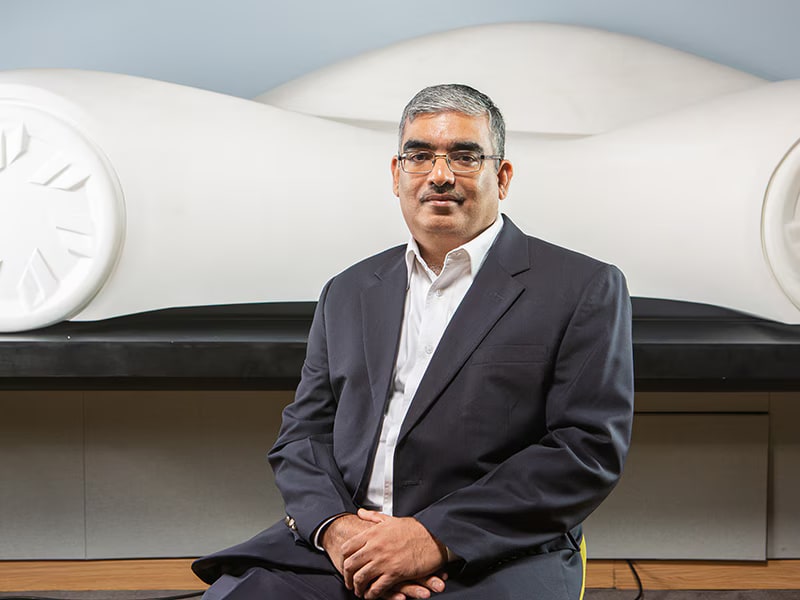

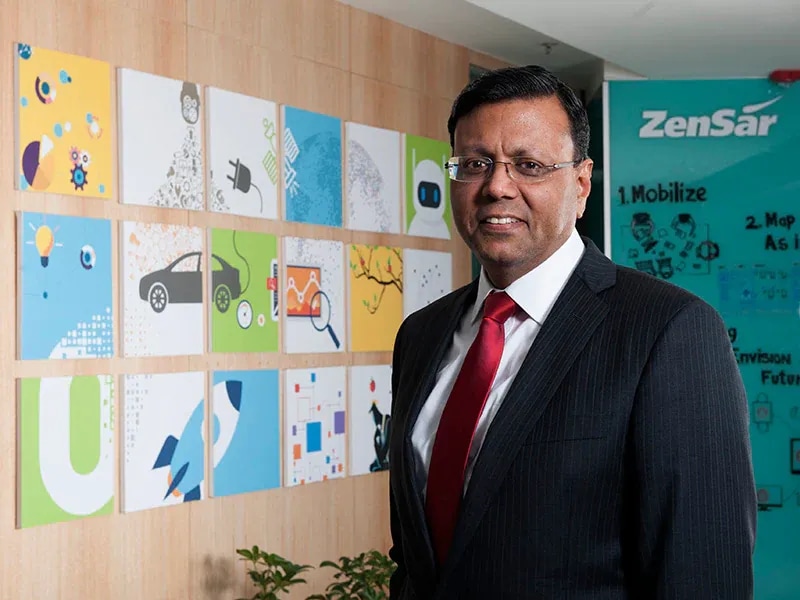

'People who can draw insights from real-time data will influence decision-making in the future'

Forbes India in conversation with Hitesh Oberoi, CEO & Managing Director of Info Edge (India), on how the profitable Rs 1,098-crore online classifieds conglomerate is harnessing data and AI (artificial intelligence) across businesses like recruitment, real estate, matrimony and education.