- Home

- Multimedia

- Photo Gallery

- Ten big ideas to change the world

Ten big ideas to change the world

Image by : Michael Prince for Forbes

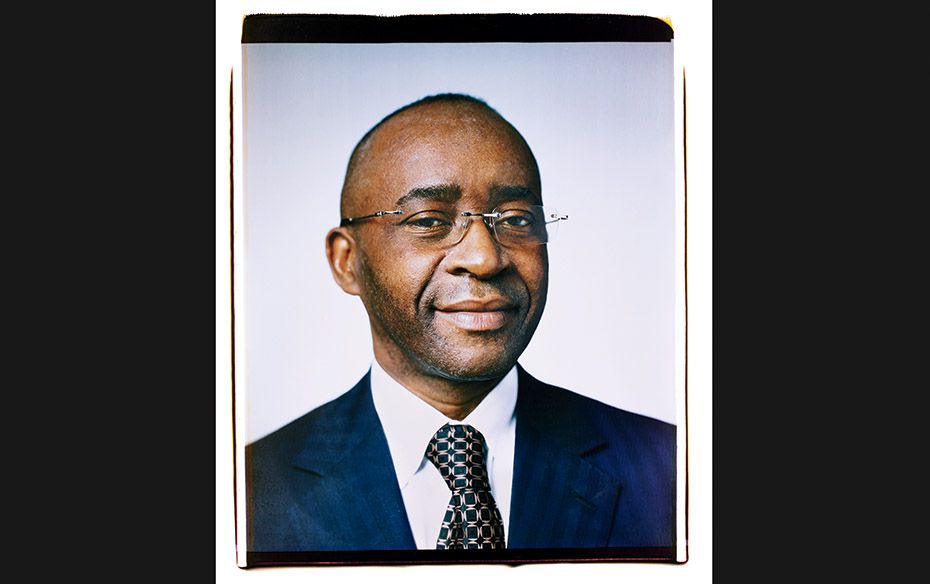

Strive Masiyiwa

Founder and chairman, Econet Wireless

Attack Problems at the Roots

when Ebola struck Liberia, a coalition of philanthropists quickly emerged to work with governments and large health organisations to stem the crisis. Strive Masiyiwa was tapped by the African Union to be the point person for the continent. That meant looking at the problem systemically, not country by country. “A pandemic doesn’t respect borders,” he says. “A weak health care system in Monrovia, Liberia, is a weak health care system in Manhattan.” Part of the plan to stop the next Ebola outbreak should be to support Africa’s health care system, he says, but only as a section of a larger approach—to broadly strengthen those economies that are as weak as their recovering populations, to do things like encourage tourists to return. “It’s not all about the billionaires. Everyone has to be part of this response. It has to be global.”

Image by : Michael Prince for Forbes

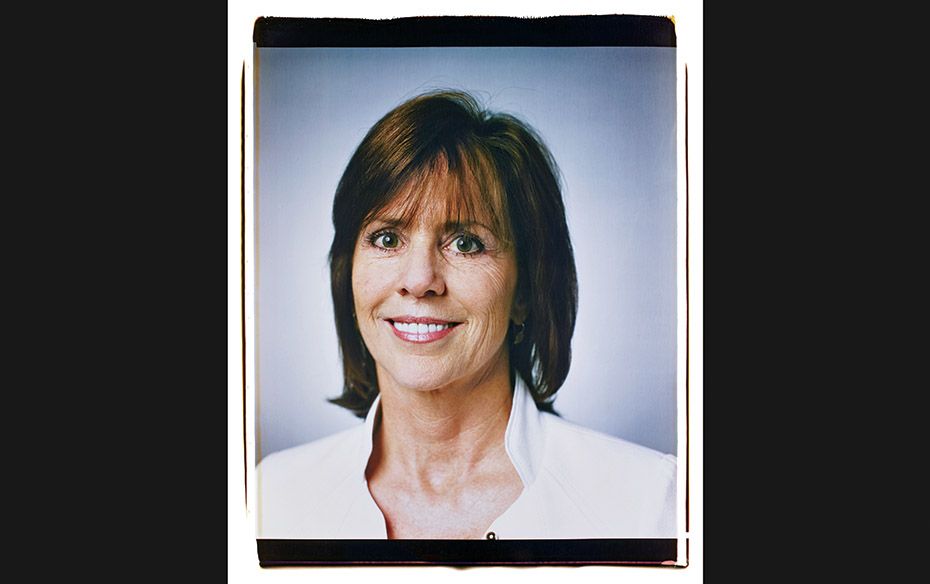

CEO, The Case Foundation

Transparency Matters

“There must be clear intentions. There has to be clear measurement. There has to be transparent reporting. It has to be a matchmaking between the entity and those making the investment.”

Image by : Michael Prince for Forbes

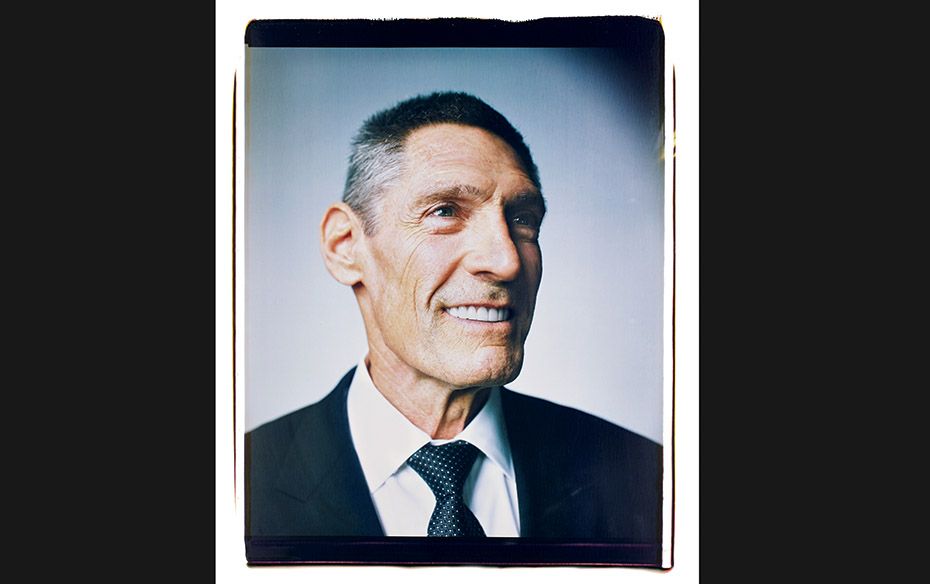

Founder, Michelson Medical Research Foundation

Think Like an Altruistic John Doerr

“You need a venture capital model—fund a large number of inexpensive propositions. You don’t expect them all to work. At the end, you get outsized returns.”

Image by : Michael Prince for Forbes

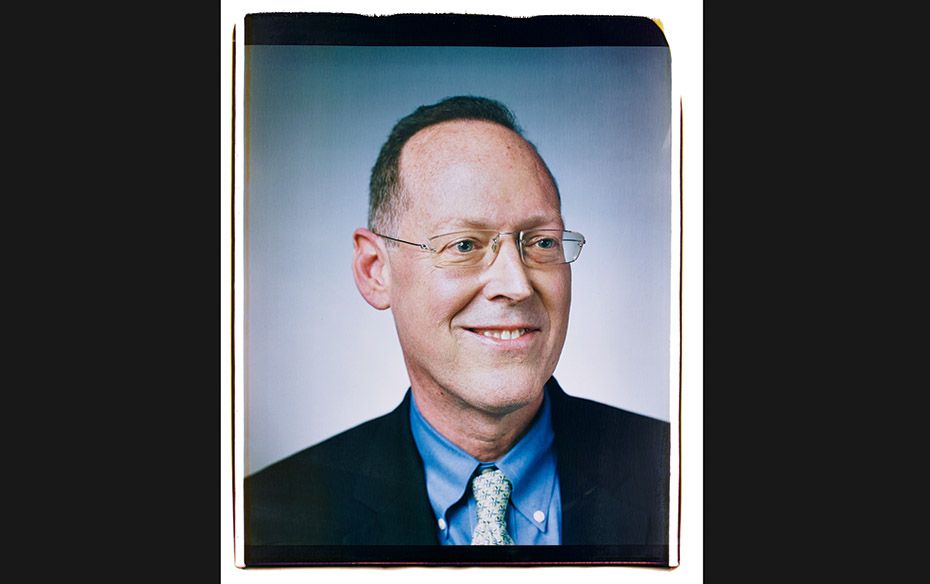

Co-founder, Partners In Health

You Can Change The Conventional Wisdom

“Twenty years ago, Rwanda was the leading basket case in the press. Everyone used the term ‘failed state’. In the last decade, they’ve had the sharpest decline in mortality. That’s because they built a health care system.”

Image by : Michael Prince for Forbes

Founder, DBL Investors

If You’re Unsure About Impact Investing, Dip Your Toe In

“We see a lot of family foundations that aren’t ready for equity investments in philanthropic companies. But they can guarantee a loan or do other things that are more in their comfort zones.”

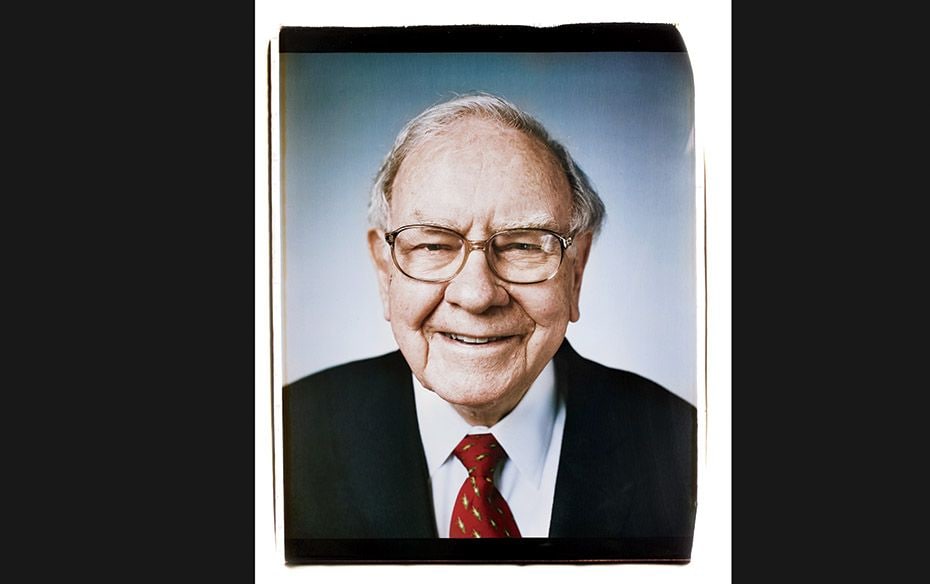

Image by : Michael Prince for Forbes

Chairman and CEO, Berkshire Hathaway

Solve Today’s Problems—Not Next Century’s

“i don’t know the important issues necessarily 50 years from now. I do know what I consider the important issues now. And I know some terrific people who operate in those fields. Everything I have will be spent within 10 years after the closing of my estate. There will be plenty of philanthropists 10, 20, 50, 100 years from now. They can look at the problems of that day and the people of that day and pick out the best managers.”

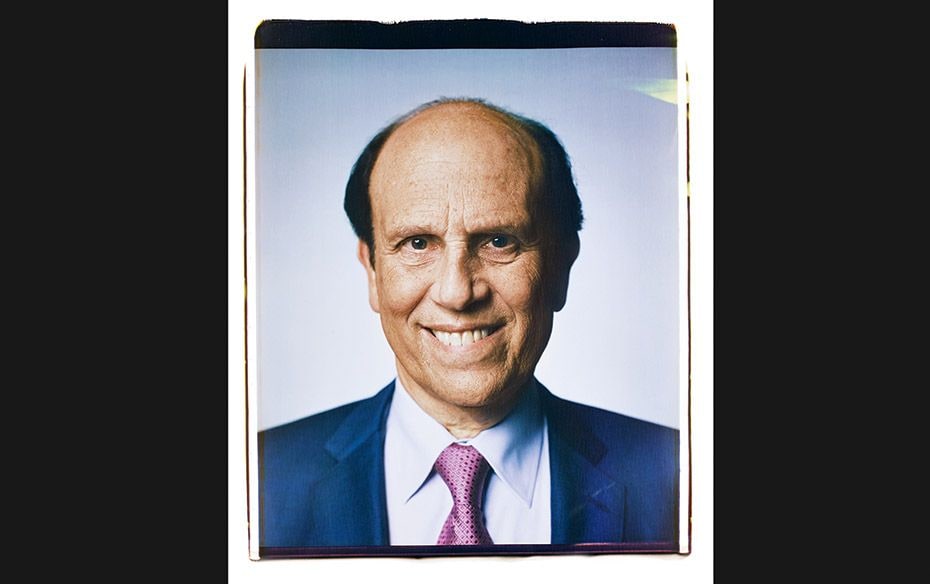

Image by : Michael Prince for Forbes

Founder, The Milken Institute

Focus on Up-and-Comers

there’s an old saying about youth that michael milken undoubtedly hates—that it is wasted on the young. Thinking back on his 40 years of philanthropy, he says, “The highest rate of return on my philanthropic dollar has been to support young scientists and young investigators.” For this reason, he tries to fund the work of only fresh minds—giving $75,000 annually for three years to scientists who are no more than six years removed from completing a professional degree or clinical training. “They’re 33 years old. Who’s going to support their lab? You can direct some of the most talented people in the world and encourage them.” Ironically, he says, funding more established names hasn’t been as rewarding. “We’ve gotten a very low return funding those at the peak of their careers.” Presumably because it takes much more money to secure the same type of motivation that is visible in their younger colleagues.

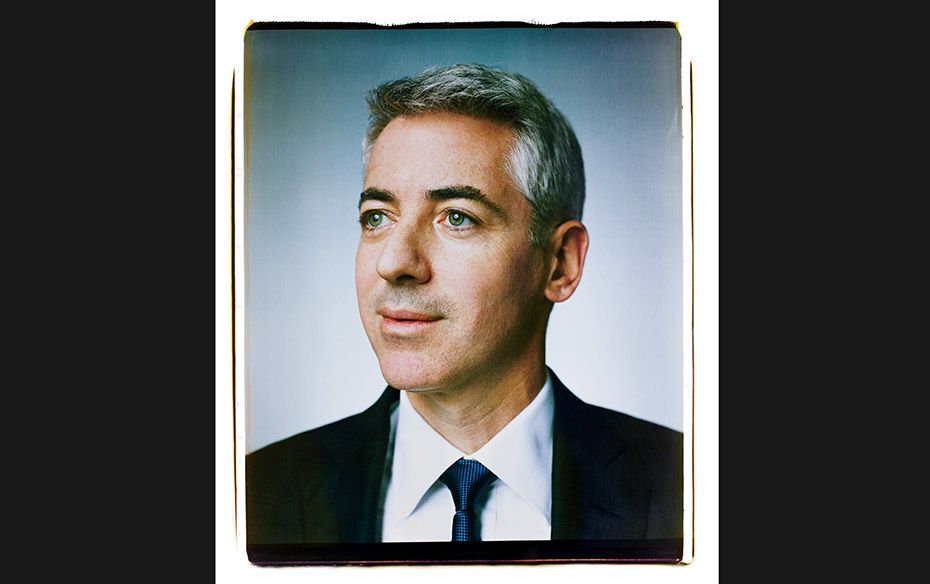

Image by :

CEO, Pershing Square Capital Management

Capitalistic Incentives Solve Social Problems

bill ackman spends the bulk of his time fixating on return on investment. So when it comes to giving back, he focuses both on non-profits with the potential to scale—and for-profit investments that do good while making money. For the latter, Ackman wants them to have the same mindset and motivations as a Silicon Valley startup. “You can build a valuable business that can incentivise management and solve a problem,” he says. “I think of social impact as someone who has devised a business plan where they can return your capital with a return and solve a very important problem. And when you think about how profits are going to be made in the 21st century, they’re going to be made solving problems.”

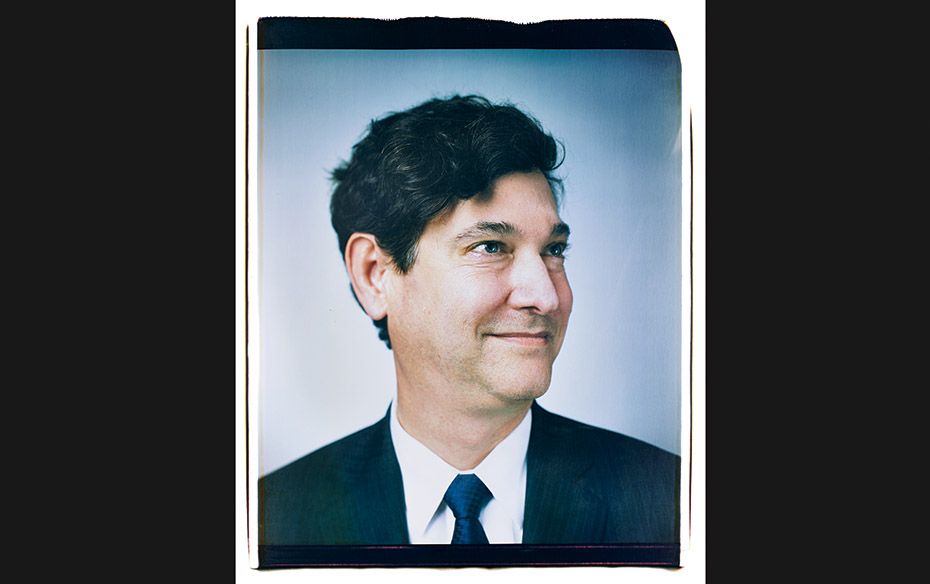

Image by : Michael Prince for Forbes

Founder and CEO, Breyer Capital

Disruption Can Serve the Public Good

“The kind of companies I’m investing in are two or three cardiologists teamed with 20-, 25-year-old data scientists who are building companies that are doing more than creating shareholder value—something more encompassing.”