now additional funds will flow towards the company and not towards paying back the government. The government has, through a massive rescue package in September, granted a four-year moratorium for companies to pay up statutory dues.

Once the moratorium is accepted, the telecom company will still need to pay the government interest on the moratorium for four years. It has the option—after four years—to pay (convert) the interest amount on the dues by way of equity, which will obviously improve cash flows. Guidelines for this option will be announced soon.

“By announcing the relief measures, the government has provided a lifeline and shown its support for the three-private-operator industry structure to continue,” says Kunal Vora, BNP Paribas’ telecom analyst. “Now, it is over to the companies to raise funds needed to survive and grow their business. Earlier, money raised would have gone towards payment of government dues; now the same can go towards the network investments which can help defend and grow the market share.”

Vodafone’s market share has dropped to 22 percent, nearly half of what it was in FY17, losing ground in metros. VI’s total adjusted gross revenue (AGR) dues are at around Rs 50,400 crore while those for Airtel are a disputed nearly Rs 26,000 crore.

No game-changing factor

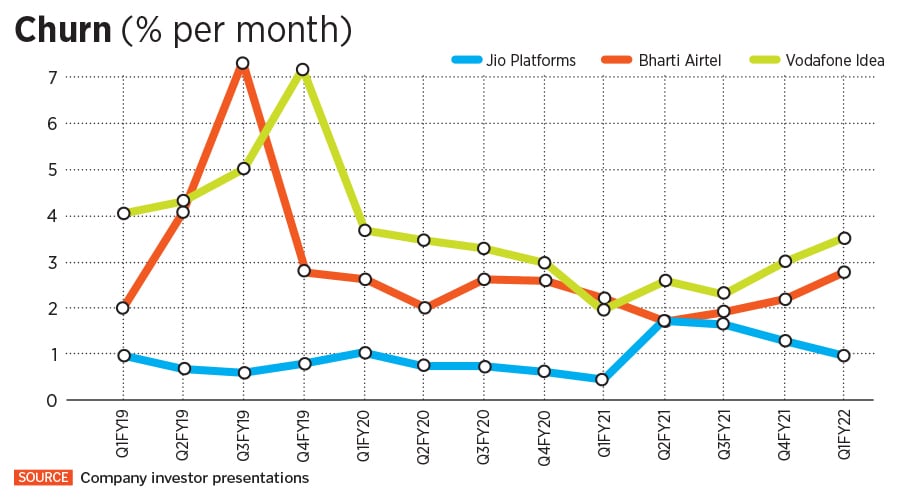

For VI, this package is a lifeline, but not a game changer. Investors were cheering when the rescue package came (the VI stock jumped up by 27 percent on September 15), but little after that (up by 1.77 percent since). This is because near- and long-term problems are still unresolved for the company.On the ground, VI needs to determine which of its 255 million subscribers it needs to safeguard from being poached by Jio or Airtel. "Its 2G customer base of 150 million is under attack; Airtel and Jio are constantly nibbling at it. VI can possibly focus on the high-end 2G customers and move them to 4G quickly,” says former Bharti Airtel CEO Sanjay Kapoor, who is now an entrepreneur and TMT consultant advising various telecom companies.

The rest of the low-end 2G subscribers may stay on or some will go to Airtel and Jio. VI will need to continue to consolidate its presence in circles where it is a leader and not pump in money where they are laggards. “It will have to play to its strengths and make tough strategic choices," adds Kapoor. In the wireless subscribers market, Jio holds a 37.3 percent market share, Airtel 29.8 percent, VI 22.9 percent, BSNL 9.6 percent and MTNL 0.28 percent, according the Telecom Regulatory Authority of India (Trai) September data.

Market share is a function of number of subscribers and the monthly average revenue per user (Arpu). As like most calamities which affect a particular population, there is a tipping point here. Analysts argue that if VI continues to lose market share to around 17-18 percent, the comeback from there will be very difficult.

VI operates in all 22 circles (which it has consolidated into clusters) of which, in 16 circles it has a double-digit market share while in the remaining six, it has a single-digit market share. It is the market leader in the Kerala circle, according to BNP Paribas data. VI management declined to talk to Forbes India despite repeated attempts.

While traditionally being a stronger voice call provider, VI is competing on data through its broadband business more closely, particularly the offerings it makes through a subsidiary called ‘You Broadband’, an internet service provider. It now competes aggressively with rivals AirtelXStream, BSNL Bharat Fibre and JioFiber by offering high-speed annual plans with unlimited data in about 22 cities, mainly in western and southern India.

Before VI plans its competitive strategy for 5G, it needs to start investing more towards the 4G network. Estimates suggest that Airtel is investing 2x in capex than what VI is investing towards 4G since 2019.

Fresh capital needed

VI’s CEO Ravinder Takkar has been talking positively about a fundraising game plan and the interest from potential investors. But the truth is that no commitment has come from the existing promoters, Vodafone Group and the Aditya Birla Group, on infusing fresh capital into the company. This is the most critical part which could decide the long-term future for VI.VI probably has a window of just the current quarter (October to December) to finalise a fundraising plan, considering that talks have been on, unsuccessfully, for months to raise around Rs 25,000 crore. The VI management has often spoken about how the confidence among investors will rise once Arpus start rising, but they might not have the liberty to wait for that, considering that it needs capital to compete on customer experience, to invest into network, pay back debt [Rs 1.9 lakh crore] and renew bank guarantees.

But a fresh investor has to take a lot of risk to put in equity, considering that the dues have to be paid back with interest. The commitment, in capital and vision, will have to be real, so that the investor has the ability to pump in money even post the moratorium towards newer technologies.

VI’s non-executive chairman Himanshu Kapania told shareholders at the annual general meeting on September 29 that the company was “speaking to other stakeholders and once the board gives approval”, they would come back to shareholders of the exact need of the funding going forward. “If funding does not come, we are looking at an accelerated decline for Vodafone Idea,” says an analyst with a local research firm, declining to be named.

Pay more for better connectivity

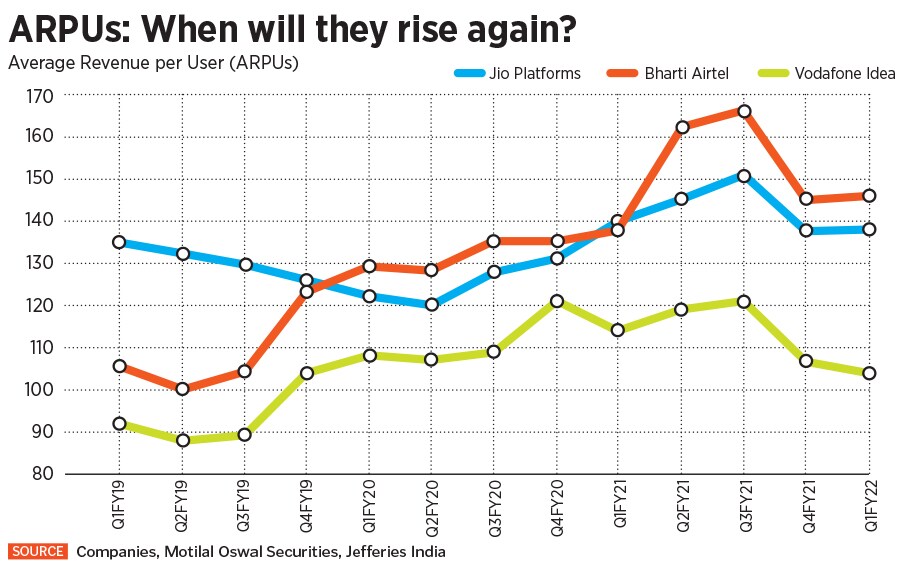

VI has seen a steady decline in Arpus since March 2020, while Bharti Airtel has seen a steady rise since then and Jio’s tariff has been steady. The dilemma for VI is whether it should take the risk of raising tariff rates and losing some subscribers. Kapoor feels the risk is worth taking. “They may become small, but beautiful,” he says.

Post pandemic, subscribers, at least in the metros, do not see paying for better connectivity as a huge concern. “Nobody denies the need for roti, kapda, makaan and connectivity—the first three have gone down the Maslow’s hierarchy,” Kapoor says. In the pandemic world, a makaan (house) without broadband connectivity is useless as a person needs to work-from-home, entertain and educate their family or shop online. “Why would the customer not be willing to pay more, considering that they were willing to do so a few years ago when tariffs were higher and broadband was not as fast?” Kapoor asks. Arpus were in the range of around Rs 200 in 2015-16, from the average Rs 150 now.

Bharti Airtel has fortified its postpaid and high-end base with customers who are loyal to the brand, so it should not worry about rising tariffs. Jio is the market leader; its ability to raise prices depends on its aspiration for market share dominance. It may decide to shift gears from price to experience premium at any time. Hence, for Jio or Airtel, raising prices would be to boost Ebitda further while VI will need a price hike to survive.

“For Vodafone Idea, its aspiration to be a competitive third player with its current balance sheet looks utopian to me. It can be a third player, but a distant third player,” Kapoor says.

"Going ahead, I expect to see much higher Arpus for the industry, which will improve business operations. Vodafone Idea, which has value in its enterprise business, needs to start monetising its assets in the coming years to help start spending capex towards 5G," says Sanchit Vir Gogia, founder and CEO of Greyhound Research, a digital and technology research, and advisory firm. Kapoor and Vora also agree that Arpus would continue to rise in the coming years, which will boost cash flows for telecom operators.

The government has done enough to create a structure for three (or more) players to exist and breathe. India’s current telecom services industry was a hyper competitive market till the early part of this decade. Mergers, exits and sell-offs happened which brought it to an oligopoly. Now the industry runs the risk of turning into a duopoly. But experts say that besides being a vast market, tower manufacturing companies, content creation companies and digital services platforms have all drawn out their business model, and settled at oligopoly.

“India’s telecom industry needs more than a duopoly," says Gogia. “If it becomes a duopoly, then the customer will suffer,” adds Kapoor.

Much of the negativity and nervousness surrounding the future of VI is due to the delay in capital raising. If the two promoter groups have a change of mind or private equity players or technology giants decide to invest into VI, the concerns would vanish. But if funds do not come quickly, VI may just get tired of playing catch-up with Jio and Airtel.

Disclaimer: Reliance Industries is the owner of Network 18, the publisher of Forbes India